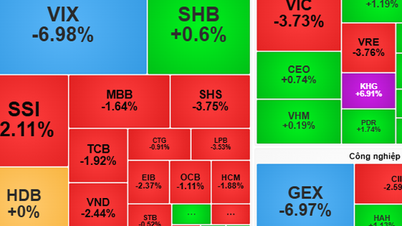

Investor sentiment is less pessimistic, which helps green dominate the stock market in the session on February 4. Many stocks that fell in price in the session on February 3 have increased again today.

Investor sentiment is less pessimistic, which helps green dominate the stock market in the session on February 4. Many stocks that fell in price in the session on February 3 have increased again today.

In contrast to the red-filled opening session of At Ty 2025, the significant improvement in investor sentiment, as the domestic market benefited from positive signals on international exchanges, helped trading on February 4 to be more positive.

Right from the beginning of the session, the main index had a certain improvement, however the increase was not really sustainable when the demand was still cautious, waiting for clearer signals from the leading stocks. Cash flow tended to focus on the small and medium capitalization group, causing many stocks in this group to increase sharply. Meanwhile, the large-cap group, although recovering compared to the previous session, the level of differentiation was still clear. Some stocks in this group played a role in supporting the market, helping the index maintain green until the end of the morning session.

In the afternoon trading session, the positive developments spread more widely in the market due to the improvement in banking, securities and steel stocks. This development helped all three indices maintain good green color until the end of the session.

At the end of the trading session, VN-Index increased by 11.65 points (0.93%) to 1,264.68 points. HNX-Index increased by 3.12 points (1.4%) to 226.61 points. UPCoM-Index increased by 0.8 points (0.85%) to 95.31 points. On the three exchanges, a total of 548 stocks increased while 217 stocks decreased and 807 stocks remained unchanged. The whole market recorded 31 stocks hitting the ceiling while only 5 stocks hit the floor.

Banking stocks were the focus of strong selling pressure yesterday and had a breakthrough today. The "king" stocks were also an important driving force to help maintain the green color of VN-Index in today's session. Of which, CTG increased by 3.6% and had the biggest impact on VN-Index when contributing 1.7 points to this index. TCB also increased by 1.65% and contributed 0.67%. Codes such as MBB, VCB, VPB, BID... all increased in price well.

The group of securities stocks also had positive fluctuations when VND was unexpectedly pulled up to the ceiling price of 12,400 VND/share. Besides, another securities stock, SHS, also increased by nearly 7% to 13,800 VND/share. The strong increase of VND and SHS helped the cash flow spread widely to many other securities stocks, in which, VIX increased by 3.15%, AGR increased by 2.7%, MBS increased by 2.2%...

Besides the banking group, large stocks such as HPG, PLX... also increased in price. At the same time,FPT recovered after yesterday's sell-off session, increasing 0.48% to 146,200 VND/share.

HPG increased by 1.7% today. Other steel stocks such as NKG, HSG, TVN... also increased sharply. The steel industry group increased strongly in line with the public investment group, in which CTD was pulled up to the ceiling price, KSB increased by 4.7%, PLC increased by 3.6%.

Market liquidity was at the same level as the previous session. The total matched volume on the HoSE floor reached 660.3 million shares, equivalent to a transaction value of VND15,325 billion, up nearly 10% compared to the previous session, of which negotiated transactions contributed VND2,274 billion. The transaction value on the HNX and UPCoM reached VND946 billion and VND562 billion, respectively.

Foreign investors continued to maintain a strong net selling position with a total value of 970 billion VND in the whole market. However, compared to the net selling value yesterday (1,400 billion VND), the selling force has "diminished" somewhat. Foreign investors net sold the most VNM code with 306 billion VND. LPB and FPT were net sold 242 billion VND and 159 billion VND respectively. In the opposite direction, HPG was net bought the most with 45 billion VND. GEX was behind with a net buying value of 22 billion VND.

Source: https://baodautu.vn/sac-xanh-phu-rong-vn-index-tang-hon-11-diem-trong-phien-ngay-42-d244270.html

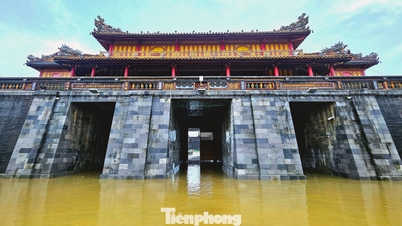

![[Photo] Da Nang: Water gradually recedes, local authorities take advantage of the cleanup](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/31/1761897188943_ndo_tr_2-jpg.webp)

Comment (0)