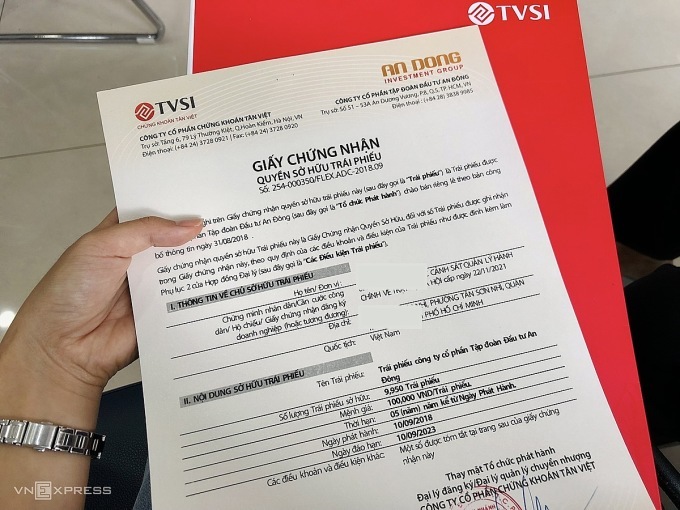

After-tax profit of Tan Viet Securities (TVSI) 'evaporated' 241 billion VND

Recently, the 2022 audit report just released by Tan Viet Securities (TVSI) has shown some changes. Notably, most of the company's profits have been "blown away", along with a number of issues pointed out by the auditing company.

After-tax profit of Tan Viet Securities (TVSI) 'evaporated' 241 billion after audit (Photo TL)

Specifically, on the audited financial statements, the company's management costs increased by VND226 billion because the company had to set aside provisions. In addition, financial asset losses recorded through profit/loss (FVTPL) also increased by VND18 billion.

Other financial indicators did not fluctuate much, but the large change in management costs alone caused Tan Viet Securities' after-tax profit to drop sharply to only VND 148.4 billion in 2022, down nearly VND 241 billion compared to the self-prepared financial statements.

Auditors give some exception opinions on TVSI's 2022 self-prepared financial statements

Some exceptions of TVSI include that as of December 31, 2022, the company has made provisions for breach of the contract to repurchase bonds that are due but not performed at a rate of 50% of the maximum value of the contractual obligation (equivalent to VND 195 billion), the total value of the repurchase contracts is VND 4,870 billion.

The auditor cannot assess the level of fines, compensation for damages, or the impact of this incident on the 2022 financial statements.

TVSI believes that the company's breach of contract was due to force majeure and was stipulated in the contract. The company will only make compensation when there is a decision from a competent state agency. Therefore, the provision for compensation for breach is in accordance with accounting principles.

In addition, in 2022, TVSI has purchased and resold individual corporate bonds from issuers and investors. As of December 31, 2022, the total face value of bonds that TVSI has signed a purchase contract for is approximately VND 20,700 billion. By the time of issuing the audited financial statements on August 18, 2023, the total face value of bonds that the company has signed a repurchase contract for is VND 18,000 billion. Of which, the amount due for payment but not yet paid is VND 14,800 billion.

However, TVSI has sent a notice of not making the purchase transaction, and is negotiating with investors to cancel the repurchase contract or extend the bond repurchase period corresponding to the bond maturity date of the issuer. This negotiation has not yet had a specific result, and the company has not recorded the above bonds in the financial statements.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)