Recently, Tan Viet Securities Joint Stock Company (TVSI) announced its 2022 audited financial statements with many exceptions from the auditor.

Notably, according to the auditor, in the course of business, TVSI purchased individual corporate bonds from issuers and investors, then resold them many times with investors. At the same time, the company also signed contracts to buy back some bonds sold to investors at a specified price on a specified date in the future. When selling and repurchasing bonds with investors, the company is recording as proprietary trading activities.

As of December 31, 2022, the total face value of the bonds that Tan Viet Securities has signed a repurchase contract for as of December 31, 2022 is approximately over VND 20,700 billion, of which the amount that has matured but has not been paid is approximately over VND 4,870 billion.

However, on August 18, 2023, the company announced its 2022 audit report, showing that the total face value of the bonds the company had signed a repurchase contract for was about 18,000 billion VND, of which the amount due for payment but not yet paid was about more than 14,800 billion VND.

In addition, the auditor's exception opinion also stated that, as of December 31, 2022, the company had made provisions for breach of the bond repurchase contract due but not performed at 50%, equivalent to about VND 195 billion of the maximum value of the breached contract obligation according to the total value of the repurchase contracts of more than VND 4,870 billion because it believed that:

“TVSI’s violation was due to force majeure as stipulated in the contract, so during the dispute resolution process, the company can negotiate to avoid being fined for the violation at the maximum level and the company will only compensate when there is a decision from a competent State agency,” the audit unit stated.

Regarding this issue, TVSI said that up to now, the company has not had to pay any costs related to the violation of bond repurchase contracts, showing that the above provision is appropriate and ensures the principle of accounting prudence.

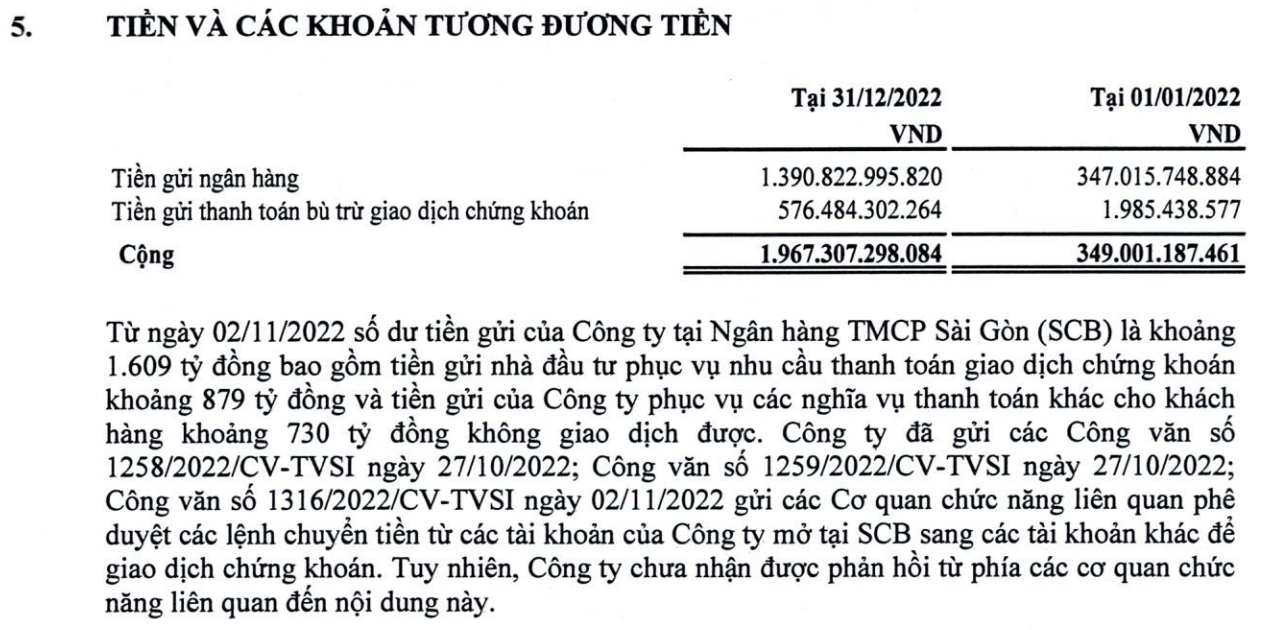

On the other hand, the auditor also noted that from November 2, 2022, TVSI's deposit balance at Saigon Commercial Joint Stock Bank (SCB) was about VND 1,609 billion, including investor deposits serving securities transaction payment needs of about VND 879 billion, TVSI's deposits serving other payment obligations to customers of about VND 730 billion that could not be traded.

The company has sent many official dispatches to relevant authorities to approve money transfer orders from TVSI's accounts at SCB to other accounts for securities trading, but has yet to receive a response from the authorities.

TVSI is currently under special control (from May 18 to September 17, 2023) according to the decision of the State Securities Commission. Along with that, the company is suspended from trading securities on the listed stock market and registered for trading from June 27, 2023 until the Securities Commission removes it from special control.

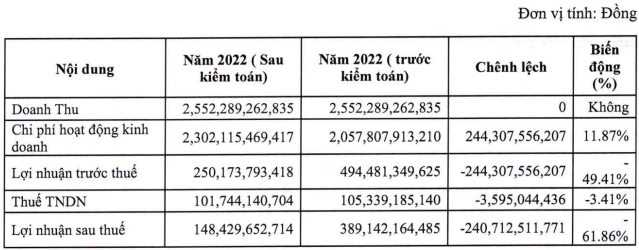

According to the 2022 audited financial report, the company's operating revenue remains at VND2,552 billion as reported independently. However, adjusted operating expenses increased by 12% to VND2,302 billion. Accordingly, after-tax profit decreased by 62% to VND148 billion.

This significant difference is due to the company's additional accounting for financial asset revaluation costs through profit/loss (FVTPL), bad debt provisions, and other payable expenses provisions with a total amount of VND 244 billion.

As of December 31, 2022, TVSI's total assets decreased by 36% compared to the beginning of the year to VND 4,288 billion, of which cash increased nearly 6 times to VND 1,967 billion and self-invested assets increased by VND 880 billion to nearly VND 1,900 billion. In contrast, loans decreased from VND 5,120 billion to only VND 363 billion.

In the separate financial report for the second quarter of 2023, accumulated in the first half of the year, TVSI recorded revenue of 134 billion VND, down 92% over the same period, profit after tax was only 24 billion VND, while in the same period it reached 275 billion VND.

In addition, as of June 30, 2023, the company's loans continued to decrease to VND 229 billion. If calculated from the beginning of 2022, Tan Viet Securities' loan capital has decreased by 96%.

Thus, compared to the plan set by the company, this result of TVSI is even somewhat acceptable. Because in 2023, the company agreed on a modest plan with a revenue target of approximately 200 billion VND, down 92% compared to 2022 and a loss after tax of 570 million VND. The goal this year is to continue to focus on solving the bond issue, protecting the interests of investors, maintaining basic brokerage activities and striving to break even .

Source

![[Photo] General Secretary To Lam receives leaders of typical Azerbaijani businesses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/998af6f177a044b4be0bfbc4858c7fd9)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)