VN-Index grows above support around 1,260 points

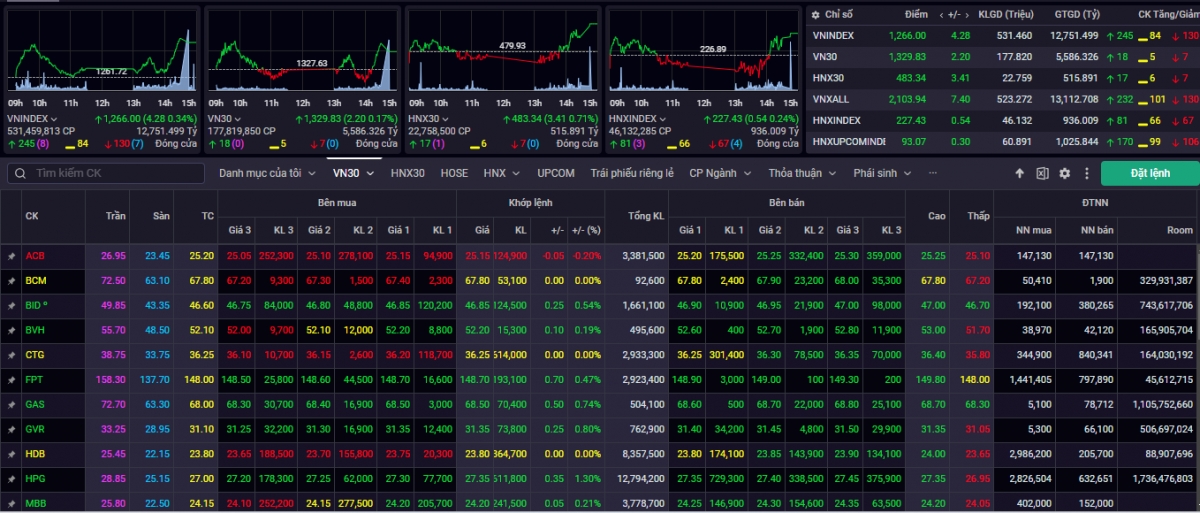

After a period of adjustment pressure with gradually decreasing liquidity, VN-Index recovered and increased points well in the session of December 18 with improved liquidity and market breadth. At the end of the trading session on December 18, VN-Index increased by 4.28 points (+0.34%) to 1,266.0 points, maintaining above the 200-session average price line. Trading volume on HOSE increased by 9.4% compared to the previous session, after a period of 09 sessions of decline.

Market breadth returned to positive with 204 stocks increasing in price, 102 stocks decreasing in price and 65 stocks maintaining the reference price. The market was positively differentiated, the pressure to adjust and accumulate was still relatively normal in many stocks, while many stocks still recovered well, with quite extraordinary liquidity, notably in the oil and gas, agriculture, steel, energy groups... The market created a balanced price zone above the highest price zone in 2023 and the average price of 200 sessions. Foreign investors were net buyers on HOSE with a value of +5.35 billion VND in the session on December 18.

According to experts from Saigon - Hanoi Securities Company (SHS), in the short term, VN-Index is growing above the support level of around 1,260 points, corresponding to the average price of 200 sessions. Meanwhile, VN30 has the nearest support level of around 1,320 points and strong support of 1,300 points, corresponding to the average price of 200 sessions. The market is entering the stage of closing NAV in 2024 for investors. This is a suitable accumulation stage, re-evaluating the fundamental factors and prospects, new growth drivers of the general market, as well as businesses.

In the short term, market quality is still improving, many stocks are at relatively attractive prices, opening up many good opportunities. VN-Index is under pressure to correct, accumulating above the support zone around 1,260 points, before waiting for new growth drivers such as expectations for growth in business results in the fourth quarter of 2024 and prospects for 2025.

“The market will overcome the accumulation trend that has lasted since the beginning of the year. Investors should maintain a reasonable proportion. Consider selectively disbursing stocks with good fundamentals, expecting continued growth. The investment target is towards leading stocks with good fundamentals,” said SHS experts.

VN-Index may challenge the 1,268 point threshold

According to the analysis team of Agribank Securities Company (Agriseco), on the technical chart, VN-Index increased positively after retesting the support of MA200 days, corresponding to the 1,260 point mark. Active demand increased well at the end of the day, expected to create positive inertia in today's session, December 19. Agriseco Research believes that VN-Index may return to an uptrend and head towards the 1,280 point mark in the upcoming trading sessions.

“Investors can continue to hold their existing stock portfolio. Note that the market may fluctuate strongly and in opposite directions when the key events of the month are approaching: The FED's interest rate announcement at the FOMC meeting taking place on the evening of December 18 (Vietnam time); December derivatives maturity today, December 19; The deadline for restructuring the portfolio of ETFs simulating the FTSE Vietnam Index and Market Vector Vietnam Local Index on December 20,” Agriseco experts noted.

Sharing the same view, experts from Yuanta Vietnam Securities Company (YSVN) said that the market may continue to increase and the VN-Index may challenge the 1,268-point threshold in today's session, December 19. At the same time, the market is still in a short-term accumulation phase, so cash flow may be differentiated among stock groups, especially the VNMidcaps and VNSmallcaps indices may continue to increase in the coming sessions. In addition, the slightly increased sentiment indicator shows that sentiment has become less cautious.

“The short-term trend of the general market remains at an upward level. Therefore, investors can continue to hold a high proportion of stocks in their portfolio and can take advantage of the correction to increase the proportion of stocks. Investors can pay attention to the Midcaps and Smallcaps groups of stocks,” YSVN experts recommended.

► Some stocks to watch on December 19

Source: https://vov.vn/thi-truong/chung-khoan/nhan-dinh-chung-khoan-1912-vn-index-co-the-thu-thach-nguong-1268-diem-post1143006.vov

Comment (0)