The event "Connecting international supply chains" (Viet Nam International Sourcing 2023) was held from September 13 to 15 in Ho Chi Minh City to support businesses to participate more deeply in the global production chain, promoting connections between distribution channels, importers with domestic manufacturing and exporting enterprises. The Ministry of Industry and Trade said that many large corporations in the world announced that they would participate such as Walmart, Amazon, Boeing, Carrefour, Central Group; Coppel (Mexico), IKEA (Sweden); Aeon, Uniqlo (Japan)...

Not only that, information from the European - American Market Department (Ministry of Industry and Trade) recently also said that the US Apple Corporation has completed the transfer of 11 factories producing audio-visual equipment to Vietnam; Intel Corporation expanded the second phase of its chip testing factory in Ho Chi Minh City with a total investment of up to 4 billion USD or the Danish Lego Corporation invested in building a factory in Binh Duong with a total capital of 1 billion USD.

Electronic equipment manufacturing at Foster VN Co., Ltd. in VSIP 2 Industrial Park (Binh Duong) - a Japanese invested company

Do Truong

The emergence of large manufacturing corporations shows that Vietnam is becoming a major global manufacturing center. Previously, foreign direct investment (FDI) enterprises that were present early in the domestic market such as Intel, Samsung, LG, Qualcomm, etc. also continuously announced investment expansion. Most notably, at the end of last year, Samsung officially put into operation the Research and Development (R&D) Center in Hanoi - this is the largest R&D center in Southeast Asia of this corporation in the plan to elevate Vietnam's position beyond its role as a global manufacturing base. Currently, Samsung has moved the entire phone production line of the corporation to Vietnam and India. About 60% of Samsung's smartphones sold worldwide are manufactured in Vietnam.

Through the R&D Center, Samsung hopes to actively contribute to the development of the hardware (H/W) and software (S/W) fields in line with the advanced IT field and the 4.0 industrial revolution. In addition, the group is preparing conditions for trial production of semiconductor chip grid products and will mass produce them at the Samsung Electro-Mechanics factory in Thai Nguyen. Similarly, the leader of LG Group said that in the future, the group will invest another 4 billion USD in Vietnam with the desire to continue investment cooperation in many fields. LG's goal is to make Vietnam a center for producing cameras for phones in the future...

Manufactured at Samsung Electronics Vietnam Co., Ltd.

Pham Hung

Made in Samsung Vietnam

Thuy Linh

In addition, a series of new names have begun to appear directly in Vietnam. For example, Synopsys (USA) announced in 2022 that it will train electrical engineers in Vietnam and support Ho Chi Minh City High-Tech Park (SHTP) to establish a chip design center through a software sponsorship program. This is one of the few American companies that dominate the global market for electronic design automation (EDA), or chip design software. A component supplier for Samsung, Hansol Electronics Vietnam (Korea), has recently been granted an investment license by the Dong Nai Provincial People's Committee for 2 projects with a total capital of up to 100 million USD...

At the forum "Seizing opportunities from new capital flows" held at the end of August, a representative of the Korea Chamber of Commerce and Industry (Kocham) informed that there were dozens of investment projects from Korea in Vietnam in the first 7 months of 2023. In particular, there are projects worth from 700 million to billions of USD. Kocham affirmed that the capital flow from Korea to Vietnam will continue to increase in the coming time, because Vietnam is still considered a potential market by Korean companies, especially after the Covid-19 pandemic, the wave of shifting of many foreign investors to Vietnam has become stronger.

Referring to President Joe Biden's official visit to Vietnam from today (September 10), Professor Nguyen Mai, Chairman of the Vietnam Association of Foreign Investment Enterprises (VAFIE), affirmed that Vietnam and the US will have important cooperation projects in the field of technology in the coming time. The US ranked 11th out of 141 countries and territories investing in Vietnam last year, but that was only direct investment from the US, while investment through third countries, through the supply chain... is actually much higher.

Sunshine aerospace components factory of UAC Group (USA) in Da Nang

Nguyen Tu

Manufactured at Terumo Company (medical equipment), Quang Minh Industrial Park, Hanoi. Photo by Pham Hung (12)

Pham Hung

Notably, the hottest issue in the recent semiconductor competition is semiconductor technology (and semiconductors cannot lack rare earths). After China, Vietnam has a huge advantage in rare earths. In 2022, Vietnam exported 4,500 tons of rare earths, earning 200 million USD. With the existing potential, assuming we can produce hundreds of thousands of tons of rare earths, the foreign currency earned will be up to tens of billions of USD. That is not only money but also the position of a country in the world. Based on rare earths, human resources are being trained better and better to push forward the process of industrialization and modernization of the country.

Professor Nguyen Mai emphasized: Therefore, the opportunity or more accurately the prospect of Vietnam becoming an important production base of the world is completely possible. Vietnam's advantage is that it has large, long-term investors from two strong countries in Asia, South Korea and Japan - always in the top 5 in terms of FDI capital in Vietnam. Now, with diplomatic trips, exchanges, work, and learning between high-ranking leaders from the US to Vietnam, accompanied by large technology corporations, it is an opportunity for the two countries to further promote cooperation in technology. The US is still the leader in high technology, future technology, and source technology.

"More than a year ago, Intel's representative in Vietnam said that this corporation has 3 factories with source technology (including a factory in the US) and now wants to turn Vietnam into one of the locations for source technology production. Therefore, in the near future, our problem is how to have human resources, resources, and foundation to absorb modern technologies from US partners. We need to do more research and development to master future technologies, clean energy, semiconductors...", Professor, Dr. Nguyen Mai shared more.

Dr. Nguyen Quoc Viet - Deputy Director of the Institute for Economic and Policy Research, School of Economics, Vietnam National University, Hanoi - commented that the trend of shifting production of many large corporations in the world to Vietnam has become clear. This is also an attractive point that Vietnam has maintained in recent years. With positive points assessed by foreign investors such as improvements in the business environment; participation in many new generation free trade agreements; developed digital platforms and infrastructure. At the same time, Vietnam's human resources are still well-qualified. If in the past it was a simple production base for textiles, footwear, recently there have been more factories producing high technology, electronics, microchips, etc.

Manufactured at R - VN Technical Research Co., Ltd.

Pham Quang Vinh

Even factories producing leather, footwear and textile products have invested in higher-tech production, such as Uniqlo, which has announced many products made in Vietnam with global quality standards, such as Ultra Light Down jackets, thermal shirts, sweatshirts, faux sheepskin coats or wool woven shirt products...

"Vietnam has truly become a destination for the world's manufacturing and processing industry in general. In addition to Vietnam's own advantages, there is also a part from objective international factors. These are countries with geopolitical tensions and conflicts with each other, causing foreign investors to need to shift production to diversify risks, so Vietnam was chosen as a suitable destination. To continue to receive new FDI capital flows and retain old investors, Vietnam must continue to improve its competitiveness, increase the ability to meet the needs of high-quality production chains in accordance with new criteria such as green production, green energy...", said Dr. Nguyen Quoc Viet.

With the presence of many large corporations in Vietnam, domestic enterprises are assessed to have many opportunities to participate in the global production chain through the role of suppliers or becoming a link in the entire production of factories. However, in reality, the number of Vietnamese enterprises participating in the production supply chain is still small, mainly in the low value-added stage.

Dr. Nguyen Quoc Viet said that currently, manufacturers are becoming more demanding, requiring much higher standards in terms of technology, infrastructure, environment, and even human resources. In many cases, Vietnam still cannot meet the requirements of large corporations when they want to open factories in Vietnam, such as weak security technology, slow digital economy, and insufficient high-quality human resources. Therefore, the shift of production to Vietnam should have increased, but there may still be "blockages" that slow down this wave. Even the uncertainty in some of Vietnam's policies makes FDI investors hesitant.

Meanwhile, neighboring countries are also constantly improving their competitiveness. Therefore, Vietnam must always strive, recognize the existing problems to have synchronous policies to improve the capacity of domestic enterprises to be able to connect and participate more in the supply chain with foreign corporations. From there, it can accelerate to attract more large corporations and truly become an important production base in the global supply chain.

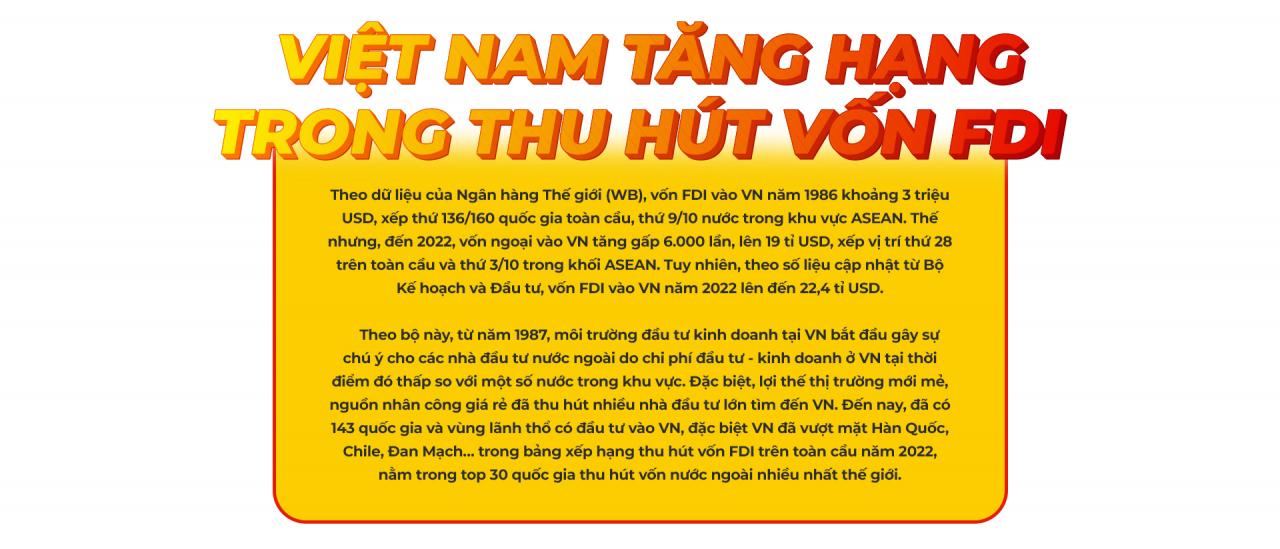

Agreeing, Associate Professor, Dr. Dinh Trong Thinh (Academy of Finance) expressed his opinion that compared to previous years and right in the year of the pandemic outbreak, Vietnam's position in the world has changed significantly. However, Vietnam needs to research and attract and develop in depth, not in breadth like China before. In particular, if it becomes a production base, Vietnam needs to focus on increasing the rate of added value enjoyed by Vietnamese people, instead of focusing on the hands of foreign investors in the supply chain or imports. For example, more than 80% of components are still imported, completely dependent on foreign countries. Today, Vietnam must gradually reduce this rate to 70%, 50 - 60% to be successful.

Thanhnien.vn

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)