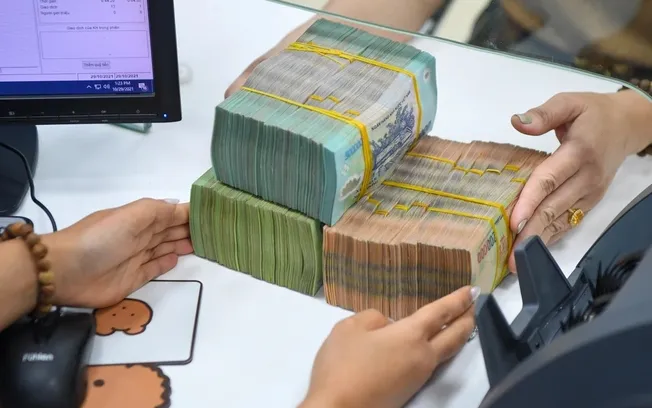

To have a place to live, many young families have chosen to borrow from banks to buy apartments. During times when interest rates "jump", they struggle to pay off their debts.

Young people buy apartments in Hanoi - Photo: QUANG THE

In the context of skyrocketing apartment prices in Hanoi, many economic experts believe that the State needs to have policies to allow young people under 35 years old to access loans from banks, but the interest rate must be fixed and low, with long terms.

Worry every time the loan to buy an apartment fluctuates

On March 9, speaking with Tuoi Tre reporter, Ms. Nguyen Thi Phuong (31 years old, from Thanh Hoa) said that after many years of saving 500 million VND, in 2021, she and her husband decided to borrow an additional 1.7 billion VND to buy a 55m2 apartment in a project in Nam Tu Liem district (Hanoi).

"The loan of 1.7 billion VND has a term of 25 years. At first, my wife and I had to pay 18 million VND in principal and interest, but at times when the floating interest rate rose to 11-13.5%, we had to pay up to 23 million VND per month.

The high interest rate coincided with the time my husband was unemployed, so every month I had to struggle to pay off the debt," said Ms. Phuong.

To buy an apartment in Hanoi, many young families choose to borrow from banks - Photo: Q.THE

Mr. Do Quang Trung (34 years old, from Nghe An province) said that although he borrowed only 500 million VND to buy an apartment, there was a time when he was struggling because of the interest.

"My family bought an apartment worth nearly 3 billion VND and had to borrow an additional 500 million VND, with a term of 15 years, the loan started in December 2020. In the first 2 years, the fixed interest rate of 7-7.5% was still comfortable for my husband and I.

Two years later, there were many times when we struggled because of the floating interest rate following the market, at one point the interest rate increased to 13.5%, the principal and interest payment amounted to nearly 7.5 million VND/month. While my wife and I had a very limited income, in addition to paying the bank monthly, we also had to worry about living expenses, school fees for our children...", Mr. Trung said.

According to Mr. Trung, the bank interest rate in February 2025 is 9.5%, the amount his family has to pay is 5.4 million VND (principal 2.8 million VND, interest 2.6 million VND). After many years of paying off the debt, his family's total bank loan is now 361 million VND.

"With an interest rate of 10%/year, the borrower must pay in installments in the first years about 18 million VND/month for a loan of 2 billion VND (term of 30 years). For a loan of 3 billion VND (term of 30 years), the borrower must pay more than 26 million VND/month in the first years," Ms. NTT - an employee of a commercial bank - advised.

The need for housing in recent years in Hanoi has always been urgent, but even in the suburbs, many urban areas have been built and then abandoned - Photo: DANH KHANG

Need low interest rate, long term home loan

Speaking to Tuoi Tre Online , Dr. Le Xuan Nghia (member of the National Financial and Monetary Advisory Council) said that the current sky-high housing prices are beyond the budget of the majority of people. The government needs to have policies to help young people access capital from banks, but the interest rate must be low - fixed, long-term.

Dr. Le Xuan Nghia - Photo: D.KHANG

"In European countries or the US, the loan term must be at least 30 years and the interest rate must be fixed so that people can calculate their repayment plan.

"If interest rates float according to the market, many people will not be able to pay their debts, and the risk of losing their homes is real," said Mr. Nghia.

Mr. Nghia analyzed: "Government support is needed because, for example, Singapore lends for 30 years with a fixed interest rate of 2.5%/year, the percentage that the bank has mobilized capital is compensated by the Government. If the Government does not compensate, the bank cannot bear it because the principle of banking business is to make a profit.

In addition, the Government and localities must fight to reduce housing prices by increasing supply, for example building social housing, creating the most favorable conditions for investors to quickly resume construction of "shelved" projects. Only by doing so vigorously within 5 years can housing prices be stabilized."

Dr. Le Dang Doanh (former director of the Central Institute for Economic Management) said that it is clear that in recent times, the "dripping" supply of housing has led to speculation and price inflation. In addition to credit policies, Hanoi and Ho Chi Minh City need to have mechanisms to encourage investors to participate in the affordable commercial housing segment.

Dr. Le Dang Doanh - Photo: Character provided

"Many countries give long-term loans to young people under 35 to encourage them to work and earn income to repay the debt over a long period of time. Young people always have to try to work, if they are late in paying, they will lose their house.

In our country, young human resources are contributing greatly to the economy, but if they keep working without a house to live in, they will be discouraged, so timely policies are needed," Mr. Doanh said.

According to Mr. Doanh, if they work forever without being able to buy a house, many young people will migrate to other places; to avoid letting the best youth of a part of young people go to work abroad just because of housing needs.

Prime Minister requests inspection of interest rate increase

That is the request made by Prime Minister Pham Minh Chinh in Official Dispatch No. 19 (dated February 24) sent to the Governor of the State Bank regarding strengthening the implementation of solutions to reduce interest rates.

Official dispatch No. 19 stated that although the Prime Minister has directed the implementation of solutions to reduce lending interest rates and remove difficulties for customers, recently some commercial banks have increased deposit interest rates, which is a factor that increases lending interest rates.

Therefore, the Prime Minister requested the State Bank to immediately inspect and examine commercial banks that have increased deposit interest rates in the past; the announcement and implementation of deposit and lending interest rates of credit institutions, ensuring compliance with regulations.

Source: https://tuoitre.vn/vay-lai-mua-nha-chung-cu-nguoi-tre-quay-cuong-tra-no-20250309161221585.htm

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)