On the morning of June 29, the National Assembly passed the Resolution of the 7th Session of the 15th National Assembly with 100% of the delegates present voting in favor.

Secretary General of the National Assembly, Head of the National Assembly Office Bui Van Cuong presented a report explaining, accepting and revising the draft Resolution on questioning activities at the 7th Session of the 15th National Assembly.

In this Resolution, the National Assembly resolves that, based on Conclusion No. 83 dated June 21, 2024 of the Politburo and Report No. 329 dated June 21, 2024 of the Government, the National Assembly agrees to implement the contents of salary reform; adjust pensions, social insurance benefits, preferential benefits for people with meritorious services and social benefits from July 1, 2024.

Specifically, fully implement 2 contents of salary reform in the enterprise sector in accordance with Resolution No. 27 including:

Adjusting regional minimum wages according to the provisions of the Labor Code (an average increase of 6% applied from July 1, 2024); regulating the wage mechanism for state-owned enterprises (applied from January 1, 2025).

Implement salary reform according to Resolution No. 27 in the public sector in a gradual, cautious, and certain manner, ensuring feasibility and contributing to improving the lives of wage earners. The Government is assigned to:

Implement the contents that are clear and eligible for implementation, including: Completing the salary increase regime; supplementing the bonus regime; regulating the funding source for implementing the salary regime; completing the salary and income management mechanism;

Adjust the basic salary from 1.8 million VND/month to 2.34 million VND/month (increase 30%) from July 1, 2024;

For agencies and units that are applying specific financial and income mechanisms at the Central level, the Government, relevant ministries and branches continue to review the entire legal framework to submit to competent authorities for consideration and decision on amending or abolishing the specific financial and income mechanisms of the agencies and units that are being implemented appropriately before December 31, 2024;

Retain the difference between the salary and additional income in June 2024 of cadres, civil servants and public employees with the salary from July 1, 2024 after amending or abolishing the special financial and income mechanism.

During the period of not amending or abolishing, the following shall be implemented: From July 1, 2024, the monthly salary and additional income will be calculated based on the basic salary of VND 2.34 million/month according to a special mechanism ensuring that it does not exceed the salary and additional income received in June 2024 (excluding the salary and additional income due to adjustment of the salary coefficient of the salary scale and grade when upgrading the grade or grade).

In case of calculation according to the above principle, if the salary and income increase from July 1, 2024 according to the special mechanism is lower than the salary according to general regulations, the salary regime according to general regulations will be implemented.

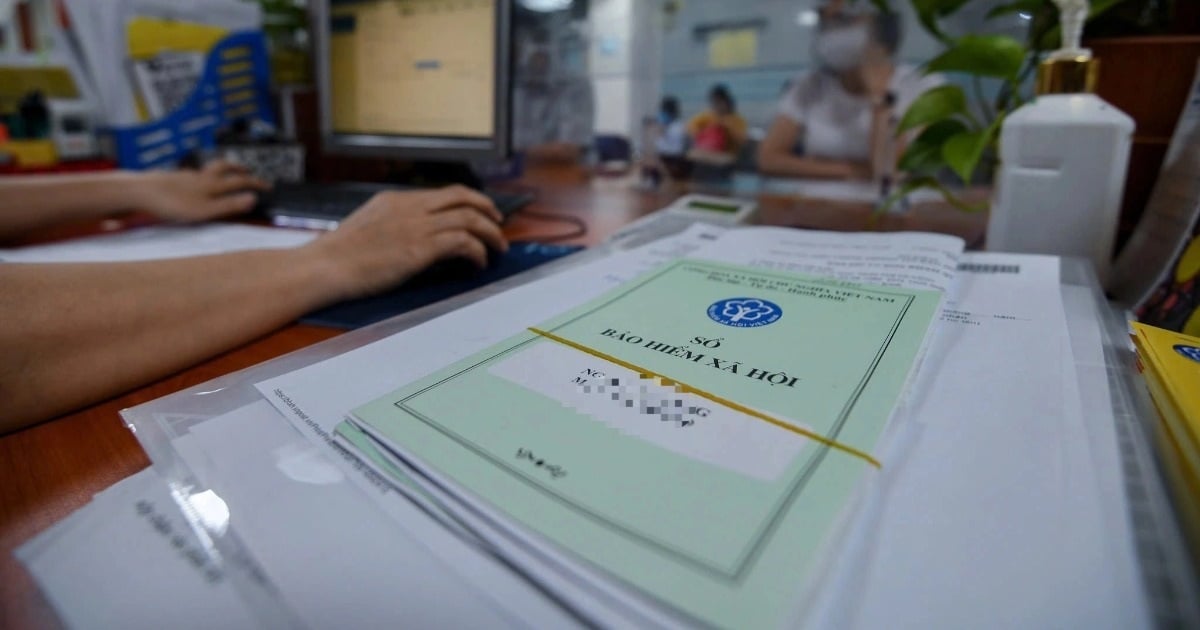

From July 1, 2024, current pension and social insurance benefits will be adjusted up by 15%.

From July 1, 2024, the current pension and social insurance benefits will be adjusted up by 15% (June 2024); for those receiving pensions before 1995, if after adjustment the benefit level is lower than 3.2 million VND/month, the adjustment will increase by 300,000 VND/month; if the benefit level is from 3.2 million VND/month to less than 3.5 million VND/month, the adjustment will be equal to 3.5 million VND/month;

Adjust the preferential allowance for meritorious people according to the standard allowance level from VND 2,055,000 to VND 2,789,000/month (an increase of 35.7%), maintaining the current correlation of preferential allowance levels for meritorious people compared to the standard allowance level; adjust social allowance according to the standard social assistance level from VND 360,000 to VND 500,000/month (an increase of 38.9%);

Assign the National Assembly Standing Committee to consider regulations on salaries and policies for full-time National Assembly deputies, full-time People's Council deputies, cadres, civil servants, public employees, other workers of the National Assembly Office and other subjects under its authority as prescribed by law.

The Resolution also resolves to assign the Government to prescribe the subjects, conditions, support levels, procedures and processes for settling retirement and death benefits for employees in cases where employers are no longer able to pay social insurance for employees before July 1, 2024.

The funding source for implementation comes from the revenue from handling late payment and evasion of payment as prescribed in Clause 3, Article 122 of the Social Insurance Law No. 58/2014/QH13 and the amount of 0.03%/day collected as prescribed in Clause 1, Article 40 and Clause 1, Article 41 of the Social Insurance Law (amended) approved by the National Assembly at the 7th Session.

In case the competent authority discovers that the employer is still able to pay social insurance for the employee, it shall collect and pay back to the Social Insurance Fund and handle violations according to the provisions of law .

Source: https://www.nguoiduatin.vn/tu-1-7-2024-dieu-chinh-tang-15-muc-luong-huu-a670762.html

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)