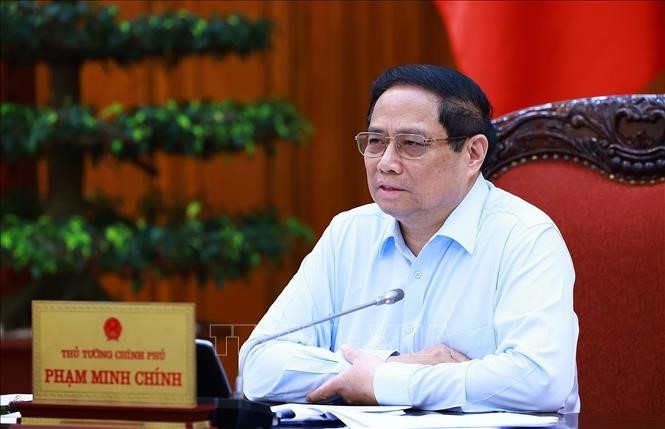

(Chinhphu.vn) - Prime Minister Pham Minh Chinh has just signed Official Dispatch No. 32/CD-TTg dated April 5, 2024 to the Governor of the State Bank of Vietnam on solutions to manage credit growth in 2024.

In order to continue to improve the efficiency of credit growth management in 2024, while strengthening state management of the monetary and banking sectors, proactively, flexibly, harmoniously, promptly and effectively managing monetary policy tools, especially interest rates, exchange rates and credit to prioritize promoting economic growth, maintaining macroeconomic stability, controlling inflation, and ensuring major balances of the economy, the Prime Minister issued Official Dispatch No. 18/CD-TTg dated March 5, 2024 on credit growth management in 2024, however, credit growth by March and the first quarter of 2024 only reached about 0.9%. The Prime Minister requested:

1. The State Bank of Vietnam presides over and coordinates with relevant agencies:

a) Continue to closely monitor developments and the world and domestic economic situation, operate monetary policy more proactively, flexibly, promptly and effectively; resolutely and effectively implement tasks and solutions, especially on promoting credit growth, reducing lending interest rates according to the direction of the Prime Minister in Official Dispatch No. 18/CD-TTg dated March 5, 2024 and related documents to prioritize promoting economic growth, removing difficulties for production and business associated with stabilizing the macro economy, controlling inflation, ensuring major balances of the economy, safe banking operations and the system of credit institutions.

b) Urgently, effectively and promptly implement credit growth solutions in line with macroeconomic developments and inflation, meeting capital needs for the economy to remove difficulties for businesses and people, support production and business development, create jobs and livelihoods for people; direct credit institutions to direct credit to production and business sectors, priority sectors and traditional economic growth drivers such as consumption, investment, export and strongly promote digital transformation, green transformation, response to climate change, circular economy, science, technology and innovation, etc.; strictly control credit for risky sectors, ensure safe and effective credit activities; continue to have breakthrough policies for preferential credit packages to contribute to removing difficulties in accessing credit for businesses and people.

c) Urgently review, analyze and carefully evaluate the results of credit limit implementation of the credit institution system for the economy, each industry and each field to have measures to manage the credit growth limit in 2024 more effectively, feasiblely and promptly, absolutely not to let it be stuck, delayed or untimely, ensuring the implementation of the credit growth targets set in 2024 and the safety of the credit institution system; in case of any content beyond the authority, promptly report and propose to the competent authority according to regulations.

d) Continue to effectively implement appropriate solutions to reduce lending interest rates associated with enhancing access to credit capital to support people and businesses in developing production and business, ensuring adequate credit capital supply, serving and meeting the capital needs of the economy and ensuring the safety of the credit institution system in accordance with the direction of the Prime Minister in Official Dispatch No. 18/CD-TTg dated March 5, 2024.

d) Direct and request credit institutions to:

- Publicly disclose the lending interest rate level and the implementation of credit packages before April 10, 2024 in accordance with the direction of the Government Standing Committee in Notice No. 134/TB-VPCP dated April 2, 2024; any organization that fails to comply will be strictly handled by the Governor of the State Bank of Vietnam according to his authority and publicly disclosed in accordance with the provisions of law.

- Continue to reduce costs, simplify administrative procedures, increase the application of information technology, digital transformation, etc., strive to reduce lending interest rates to contribute to promoting production and business, creating livelihoods for people and constantly supporting people and businesses.

- Promote effective implementation and ensure publicity and transparency of preferential credit packages suitable to the characteristics of each credit institution for important sectors, contributing to promoting the growth drivers of the economy according to the Government's policy; promote the role, enhance social responsibility and business ethics of credit institutions in understanding, sharing and supporting people and businesses; in the spirit of working together, enjoying together, winning together, and developing sustainably and long-term.

e) Direct state-owned commercial banks to immediately study the development and provision of credit packages for social housing buyers with terms of up to 15 years, with preferential interest rates lower than normal commercial loans, and to lend to businesses and investors building social housing with more preferential interest rates so that low-income people have the opportunity and motivation to buy houses or have convenience in renting or leasing; continue to study and consider lowering interest rates, simplifying procedures, and facilitating borrowing of VND 120,000 billion in support capital in accordance with the practical situation in accordance with the direction of the Prime Minister in Notice No. 123/TB-VPCP dated March 27, 2024.

g) Strengthen and enhance inspection, examination, control and close supervision of credit granting by credit institutions and have effective and timely solutions to handle bad debts of the credit institution system.

2. Deputy Prime Minister Le Minh Khai focused on directing the State Bank of Vietnam and relevant agencies to resolutely, promptly and effectively implement the assigned tasks and solutions.

3. The Government Office monitors and urges according to assigned functions, tasks and authorities./.

Government Portal

Source

Comment (0)