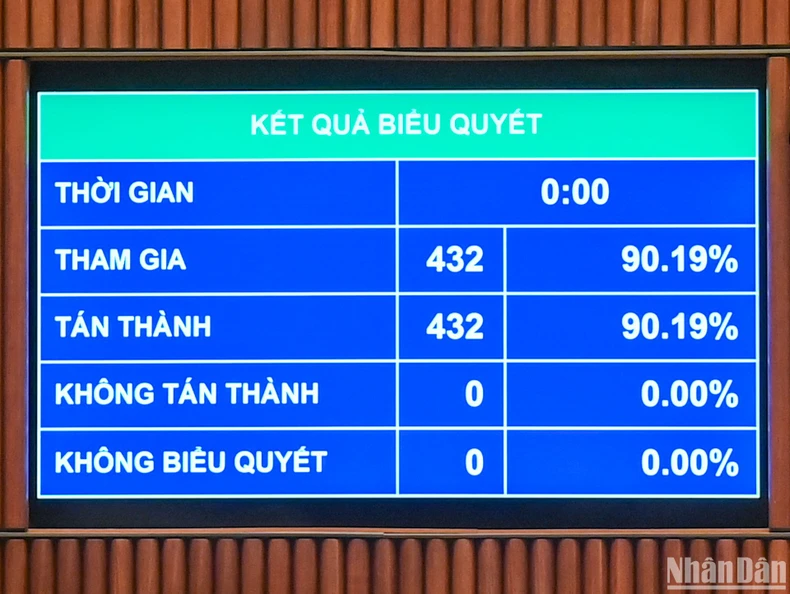

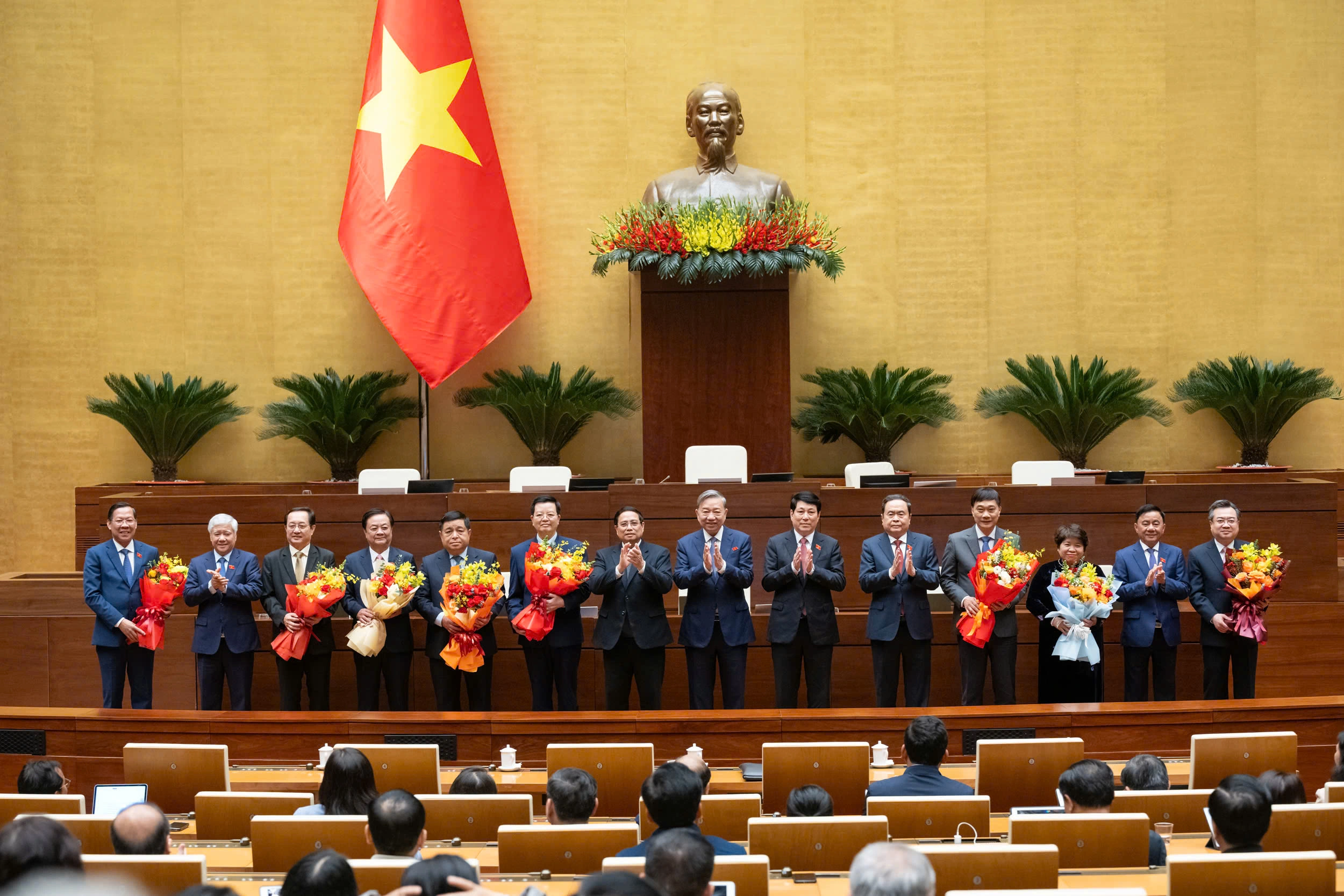

NDO - On the afternoon of November 13, the National Assembly voted to pass the Resolution on the central budget allocation plan for 2025 with 432/432 National Assembly deputies participating in the vote in favor, accounting for 90.19% of the total number of National Assembly deputies.

Accordingly, the National Assembly resolved that the total central budget revenue in 2025 is VND 1,020,164 billion. The total local budget revenue is VND 946,675 billion. Using VND 60,000 billion of the central budget's accumulated salary reform fund and VND 50,619 billion of the local budget's salary reform fund by the end of 2024, the remaining balance will be transferred to the 2025 budget arrangement of ministries, central and local agencies to implement the basic salary level of VND 2.34 million/month.

The Resolution also stated that the total central budget expenditure is VND 1,523,264 billion, of which: an estimate of VND 248,786 billion to supplement the budget balance (including a 2% increase in the balance compared to the 2024 state budget estimate and an increase of VND 917.3 billion for the Nghe An provincial budget to implement Resolution No. 137/2024/QH15 dated June 26, 2024 of the National Assembly on piloting a number of specific mechanisms and policies for the development of Nghe An province), a targeted additional estimate for the local budget (including an additional amount of VND 14,434.4 billion to ensure that the local budget balance estimate in 2025 is not lower than the local budget balance estimate in 2023).

The National Assembly assigns the Government to assign the tasks of state budget collection and expenditure, and the central budget allocation level to each ministry, central agency, province, and centrally-run city in accordance with the provisions of the State Budget Law, the National Assembly Resolution, and to notify in writing each National Assembly delegation of the province and centrally-run city.

At the same time, direct and guide ministries, central agencies and provinces and centrally run cities to allocate state budget investment capital in a concentrated, focused and key manner, in compliance with conditions and priority order as prescribed by the Law on Public Investment, Resolutions of the National Assembly, Resolutions of the National Assembly Standing Committee; fully pay off outstanding debts for basic construction in accordance with the provisions of law; allocate capital according to progress for important national projects, connecting projects, projects with inter-regional impacts that are meaningful in promoting rapid and sustainable socio-economic development, and transitional projects according to progress; after allocating sufficient capital for the above tasks, the remaining capital is allocated to newly started projects that have completed investment procedures in accordance with the provisions of law.

Tighten financial discipline, strictly handle violations and obstacles that slow down capital allocation, implementation and disbursement; individualize the responsibility of the head in case of slow implementation and disbursement, associated with the assessment of the level of completion of assigned tasks.

|

Voting results. (Photo: DUY LINH) |

The Resolution also assigns the Government to direct the People's Committees of provinces and centrally run cities to submit to the People's Councils of the same level for decision on the state budget revenue estimates in the locality, local budget revenue and expenditure estimates, local budget deficit, total borrowing of the local budget (including borrowing to offset deficit and borrowing to repay principal), and decide on the allocation of budget estimates according to their authority, in accordance with the provisions of the State Budget Law.

The Government is responsible for the accuracy of information, data, completeness, compliance with standards, norms, spending regimes and conditions for budget allocation in accordance with legal provisions; managing, using and settling allocated funds in accordance with the provisions of the State Budget Law and relevant laws; ensuring timely, effective and appropriate implementation, avoiding loss, waste and negativity.

The Standing Committee of the National Assembly, the Committee on Finance and Budget, the Council of Nationalities, other Committees of the National Assembly, National Assembly delegations, National Assembly deputies, the Vietnam Fatherland Front and its member organizations, within the scope of their tasks and powers, shall supervise the implementation of the Resolution.

The State Audit, within the scope of its tasks and powers, shall conduct audits of the implementation of the Resolution to ensure compliance with legal provisions.

Source: https://nhandan.vn/thong-qua-nghi-quyet-ve-phuong-an-phan-bo-ngan-sach-trung-uong-nam-2025-post844673.html

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

![[Photo] A brief moment of rest for the rescue force of the Vietnam People's Army](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a2c91fa05dc04293a4b64cfd27ed4dbe)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting after US announces reciprocal tariffs](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/ee90a2786c0a45d7868de039cef4a712)

![[Photo] Moment of love: Myanmar people are moved to thank Vietnamese soldiers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/9b2e07196eb14aa5aacb1bc9e067ae6f)

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

Comment (0)