(TN&MT) - Answering questions from National Assembly Deputies, Governor of the State Bank Nguyen Thi Hong proposed solutions to help low-income people buy houses in the coming time.

On the morning of November 11, at the question-and-answer session with the Governor of the State Bank of Vietnam, Delegate Nguyen Quoc Han - National Assembly Delegation of Ca Mau province asked Governor Nguyen Thi Hong to inform about the State Bank's solutions to speed up the disbursement of the credit program for social housing, workers' housing, and apartment building renovation and reconstruction according to Resolution No. 33 of the Government.

With the same content, Delegate Tran Thi Van - National Assembly Delegation of Bac Ninh province asked the Governor to provide solutions to remove difficulties and promote the development of the current real estate market. Especially for low-income people to buy social housing.

Responding to the question of delegate Nguyen Quoc Han about the credit package for workers and low-income people under the social housing program, Governor Nguyen Thi Hong stated that the program of 1 million apartments by 2030 is a very humane major policy and this is a policy to solve housing for low-income people. Therefore, it is necessary to mobilize capital from many sources, especially capital from the state budget.

In response to this program, the State Bank reported to the Government to include in Resolution No. 33 that commercial banks voluntarily offer a package of 120 trillion VND, which has now increased to 145 trillion VND. According to this program, capital is mobilized by banks from the people and the interest rate is reduced by about 1.5 - 2% compared to the normal interest rate of 3 years for low-income people and 5 years for investors.

However, Governor Nguyen Thi Hong said that the disbursement of this capital is low and depends on localities having to announce projects eligible to participate in this Program according to the guidance of the Ministry of Construction; secondly, borrowers must meet the conditions to guarantee the loan. In the context of the impact and consequences of Covid 19, low-income people and workers are having more difficulty borrowing and owning a house.

Therefore, the time to report this issue at the Socio-Economic Discussion Session is the initial stage of implementation, when disbursement has not been increased, this disbursement will be increased when the economic difficulties are less. Governor Nguyen Thi Hong said that the Ministry of Construction and localities need to assess the need for home ownership or rental needs of low-income people to come up with appropriate solutions.

Regarding the question of delegate Tran Thi Van about solutions to remove difficulties for the real estate market, Governor Nguyen Thi Hong said that the current situation of the real estate market is an imbalance between supply and demand in the real estate market segments, especially the real estate market segment for low-income people has not been strongly developed.

Among the economic policies, under the direction of the Government, the Prime Minister has strongly directed in Resolution No. 33 to remove difficulties for businesses doing business and investing in real estate.

During the recent past, the State Bank has had the following solutions:

Firstly, the State Bank has actively reviewed legal documents to propose solutions to remove difficulties for businesses when they encounter difficulties and cannot repay their debts. The State Bank has issued a circular to restructure the debt repayment period and maintain the debt group, and in this way, the debts of businesses operating in the real estate market have also been restructured and can access new sources of loans.

Second, the State Bank also directed credit institutions to reduce and waive interest rates for projects, including real estate projects. Regarding circulars related to lending, some regulations under the direction of the Government have also been stopped and not implemented.

“We have also amended some circulars regulating the purchase of corporate bonds by credit institutions to ensure more favorable conditions for the real estate market. For the low-income housing segment, this is a resource that must mainly come from the budget. The State Bank has proposed a VND120,000 billion package, which we will actively implement in the coming time,” Governor Nguyen Thi Hong replied.

For those who are eligible for housing loans, land support, and housing support from programs among the programs that the Social Policy Bank has implemented according to national target programs such as the Socio-Economic Development Program for Ethnic Minorities and Mountainous Areas, the State Bank has taken the lead in advising and issuing Decree 28, which includes relevant regulations. When resources are allocated, these support solutions will be implemented according to the program.

Source: https://baotainguyenmoitruong.vn/thong-doc-ngan-hang-neu-giai-phap-de-nguoi-thu-nhap-thap-mua-duoc-nha-o-382947.html

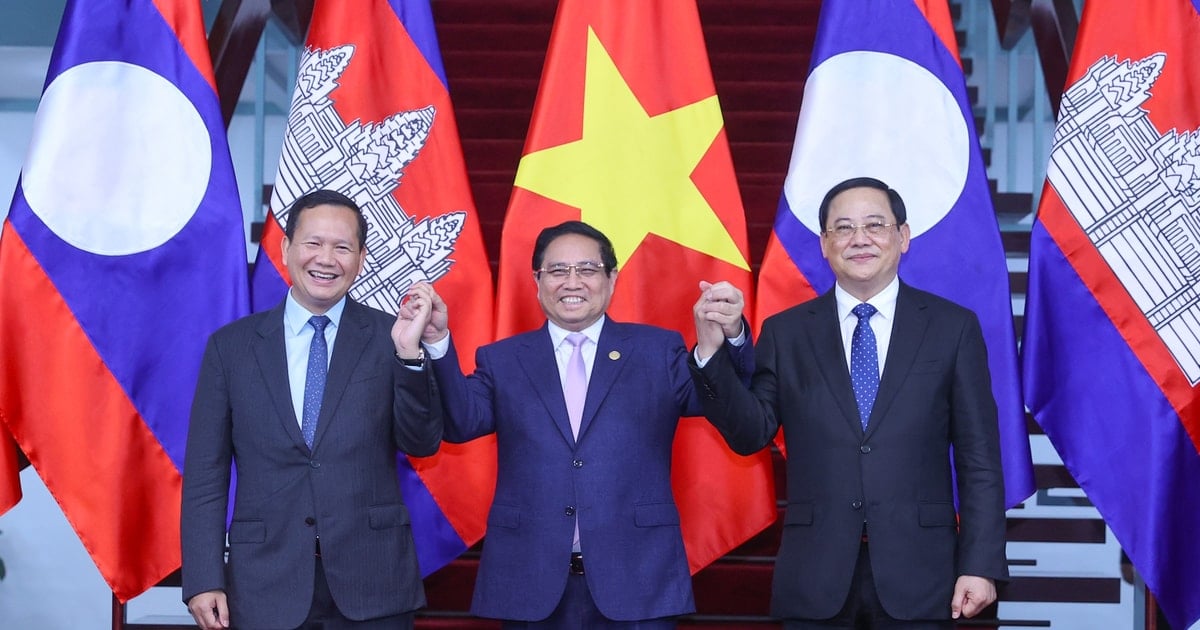

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)