The Draft Resolution of the National Assembly on the establishment and operation of financial centers (TTTC) in Vietnam was developed and promulgated to institutionalize the Party's policies, viewpoints and directions on the development of regional and international financial centers in Vietnam. Developing the financial market to effectively mobilize resources and financial services to serve the socio-economic development of localities with financial centers in particular and Vietnam in general in the direction of ensuring transparency, efficiency, modernity, advancement, keeping up with international standards; creating new momentum for economic development...

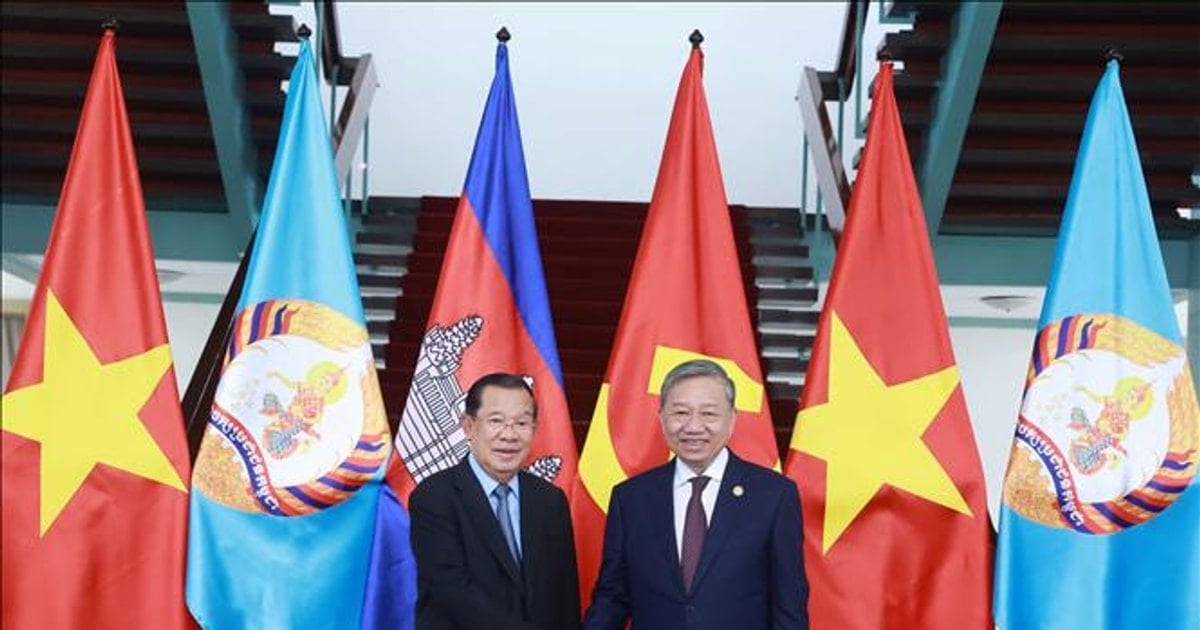

This afternoon (February 21), Permanent Deputy Prime Minister Nguyen Hoa Binh chaired a meeting with leaders of several ministries and functional agencies on the draft Resolution of the National Assembly on the establishment and operation of the Financial Center in Vietnam (Resolution).

Vietnam possesses many natural advantages available to develop regional and international financial markets.

Financial market is a "diverse ecosystem of financial services concentrated in a certain area", where many financial institutions, banks, investment funds, financial service companies are concentrated and there are stock, currency and commodity exchanges.

Building a financial market is the formation of a region with its own, superior, and unique institutions, encouraging and attracting investors to provide financial products and services, and connecting with international financial markets.

Currently, there are 121 financial centers in the world and there is strong competition to become the leading financial centers, with attractive, innovative products, suitable for movement and development. The need for a new financial center, different from the existing financial centers to receive financial resources transferred from large international financial centers, provide new financial services, access new markets, new development trends... is urgent. In particular, the possibility of forming a new financial center in Asia-Pacific, which is considered the most dynamic economic center in the world today, is increasingly evident.

Vietnam is a bright spot in economic development and growth, macroeconomic stability, investment attraction, and is gradually converging the necessary factors to develop a modern financial market, aiming to form a financial market, capable of connecting with financial markets in the region and the world.

Vietnam is also among the leading markets in terms of the rate of application of future financial technologies, which can create competitive advantages and form "specific" products for the financial market in Vietnam.

Vietnam possesses many natural advantages to develop regional and international financial markets, such as being located at the international crossroads between maritime routes from North to South, from East to West, being the center of Southeast Asia; having a different time zone from the 21 largest financial markets in the world. This is a "unique and special" advantage in attracting idle capital during trading breaks from financial markets around the world.

In 2022, Vietnam will have Ho Chi Minh City included in the official list of global financial centers in the GFCI 31 Report with a ranking of 102/120; in the GFCI 35 Report (March 2024), Ho Chi Minh City ranked 108/121 and in the GFCI 36 Report (September 2024), ranked 105/121.

In 2023, Vietnam will be assessed by the World Intellectual Property Organization (WIPO) as one of the top 3 innovative economies among lower-middle-income countries; one of the 7 countries with the most progress in innovation over the past decade; in 2024, it will be recognized by WIPO as one of the 8 middle-income countries with the most improved rankings since 20133 and one of the 3 countries holding the record for outstanding achievements compared to their development level for 14 consecutive years.

The successful construction and formation of regional and international financial markets will help Vietnam connect to the global financial market; attract foreign financial institutions, create new investment resources, promote existing investment resources; take advantage of opportunities to shift international investment capital flows; promote the effective development of Vietnam's financial market, catch up with international standards; contribute to the sustainable development of the country's economy, enhance the role, position, prestige and influence of Vietnam in the international arena, thereby ensuring national defense and security, especially in the financial sector from an early and distant time. At the same time, the construction, operation and development of competitive regional and international financial markets in Vietnam will contribute to bringing the country into a new era, the era of national development.

Effectively mobilize resources and financial services to serve socio-economic development.

Reporting at the meeting, Deputy Minister of Planning and Investment Nguyen Thi Bich Ngoc said that the purpose of developing the Resolution is to institutionalize the Party's policies, viewpoints and directions on developing regional and international financial markets in Vietnam. Developing the financial market to effectively mobilize resources and financial services to serve the socio-economic development of localities with financial markets in particular and Vietnam in general in the direction of ensuring transparency, efficiency, modernity, advancement, keeping up with international standards; creating new momentum for economic development; promoting the process of Vietnam's deep participation in the world economy.

The drafting of the National Assembly's Resolution on the establishment and operation of the TTTC in Vietnam is based on the viewpoint of ensuring compliance with the direction of the Politburo in Notice No. 47-TB/TW dated November 15, 2024 of the Party Central Committee on the conclusion of the Politburo on the establishment of the TTTC in Vietnam; ensuring the absolute leadership and direction of the Party; the centralized, unified, smooth and continuous management of the State.

The National Assembly's Resolution stipulates the principles and policy framework for developing the financial market and assigns the Government to provide detailed guidance and handle specific issues. Policies applied to the financial market must be innovative, ensuring the maximum promotion of Vietnam's advantages; keeping up with international development trends, following advanced world standards and practices, ensuring the rule of law, in harmony with international commitments; ensuring consistency, publicity, transparency, stability, and accessibility, paving the way for innovation and sustainable development; a strict, highly competitive, feasible and appropriate law enforcement mechanism in accordance with practical conditions and internal capacity, in which national interests are given top priority, especially the position, prestige and national financial security.

Developing financial markets in areas with defined boundaries and applying specific policies in the financial markets area, the participants are determined according to clear criteria, with outstanding preferential policies to allow Vietnam to: Controlled testing of specific policies to create competitive advantages in the global financial market; decentralizing and decentralizing financial market management agencies and reforming administrative procedures to the maximum extent possible; focusing on risk-based management and supervision; assessing the impact on financial market development policies in accordance with domestic conditions in each stage for appropriate and flexible adjustments.

At the same time, it is necessary to ensure a balance of interests between the State, investors and people in the spirit of harmonizing interests and sharing risks; it is necessary to forecast and possibly accept a certain level of risk and accompany it with appropriate risk monitoring and management mechanisms to strengthen Vietnam's geopolitical and geo-economic position, linking the economic interests of partners and major countries; thereby contributing to ensuring "non-traditional" national defense and security; stability and comprehensive development in economic, political, social and environmental aspects.

Regarding the scope of regulation, the Resolution regulates the establishment and operation of financial centers in Vietnam and specific policies applied to financial centers. This Resolution applies to investors and agencies, organizations and individuals related to the establishment and operation of financial centers.

Regarding the principles and policies for the establishment and operation of the TTTC, Deputy Minister Nguyen Thi Bich Ngoc emphasized that the State has mechanisms and policies to encourage and create favorable conditions to attract capital, technology, modern management methods, encourage the development of infrastructure and form a civilized, high-quality living environment at the TTTC.

The State has mechanisms and policies to encourage the selection, attraction, training and development of high-quality human resources to meet the requirements of developing the financial market. Transactions and activities at the financial market are conducted in English, or in English and Vietnamese.

The agencies managing the financial market are organized in a streamlined manner, with appropriate, effective and efficient authority; special administrative procedures are applied, meeting the requirements of investors, organizations and individuals according to international regulations and practices, suitable to the conditions of Vietnam. The provisions of this Resolution are different from the provisions of other laws, resolutions and ordinances, then the provisions of this Resolution shall be implemented, except in cases where other laws and resolutions of the National Assembly are issued after the Resolution.

Ensure the most perfect draft Resolution possible

Affirming the necessity of developing and promulgating a National Assembly Resolution on the establishment and operation of the TTTC in Vietnam, as well as welcoming the efforts and effective coordination of relevant ministries, branches and localities in developing the draft Resolution, Deputy Prime Minister Nguyen Hoa Binh said that the Resolution was developed to form a legal basis to solve three major issues, namely: Creating regulations on organizational structure; regulations on policies for the TTTC, especially regulations on immigration, labor, monetary policy, and tax; developing State regulations on the management of the centers, specifically the management responsibilities of the Government, ministries, and branches, and the responsibilities of cities with the TTTC.

The Permanent Deputy Prime Minister stated that this is a new issue, so the Resolution focuses on regulating the contents of principles and framework policies, but also needs to be as specific as possible. As for detailed regulations, relevant ministries and branches need to continue to refer to international experience in developing regional and international financial centers to advise the Government to issue separate decrees and sub-decrees to regulate in detail, ensuring compliance with international practices and requirements for developing financial centers.

"We are building this draft Resolution to build superior mechanisms and policies but with control. We must clarify the content of each group of policies that we are planning to build. We must have a specific assessment of the impacts of the policies on the economy."

Regarding the time for submission to the National Assembly, the drafting and submission of the Resolution will be carried out according to the procedure at one session. It is expected that the Government will submit the Resolution to the National Assembly for consideration and approval at the 9th session of the 15th National Assembly in May 2025.

For the two beneficiary cities, Ho Chi Minh City and Da Nang, it is necessary to actively prepare facilities, technology, infrastructure, and human resources to be ready for the operation of the TTTC.

In the spirit of continuing to absorb international experiences as well as comments contributed at the meeting, Permanent Deputy Prime Minister Nguyen Hoa Binh requested the Ministry of Planning and Investment to continue to supplement and complete the draft Resolution so that we "have the most perfect draft Resolution possible", and submit it to the National Assembly according to the set time requirements.

Source: https://baotainguyenmoitruong.vn/the-che-hoa-chu-truong-quan-diem-cua-dang-ve-phat-trien-trung-tam-tai-chinh-khu-vuc-va-quoc-te-386920.html

Comment (0)