Apartment consumption rate increased sharply

Recently, many new projects or the next phase of projects in Ho Chi Minh City and neighboring provinces such as Dong Nai and Binh Duong have had a stable number of customers. The reason is that the product price is quite "soft", only around 2-3 billion VND/unit, meeting the actual housing needs in the market, so it is welcomed by customers.

For example, a distribution unit for an apartment project on Pham Van Dong Street (Thu Duc City, Ho Chi Minh City) said that from mid-October to the present, this unit has recorded about 4-5 customers placing orders every day. Among them, many customers proactively contacted directly without going through other brokerage channels. Thanks to that, a distribution unit has sold 2-3 apartments every day, regularly for nearly a month.

Many apartment projects with reasonable prices recorded positive transactions last month.

This positive signal is also recorded in DKRA's Real Estate Market Report for the third quarter of 2023. Accordingly, the Southern region recorded positive signals from Q2/2023 and became increasingly positive in the quarter with the consumption rate of new supply reaching 72%. The number of units sold reached 3,270 units, an increase of 13% over the same period in 2022 and 2.8 times higher than the previous quarter.

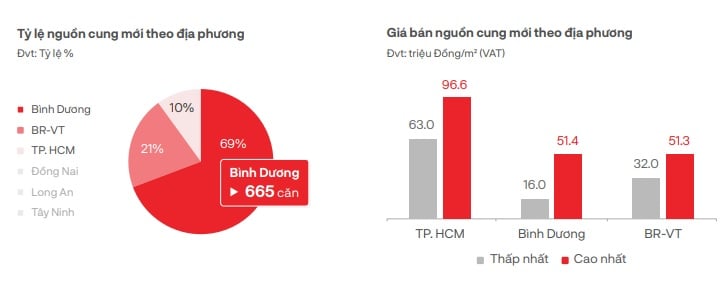

In the October report, the market in Ho Chi Minh City and neighboring provinces recorded 1 new project opening for sale along with the subsequent opening of 7 existing apartment projects. The total supply for sale reached 960 units, an increase of 56% compared to the previous month. Of which, about 549 apartments were successfully traded, reaching a consumption rate of 57%.

Notably, the Class B apartment segment accounts for 55% of new supply and 72% of new consumption in the entire market, with projects concentrated in Di An City and Thu Dau Mot City of Binh Duong.

Apartment supply is mainly concentrated in Binh Duong market 10/2023 (Photo: DKRA)

This shows a positive growth in customer access and interest. DKRA commented that market liquidity has improved compared to last month, which is a positive signal for buying and selling activities in the real estate sector.

The demand for housing is increasing rapidly.

Along with the development of supply and liquidity, according to research by Batdongsan.com.vn, the demand for apartments also improved in October.

Specifically in Ho Chi Minh City, the number of searches for apartments increased by 15%, and the number of listings increased by 5% compared to the previous month. In particular, the inner-city districts with a sharp increase in searches are: District 3 (up 18.3%); Binh Thanh (up 18.9%); District 1 (21.1%), District 8 (20%). Other areas also recorded an increase in apartment searches of 13-17% in the past month. In neighboring markets such as Long An, Dong Nai, Can Tho, Ba Ria - Vung Tau or Binh Duong, real estate searches also increased by 10 - 19%.

The reason why newly launched projects are well received is due to the appropriate price when combined with preferential policies. At the same time, the reasonable payment schedule, combined with significantly reduced bank interest rates, makes it easier for home buyers to accept to pay more than before.

Ho Chi Minh City market recorded positive interest in apartment buildings.

According to Mr. Dinh Minh Tuan - Director of Batdongsan.com.vn in the Southern region, when banks lowered interest rates to 7-9%, demand for real estate began to increase. Records from sales units showed that transactions improved significantly.

In addition to the cooling interest rate, there are many other factors affecting apartment liquidity in recent times. The first is the change in the supply for sale. If in the period 2021-2022, the supply of apartments was mainly high-end and luxury, currently the mid-range price type with about 2-4 billion VND per apartment is taking the majority. This is a product with a price that the majority of people looking for residential real estate in Ho Chi Minh City and neighboring areas can accept.

In addition, after the "frozen" period of the market, investors have made strong adjustments in selling prices. To increase liquidity, most of the actual selling prices of projects are lower than the previously expected prices of businesses. This adjustment creates a good psychology for buyers, especially for the group of buyers for living.

Investors also offer the most suitable policies and solutions to reduce monthly home buying costs for customers, avoiding causing too much financial pressure. Finally, promoting activities through the sales team. Thereby, the product is recognized more and reaches a larger customer base.

However, this expert also believes that the market is still forecast to be difficult and it is difficult to record a sudden change in liquidity. Transactions in the remaining months of the year will be low, and it will be until 2024 that more positive points can be received.

Source

Comment (0)