After a few minutes of opening with investors' cautious sentiment, selling pressure suddenly appeared, causing all indices to drop sharply, along with foreign investors continuing to sell strongly, making the situation even more negative.

Most industry groups were in red at the end of this morning's session, typically the plastics - chemicals group when it recorded a decrease of 5.75%. Leading codes such as GVR decreased by 6.21%, DGC decreased by 6.93%, DCM decreased by 5.07%, DPM decreased by 5.49%...

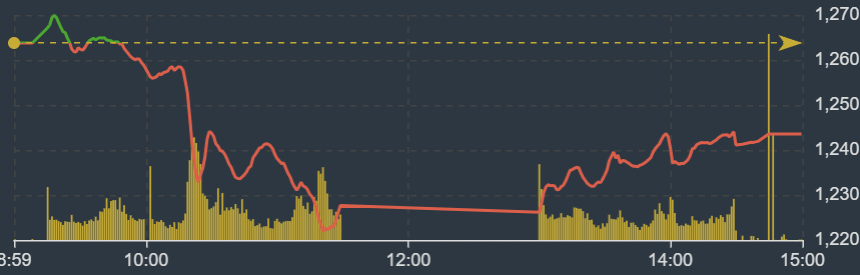

At the end of the morning session on March 18, VN-Index decreased by 35.91 points, equivalent to 2.84% to 1,227.87 points. The entire floor had only 38 stocks increasing but 416 stocks decreasing.

VN-Index performance on March 18 (Source: FireAnt).

Entering the afternoon session, negative sentiment continued to prevail, but was less negative than in the morning session with the participation of the real estate group.

HNX-Index decreased by 2.86 points to 236.68 points. The entire floor had 58 stocks increasing, 125 stocks decreasing and 64 stocks remaining unchanged. UPCoM-Index decreased by 1.03 points to 90.32 points. In the VN30 basket alone, 28 stocks decreased in price.

The chemical group continued to have negative developments when GVR led the market's decline, taking more than 2 points off the general index. Other codes such as DCM, DPM, AAA, DDV, LAS, DPR were also in red, with DGC and BFC falling to the floor.

The securities group also had a negative performance when red covered most of the industry, only DSC code ended the session up 3.31% and two reference codes were HAC and ART. Of which, VIX matched 62.7 million units, VND matched nearly 51 million units, SHS matched 50 million units, SSI matched more than 48 million units, these codes were all in the top of high liquidity.

The bright spot was real estate stocks that went against the trend when recording an increase of 0.69%. There were 5 stocks that hit the ceiling: DIG, TCH, VRE, QCG, EIN. Of which, DIG had a sudden high matching order of nearly 79 million units, TCH also matched orders of 45.5 million units, VRE matched orders of 34.6 million units.

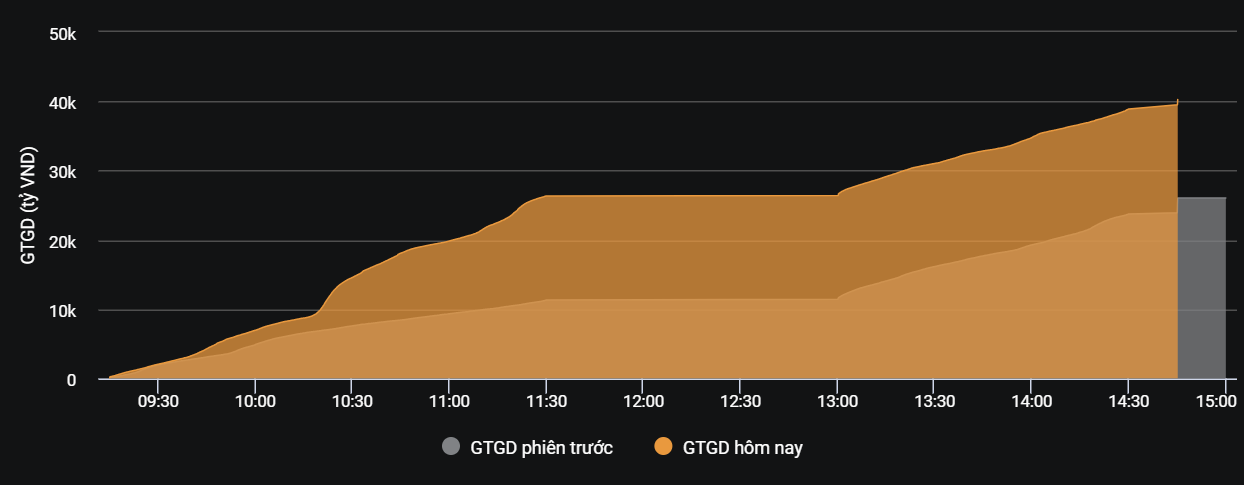

Liquidity today compared to previous session.

The total value of orders matched in today's session was VND47,921 billion, up 56%, of which the value of orders matched on the HoSE floor reached VND43,132 billion, up 57%. In the VN30 group, liquidity reached VND14,343 billion.

Foreign investors net sold for the 5th consecutive session with a value of 947.2 billion VND today, of which this group disbursed 3,208 billion VND and sold 4,156 billion VND.

The codes that were sold heavily were FUEVFVND fund at 853 billion VND, VHM at 184 billion VND, DGC at 143 billion VND, VPB at 131 billion VND, VNM at 107 billion VND, etc. On the contrary, the codes that were mainly bought were VRE at 141 billion VND, DIG at 133 billion VND, FRT at 94 billion VND, EIB at 80 billion VND, MSN at 78 billion VND, etc.

Source

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)