After the difficulties of the Covid 19 pandemic, import-export enterprises have gradually recovered to return to the "race" in the second half of 2024. Taking advantage of foreign currency trading and international payment solutions" on Techcombank Business digital bank, import-export enterprises can easily seize business opportunities, increasing their position and strength.

In addition to competitive exchange rates,

Techcombank Business offers many convenient features such as checking transaction information in advance, fast money transfer Swift go, along with many fee incentives to help create momentum for import-export businesses to develop best.

The recovery after the pandemic Import-export activities in 2024 will return stronger, opening up opportunities for many businesses. To accompany and support businesses to make the best use of cross-border business opportunities, international money transfer solutions play an extremely important role, helping businesses to conveniently transact and do business with international partners and customers. According to information from the Import-Export Department (Ministry of Industry and Trade), in the first 4 months of the year, the total value of Vietnam's import-export goods reached nearly 239 billion USD, up 15.1%, equivalent to an increase of 31.4 billion USD over the same period last year. Of which, exports reached 124 billion USD, up 15.1% and imports reached 115 billion USD, up 15.1%. Notably, the structure of imported goods in the first quarter of 2024 is still very positive. Of which, the group of production materials is estimated at 79.9 billion USD, up 14.5% over the same period last year, accounting for 94%. The group of consumer goods is estimated at 5.08 billion USD, up 4.6%, accounting for 6%. The rapid increase in imports of production materials is an indicator that businesses tend to increase imports to serve export production. These positive signals show that opportunities for import-export enterprises are gradually expanding in the remaining half of the year. The long-standing barrier for import-export enterprises is the difficulty in international payment procedures, which is more difficult than domestic ones and requires timeliness to avoid objective "losses". Unforeseen impacts of the world market will increase difficulties in exchange rates, and import-export payment procedures need to be carried out correctly and accurately to seize the opportunity. Especially in the context of the reality, the US dollar exchange rate has increased continuously to the ceiling in the past 3 months, creating great pressure on costs for import enterprises. "Our biggest concern is how to minimize exchange rate risks as well as get the best exchange rate", said Mr. Hung Thuan - owner of a packaging processing and exporting enterprise to European countries. This is also a concern of many import-export enterprises, especially small and medium enterprises that have had to "bear" many difficulties after the Covid 19 pandemic.

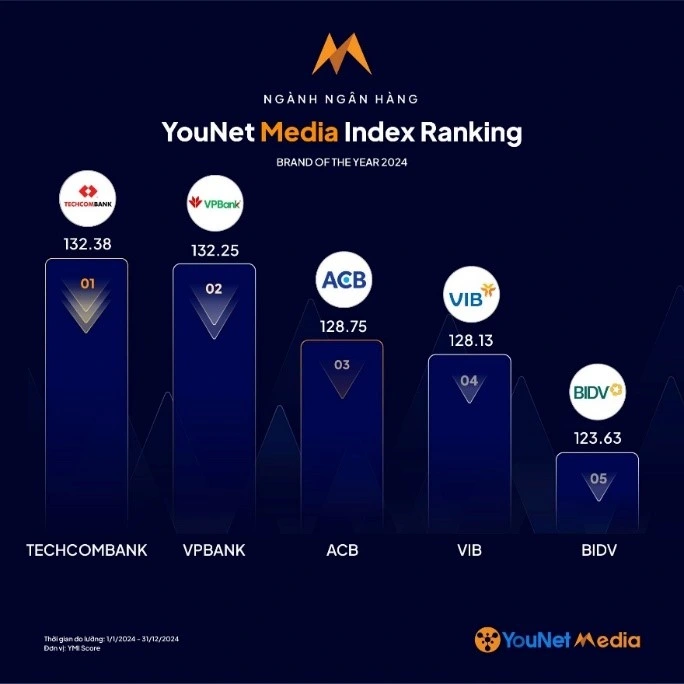

Taking advantage of the advantages of banks With investment in technology platforms and professional experience in the financial sector, banks always strive to create effective "cross-border" payment solutions for businesses. Pioneering on that journey, Techcombank is highly appreciated by the business community. with safe, convenient and preferential international payment solutions

With Techcombank Business, international payments become easier and faster than ever, within just 2 hours. All transactions are made 100% online. In addition, to limit risks and errors, and increase customer peace of mind, Techcombank also adds the feature of checking transaction information in advance, the SWIFT GO fast money transfer service helps businesses receive status from the beneficiary bank within a maximum of 4 hours. Businesses can also easily pay port fees, export taxes, etc. right on Techcombank Business. The most attractive exchange rate on the market, along with many attractive fee incentives, is also a factor that convinces businesses to choose foreign currency transactions and international payments at Techcombank. "My company regularly imports goods from foreign partners. However, currently, input costs from importing goods to storage and transportation have increased by 8% compared to normal. Therefore, the company is forced to find ways to reduce operating costs, personnel management, optimize production lines and minimize other expenses to maintain operations. International payment transaction fees are no exception," said Mr. Minh, the owner of a seafood import-export company in Nha Trang. Statistics show that, not only Mr. Minh, more than 80% of businesses that regularly have international payment transactions asked want to have their expenses reduced, especially money transfer fees. This helps businesses save a significant amount of budget, focus resources on boosting production, and better serve customers' needs. Understanding the concerns of businesses in the current challenging context, Techcombank has implemented many programs to accompany corporate customers, including the program "Free online international money transfer for the first year" and "Free receiving money from abroad". At the same time, it provides many other incentives when opening a Techcombank Business account such as free online domestic money transfer for life, free account management, giving away beautiful account numbers from 6 to 10 super short worth 100 million VND. Customers can also easily access credit sources with a limit of up to 70 billion VND right on the platform, providing maximum support for all loan needs to serve the production and business activities of enterprises. In addition, to accompany businesses in the period of high exchange rates, the bank also constantly provides information and recommendations closely following each market fluctuation, helping businesses make appropriate adjustments, minimize costs, and optimize business operations. "We believe that from the Techcombank Business digital banking platform, import-export enterprises can take full advantage of the bank's advantages to increase competitive advantage, optimize operating costs, increase initiative in transaction activities, international payments with partners, thereby easily grasping competitive opportunities. The nature of the import-export industry is quite unique and understanding to create value with businesses is what Techcombank always aims for", shared more from the leader of Techcombank. From the perspective of businesses, of course, the benefits must be practical because they are related to their survival problem. With the right investment, the "Foreign Exchange Transactions and International Payments" solution on Techcombank Business digital banking is expected to become one of the important tools to help import-export enterprises "reach out" to the ocean. Businesses can learn more about foreign currency trading and international payment solutions:

Here Source: https://nhipsongkinhte.toquoc.vn/techcombank-uu-dai-lon-cho-doanh-nghiep-mua-ban-ngoai-te-thanh-toan-quoc-te-20240715110458743.htm  In addition to competitive exchange rates, Techcombank Business offers many convenient features such as checking transaction information in advance, fast money transfer Swift go, along with many fee incentives to help create momentum for import-export businesses to develop best. The recovery after the pandemic Import-export activities in 2024 will return stronger, opening up opportunities for many businesses. To accompany and support businesses to make the best use of cross-border business opportunities, international money transfer solutions play an extremely important role, helping businesses to conveniently transact and do business with international partners and customers. According to information from the Import-Export Department (Ministry of Industry and Trade), in the first 4 months of the year, the total value of Vietnam's import-export goods reached nearly 239 billion USD, up 15.1%, equivalent to an increase of 31.4 billion USD over the same period last year. Of which, exports reached 124 billion USD, up 15.1% and imports reached 115 billion USD, up 15.1%. Notably, the structure of imported goods in the first quarter of 2024 is still very positive. Of which, the group of production materials is estimated at 79.9 billion USD, up 14.5% over the same period last year, accounting for 94%. The group of consumer goods is estimated at 5.08 billion USD, up 4.6%, accounting for 6%. The rapid increase in imports of production materials is an indicator that businesses tend to increase imports to serve export production. These positive signals show that opportunities for import-export enterprises are gradually expanding in the remaining half of the year. The long-standing barrier for import-export enterprises is the difficulty in international payment procedures, which is more difficult than domestic ones and requires timeliness to avoid objective "losses". Unforeseen impacts of the world market will increase difficulties in exchange rates, and import-export payment procedures need to be carried out correctly and accurately to seize the opportunity. Especially in the context of the reality, the US dollar exchange rate has increased continuously to the ceiling in the past 3 months, creating great pressure on costs for import enterprises. "Our biggest concern is how to minimize exchange rate risks as well as get the best exchange rate", said Mr. Hung Thuan - owner of a packaging processing and exporting enterprise to European countries. This is also a concern of many import-export enterprises, especially small and medium enterprises that have had to "bear" many difficulties after the Covid 19 pandemic. Taking advantage of the advantages of banks With investment in technology platforms and professional experience in the financial sector, banks always strive to create effective "cross-border" payment solutions for businesses. Pioneering on that journey, Techcombank is highly appreciated by the business community. with safe, convenient and preferential international payment solutions

In addition to competitive exchange rates, Techcombank Business offers many convenient features such as checking transaction information in advance, fast money transfer Swift go, along with many fee incentives to help create momentum for import-export businesses to develop best. The recovery after the pandemic Import-export activities in 2024 will return stronger, opening up opportunities for many businesses. To accompany and support businesses to make the best use of cross-border business opportunities, international money transfer solutions play an extremely important role, helping businesses to conveniently transact and do business with international partners and customers. According to information from the Import-Export Department (Ministry of Industry and Trade), in the first 4 months of the year, the total value of Vietnam's import-export goods reached nearly 239 billion USD, up 15.1%, equivalent to an increase of 31.4 billion USD over the same period last year. Of which, exports reached 124 billion USD, up 15.1% and imports reached 115 billion USD, up 15.1%. Notably, the structure of imported goods in the first quarter of 2024 is still very positive. Of which, the group of production materials is estimated at 79.9 billion USD, up 14.5% over the same period last year, accounting for 94%. The group of consumer goods is estimated at 5.08 billion USD, up 4.6%, accounting for 6%. The rapid increase in imports of production materials is an indicator that businesses tend to increase imports to serve export production. These positive signals show that opportunities for import-export enterprises are gradually expanding in the remaining half of the year. The long-standing barrier for import-export enterprises is the difficulty in international payment procedures, which is more difficult than domestic ones and requires timeliness to avoid objective "losses". Unforeseen impacts of the world market will increase difficulties in exchange rates, and import-export payment procedures need to be carried out correctly and accurately to seize the opportunity. Especially in the context of the reality, the US dollar exchange rate has increased continuously to the ceiling in the past 3 months, creating great pressure on costs for import enterprises. "Our biggest concern is how to minimize exchange rate risks as well as get the best exchange rate", said Mr. Hung Thuan - owner of a packaging processing and exporting enterprise to European countries. This is also a concern of many import-export enterprises, especially small and medium enterprises that have had to "bear" many difficulties after the Covid 19 pandemic. Taking advantage of the advantages of banks With investment in technology platforms and professional experience in the financial sector, banks always strive to create effective "cross-border" payment solutions for businesses. Pioneering on that journey, Techcombank is highly appreciated by the business community. with safe, convenient and preferential international payment solutions

Comment (0)