On the morning of June 21, the State Bank held a press conference to inform about the banking performance results in the first 6 months of 2023.

At the press conference, Permanent Deputy Governor of the State Bank Dao Minh Tu said that as of June 15, outstanding credit balance of the entire economy reached about 12.32 million billion VND, up 3.36% compared to the end of 2022, up 8.94% over the same period last year.

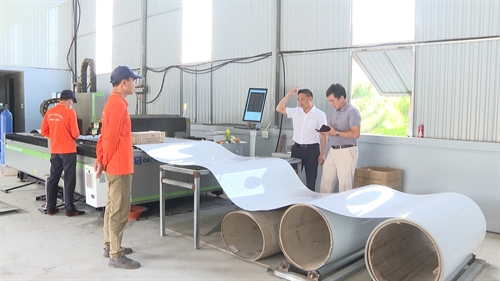

In particular, the credit structure continues to focus capital on production and business sectors, priority sectors according to the Government's policy, contributing positively to the country's GDP growth. Credit for sectors with potential risks is controlled.

"Credit growth is still slow and limited. The State Bank also really wants to increase credit, but not by lowering credit standards, pumping out credit indiscriminately, regardless of whether the credit is healthy or not, but must ensure efficiency and quality," said the Deputy Governor.

The State Bank also identified that increasing credit is an important task that must be implemented vigorously in the coming time. Regarding the reason why credit only increased by 3.36%, quite low since the beginning of the year, Mr. Tu said that there were both subjective and objective reasons, especially the reason coming from the low credit demand of the economy.

“Liquidity of credit institutions, state-owned and private commercial banks is still abundant, liquidity of the economy, the ability to supply capital to the economy is not lacking and is very ready,” the Deputy Governor affirmed.

Permanent Deputy Governor of the State Bank Dao Minh Tu.

With the credit growth target for the whole year at around 14-15%, since the beginning of the year, the State Bank has assigned the credit growth target to banks at 11%. But up to now, the national outstanding debt has only reached 3.36%, meaning that the limit for banks to continue lending is not lacking.

However, due to the current difficulties of businesses, cash flow is disrupted, inventories are high, and some businesses have even had to reduce their workforce. Meanwhile, the price of imported raw materials has increased, leading to an increase in the price of goods. Purchasing power has also weakened, leading to low demand for loans.

Other reasons include that businesses have not yet met legal procedures, small and medium enterprises do not have much demand for credit, and the debt guarantee fund for these businesses is not very active. Although there are many policies to support businesses, they are still limited in terms of finance and management capacity.

In the coming time, Mr. Tu said, the State Bank will continue to operate open market operations flexibly and proactively, ready to support liquidity for the credit institution system. Recapitalize credit institutions to support liquidity, lend to programs approved by the Government and the Prime Minister, support the process of restructuring credit institutions and handling bad debts.

Panorama of the press conference.

In addition, continue to encourage credit institutions to reduce costs and reduce lending interest rates to support businesses in recovering and developing production and business.

The Deputy Governor revealed that in the next few days, the State Bank will work with commercial banks. "Since the operating interest rate has decreased, commercial banks must share by cutting profits and operating costs to reduce lending interest rates," said Mr. Tu.

In addition, the State Bank also manages the growth of credit volume and structure reasonably, meeting the credit capital demand of the economy to contribute to controlling inflation, supporting economic growth, directing credit to production and business sectors, priority sectors and economic growth drivers according to the Government's policy, strictly controlling credit in sectors with potential risks; creating favorable conditions for businesses and people to access bank credit capital.

Continue to implement assigned tasks in the Project on restructuring the system of credit institutions associated with bad debt settlement for the period 2021-2025 according to the direction of all levels .

Source

![[Photo] General Secretary To Lam receives Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/4bc6a8b08fcc4cb78cf30928f6bd979e)

![[Photo] Editor-in-Chief of Nhan Dan Newspaper Le Quoc Minh receives Iranian Ambassador Ali Akbar Nazari](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/269ebdab536444818728656f8e3ba653)

![[Photo] President Luong Cuong attends the 90th Anniversary of Vietnam Militia and Self-Defense Forces](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/678c7652b6324b29ba069915c5f0fdaf)

Comment (0)