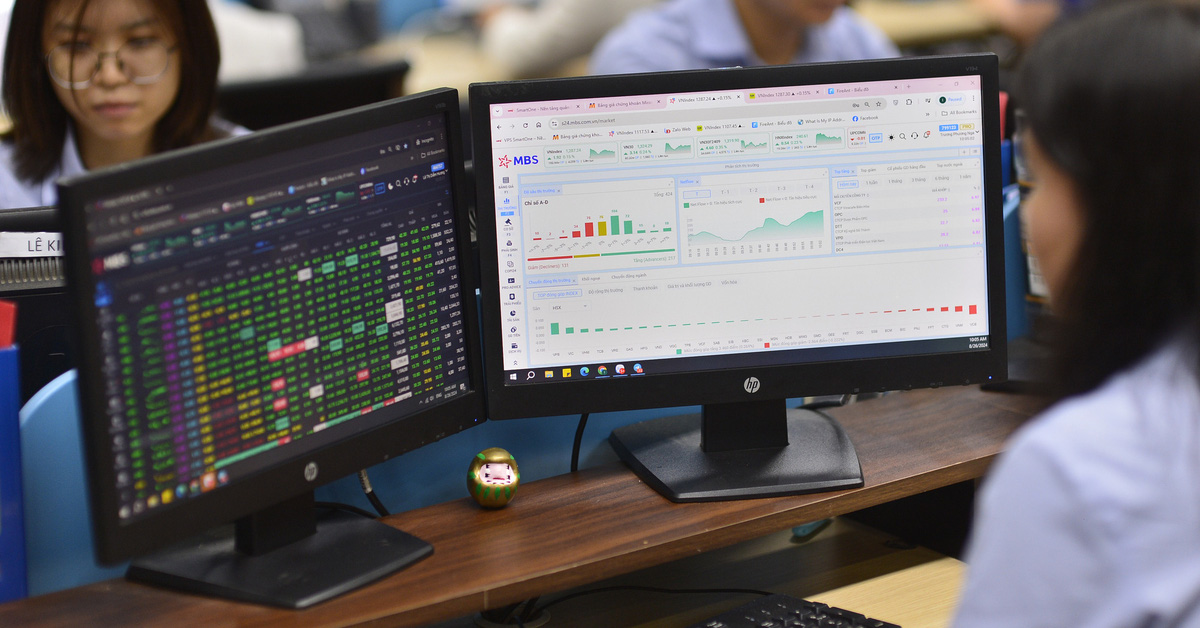

Investment Comments

Asean Securities (Aseansc) : VN-Index is still trading in a short-term downtrend. Closing prices are lower than most recent opening prices. MA20 and MA10 lines are both trending down, indicating a short-term downtrend.

The market recorded a recovery session after there was no great pressure from the supply side, however, the buying pressure was not too great, just for testing purposes. Investors still need to pay attention to the market's price reaction from the nearest resistance level, which is the previous gap down zone of 1,260 - 1,280 points.

Aseansc maintains its recommendation that investors keep their stock holdings at a low level and continue to wait for testing periods to make new purchases.

Shinhan Vietnam Securities (SSV) : At the end of the session on April 9, VN-Index increased thanks to pillar stocks such as banks and securities. However, the buying money flow is still cautious. MACD is sloping down, showing that the correction process is still continuing.

The strategy is for investors to reduce the proportion of stocks and handle stocks that violate technical regulations. Maintain an observational state and should not rush to open positions.

BIDV Securities (BSC) : In the coming trading sessions, the market may continue to increase by inertia to the 1,270 - 1,275 point range, but there is a possibility of profit-taking pressure here. Liquidity in today's recovery session is still weak, investors should trade cautiously in the coming sessions.

Stock news

Investors and economists are cutting bets on the Federal Reserve cutting interest rates this year as stronger-than-expected economic data reinforces the argument that the central bank will have to keep rates higher for longer to fight inflation.

At present, the market is basically pricing in only two rate cuts by the Fed in 2024, and the probability of a third rate cut this year is only 50%. At the beginning of the year, the market expected the Fed to cut rates 5-6 times, or even 7 times this year.

- The wind is turning in monetary policy, when will the "cheap money" era return? The Swiss National Bank (SNB) unexpectedly decided to cut interest rates. The SNB's action may lead to further monetary policy easing moves from other central banks. Switzerland has cut its policy rate by 25 basis points to 1.5%.

The move is in contrast to economists' forecasts for a rate freeze. Swiss inflation continued to fall in February, at 1.2%. "Over the past few months, inflation has returned to below 2% and is within the SNB's controllable range. According to the new forecast, inflation is likely to remain at this stable level for the next few years," the SNB stressed .

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)