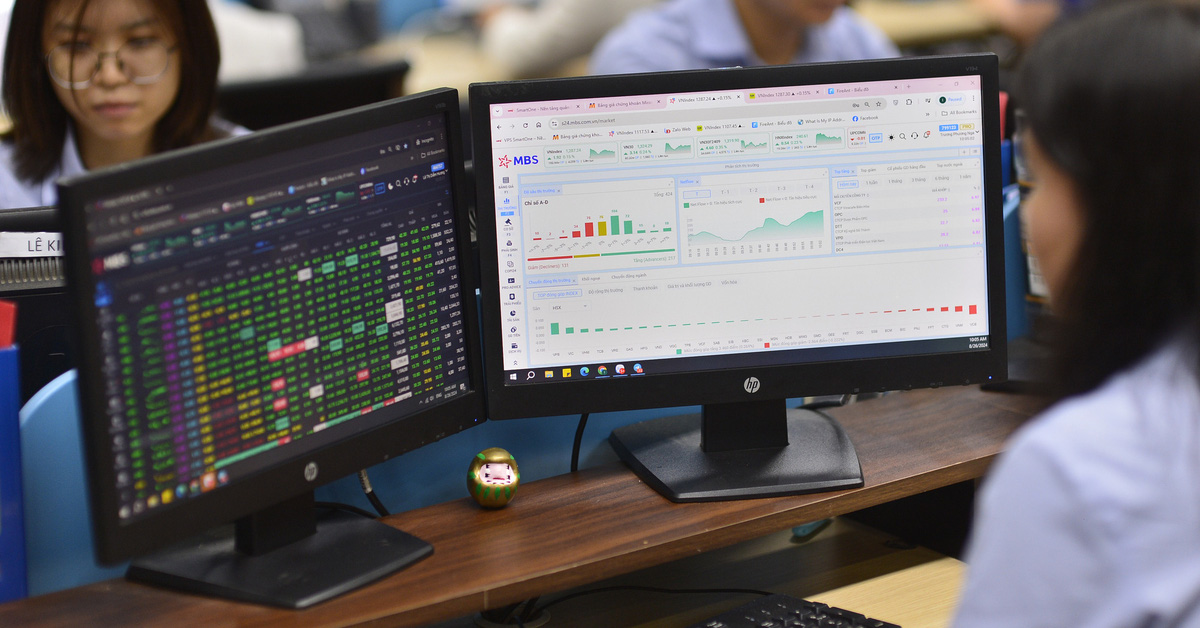

Investment Comments

KB Vietnam Securities (KBSV) : It is likely that VN-Index will continue to be under pressure to fluctuate in the coming sessions because the buyers are still somewhat more passive and the risk of large distribution sessions still needs attention if the index has strong bulltrap sessions.

Investors are advised to avoid chasing buying during uptrends and prioritize restructuring portfolio proportions to safe levels.

Asean Securities (Aseansc) : The market's performance up to now is reasonable, however, short-term risks still exist when "bulltrap" movements appear in the following sessions.

Therefore, Aseansc maintains its recommendation that investors be cautious, stop opening new purchases and wait for profit taking in the current context.

Vietcombank Securities (VCBS) : In a positive scenario, VN-Index will adjust to accumulate sideways, but the probability of strong fluctuations may still occur.

VCBS recommends that investors take profits on stocks that have recorded good growth recently, maintaining a reasonable stock ratio of below 60% to be able to manage short-term risks to the maximum.

Stock news

- The world's experiment with negative interest rates has ended. On March 19, 2024, the Bank of Japan (BOJ) raised interest rates for the first time in 17 years, returning interest rates to positive territory after 8 years of maintaining negative interest rates.

In a move widely anticipated by the media and financial markets, BOJ Governor Kazuo Ueda announced that he would raise short-term interest rates from -0.1% to a range of 0-0.1%. At the same time, the yield curve control (YCC) policy aimed at keeping long-term interest rates - the yield on 10-year Japanese government bonds - around 0% was also lifted.

- The world's second-largest economy unexpectedly received good news after releasing a series of new data. A survey by Caixin showed that China's manufacturing activity in March grew at its fastest pace in more than a year. This indicates that the world's second-largest economy is growing somewhat stably.

The Caixin China Manufacturing Purchasing Managers' Index (PMI) rose to 51.1 in March, the strongest since February 2023 and up from 50.9 in February. This was attributed to rising new orders from both domestic and foreign customers .

Source

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)