In the first half of 2024, domestic investors will dominate the real estate M&A market.

If in the same period of 2023, foreign investors accounted for 93% of the buyer structure in real estate M&A deals, domestic investors rose to the leading position with a rate of 92.6% in the first half of 2024.

The above developments were pointed out by Mr. Le Xuan Dong, Director of EY Parthenon - Strategic Consulting, EY Consulting Joint Stock Company Vietnam at the Workshop "Legal and financial aspects in real estate M&A transactions under the impact of the new legal framework" , held on July 11.

The market is down in volume, but up in value.

In the first half of 2024, the M&A market in Southeast Asia tended to decline in both total value and number of deals. Vietnam was no exception, recording a slight decrease in the number of transactions, but the transaction value increased by nearly 9% compared to the same period last year.

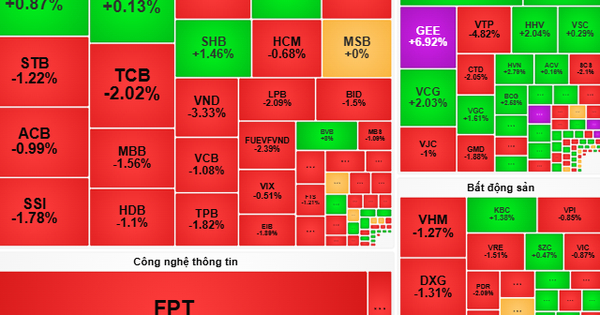

|

Experts say real estate continues to be a sector that attracts the attention of foreign investors thanks to the potential for stable long-term economic growth of the economy. Photo: Trong Tin |

Regarding the real estate market, Mr. Le Xuan Dong said that the number of transactions has decreased significantly in the first half of the year with 8 transactions, the average transaction value reached 179.7 million USD (in the same period last year, there were 18 transactions with the average transaction value reached 81.8 million USD).

Mr. Dong assessed that the value of real estate M&A transactions in the first half of the year increased sharply thanks to the divestment transaction of Vingroup Corporation from Vincom Retail with a transaction value of 982.3 million USD.

A notable point about the buyer structure in real estate M&A deals in Vietnam that Mr. Dong pointed out is that there is a reversal.

According to Mr. Dong, in 2023, when domestic enterprises faced many difficulties and were forced to shrink their operations, foreign investors dominated the M&A market with 81.6% of the buyer structure. However, by the first half of 2024, domestic investors took the lead with a rate of 92.6%.

More talk with reporters According to Mr. Dong, if we separate the Vingroup divestment from Vincom Retail, the market only recorded about 7 transactions with a value of several hundred million USD. This is a very small number.

“For domestic investors, at this time there are still many difficulties for them in terms of capital and legal issues to be able to complete and bring the project to the market. Therefore, domestic investors have not really returned to the market,” Mr. Dong said.

Mr. Dong also commented that in the second half of 2024, the decline in the number of M&A deals will continue.

According to Mr. Dong, although foreign investors are still actively looking for projects and businesses for M&A, closing a deal during this period is not simple.

“Investors have been much more cautious in project appraisal, especially in the context of a still difficult market. In addition, we see a gap in expected valuation between sellers and buyers, leading to delays and inability to close deals,” said Mr. Dong.

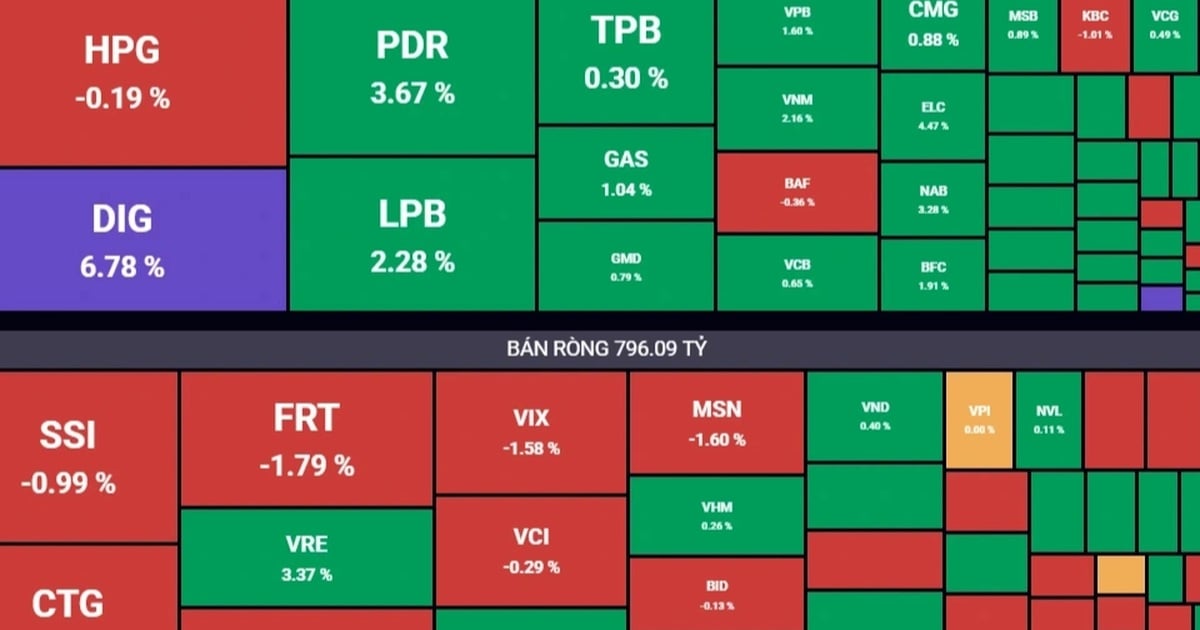

|

| Buyer structure in real estate M&A deals in Vietnam. Source: EY |

Assessing the real estate market is always a bright spot attracting the attention of domestic and foreign investors, but Ms. Nguyen Truc Hien, Member Lawyer of Vietnam International Law Firm Limited (VILAF) assessed that there are still many barriers, especially legal barriers, that prevent M&A activities from breaking through.

According to Ms. Hien, in the coming time, many "comprehensive" changes in regulations will make it easier for investors to compensate and clear land, thereby increasing land prices according to market prices, thereby creating benefits for land owners and helping reduce difficulties for investors in the compensation process in projects.

The 2024 Land Law also adds many benefits for foreign investors such as receiving the transfer of land use rights in industrial parks, industrial clusters, high-tech zones, using land due to receiving the transfer of real estate projects and expanding the method of receiving land use rights for foreign-invested enterprises.

“Open regulations are a prerequisite for welcoming the wave of foreign M&A in this market. However, investors should conduct thorough research and study of the legal framework when considering investing to ensure the deal goes smoothly,” said Ms. Hien.

Green real estate will have value

Registered FDI capital inflows into Vietnam continued to grow in the first half of 2024, reaching more than 15 billion USD, an increase of more than 13% over the same period in 2023. Of which, FDI poured into the real estate business sector reached 1.89 billion USD, accounting for nearly 20% of the total newly registered capital, 4.7 times higher than the same period last year.

Mr. Le Xuan Dong assessed that the real estate sector continues to attract the attention of foreign investors, especially investors from the US, Singapore, Japan, and South Korea (through both M&A and FDI) thanks to the potential for stable economic growth in the long term of the economy, the trend of shifting production facilities to Vietnam, the young population structure, and the high urbanization rate.

Sharing the same view, Ms. Hoang Nguyen Ha Quyen, Managing Lawyer of LNT Law Firm & Members, recently, registered FDI in Vietnam increased by more than 13% compared to the same period in 2023, real estate business activities increased 4.7 times over the same period and accounted for nearly 20% of the total newly registered capital.

Notably, investors tend to be more interested in housing projects, industrial parks, and resort areas, in which, besides many other forms, popular transaction structures include capital transfer in project companies, project transfer or part of project transfer.

|

In terms of segment, Mr. Dong said that industrial real estate continues to be a segment that receives high attention from investors.

Specifically, industrial real estate projects near highways, border gates, seaports, river ports, airports and in major provinces and cities such as Hanoi, Hung Yen, Hai Duong, Hai Phong, Bac Ninh, Bac Giang (North) and Ho Chi Minh City, Binh Duong, Dong Nai, Long An, Ba Ria - Vung Tau, Tay Ninh (South) ... will continue to attract the attention of investors in the coming years.

In addition, investors also tend to seek to acquire residential real estate projects or large clean land funds in suburban areas or satellite provinces and cities, adjacent to major cities such as Hanoi and Ho Chi Minh City to invest in developing complex housing projects including houses, schools, hospitals, commercial centers, entertainment areas, etc. to provide full amenities for residents and welcome the wave of urbanization.

In addition to the above two segments, Mr. Dong said that retail real estate in the central areas of big cities or located in complex urban area projects, providing diverse services such as retail fashion, consumer goods, cosmetics; F&B; entertainment services... with high occupancy rates will often attract great attention from investors.

In particular, real estate such as shopping malls, office buildings, hotels, etc. that comply with sustainable development criteria and achieve green certifications will attract the attention of large institutional investors and are often valued higher, helping investors easily access green financial sources with competitive interest rates to finance this acquisition transaction.

Comment (0)