Ring gold is still far behind SJC gold in terms of price increase

In the last days of January 2024, gold rings became the focus of the precious metal market when they increased sharply, far exceeding the 65 million VND/tael mark and continuously setting new records.

Specifically, at Bao Tin Minh Chau Gold and Gemstone Company, the closing price of Thang Long Dragon gold in January 2024 was: VND 64.28 million/tael - VND 65.38 million/tael, an increase of VND 2.2 million/tael for buying (equivalent to 3.54%), an increase of VND 2.1 million/tael for selling (equivalent to 3.32%).

With a similar increase, the price of PNJ gold at Phu Nhuan Jewelry Company - PNJ was listed at 62.90 million VND/tael - 64.20 million VND/tael on the last day of the first month of 2024.

One of the highlights of the gold market in January 2024 is the clear heating up of gold rings. However, surprisingly, gold rings are still far behind SJC gold in terms of price increase. Photo: Hoang Tu

An increase of more than 3% in 1 month is a positive sign for non-SJC gold. However, despite being considered “cold-shouldered” by investors, SJC gold surprisingly recorded an upward momentum that was much higher than that of gold rings.

At the end of January 2024, Bao Tin Minh Chau listed the price of SJC gold at: 75.45 million VND/tael - 77.80 million VND/tael, an increase of 4.35 million VND/tael for buying (equivalent to 6.12%), an increase of 3.9 million VND/tael for selling (equivalent to 5.28%).

At Saigon Jewelry Company – SJC, SJC gold price is traded at: 75.40 million VND/tael – 77.90 million VND/tael, up 4.4 million VND/tael for buying (equivalent to 6.2%), up 3.9 million VND/tael for selling (equivalent to 5.27%).

PNJ Company listed the price of SJC gold at: 75.40 million VND/tael - 77.90 million VND/tael, an increase of 5.4 million VND/tael for buying (equivalent to 7.71%), an increase of 2.9 million VND/tael for selling (equivalent to 3.87%).

At Doji Group, SJC gold price stopped at 75.25 million VND/tael - 77.85 million VND/tael. Doji is a rather special case when at the end of December 2023, the price list of this Group in the two regions had a very large difference.

Therefore, after 1 month of trading, in Hanoi, the price of SJC gold increased by 7.25 million VND/tael for buying (equivalent to 10.66%), increased by 3.85 million VND/tael for selling (equivalent to 5.2%). Meanwhile, in the Ho Chi Minh City market, Doji Group adjusted the price of SJC gold to increase by 5.25 million VND/tael for buying (equivalent to 7.5%), increased by 2.85 million VND/tael for selling (equivalent to 3.8%).

Although the price of SJC gold has increased significantly, the difference between the buying and selling prices is quite high, so the profit that investors can make is only about 1 million VND/tael.

SJC gold price is 16.7 million VND/tael more expensive than world gold price

Notably, domestic gold prices increased from 3.32% to 10.66% in the context of a gloomy period in world gold prices. In the last session of January 2024, world gold prices recovered but were not enough to offset the losses from the beginning of the month.

At the end of the month, the world gold price was almost flat at 2,053 USD/ounce, down 10 USD/ounce, equivalent to 0.48%. At this level of world gold, SJC gold converted to about 61.2 million VND/tael. Thus, the price of SJC gold is about 16.7 million VND/tael more expensive than world gold. This is a very high difference, which can cause many risks for investors.

Gold prices have fallen this month after hitting a record high in December as traders cut bets on a US interest rate cut in March. The probability of the US Federal Reserve cutting interest rates in March has now dropped to about 46%, down from about 90% a month ago, according to the CME FedWatch Tool.

“Fed officials will consider all options and make a decision at the March meeting depending on upcoming macro data,” said UBS analyst Giovanni Staunovo.

“Therefore, gold prices are expected to see modest fluctuations with the focus shifting to employment and inflation data in the coming weeks,” commented Giovanni Staunovo.

The two-day Federal Open Market Committee (FOMC) meeting concludes later on Wednesday. While the Fed is likely to leave rates unchanged, Chairman Jerome Powell’s press conference will be watched for details on when the Fed will cut rates this year.

“Signs of strength in the US economy make it more likely that the Fed will keep interest rates on hold in the near term, creating a drag on non-yielding assets like gold,” said Frank Watson, market analyst at Kinesis Money.

Weighing on gold, the dollar index is on track for its best month since September, while the benchmark US Treasury yield is at a more than two-week low of 3.9920%.

Spot silver fell 0.2% to $23.1136 an ounce, while platinum fell 0.1% to $920.14. Palladium rose 0.2% to $977.93. All three metals are on track for a monthly decline.

Source

![[Photo] President Luong Cuong attends the 90th Anniversary of Vietnam Militia and Self-Defense Forces](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/678c7652b6324b29ba069915c5f0fdaf)

![[Photo] Students of the Academy of Posts and Telecommunications visit the editorial office of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/51093483a84448ccb39d59333ead674e)

![[Photo] Prime Minister Pham Minh Chinh attends the launching ceremony of the "Digital Literacy for All" Movement](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/a58cb8d1bc424828919805bc30e8c348)

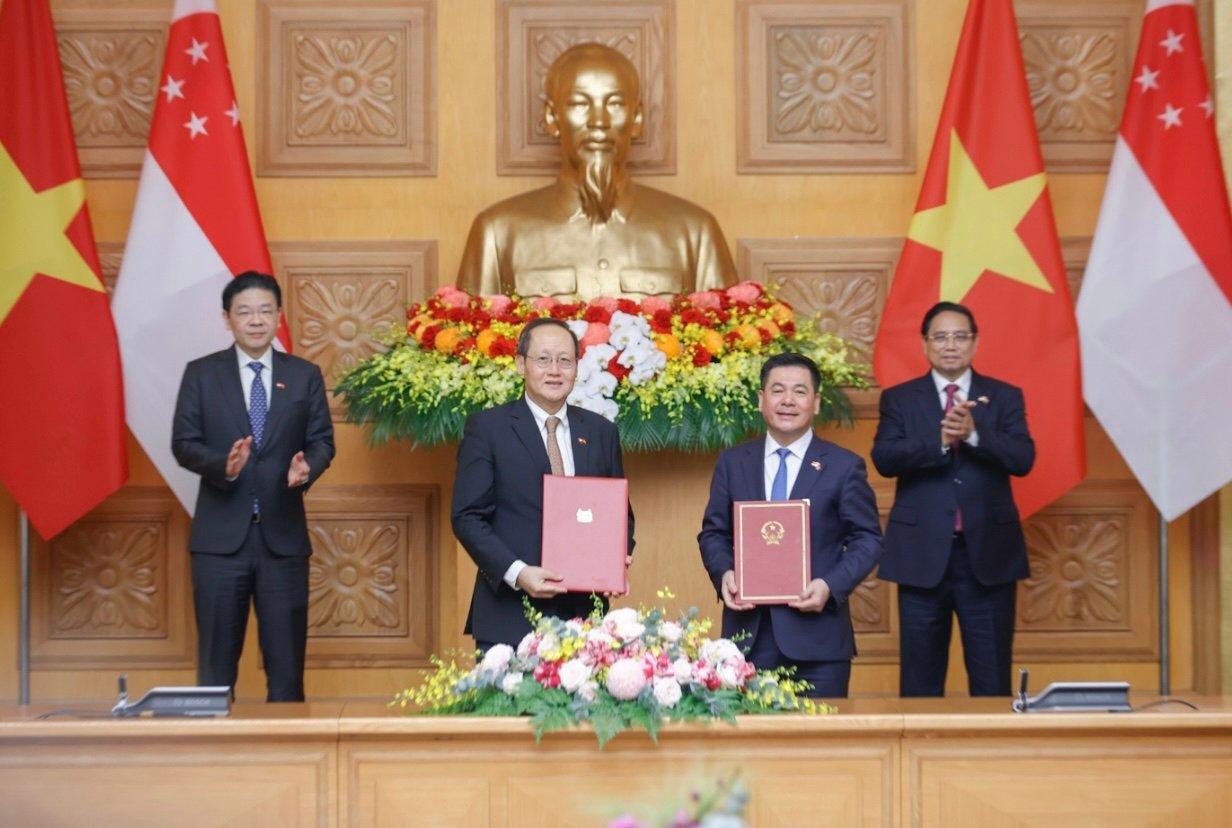

![[Photo] General Secretary To Lam receives Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/4bc6a8b08fcc4cb78cf30928f6bd979e)

![[Photo] Editor-in-Chief of Nhan Dan Newspaper Le Quoc Minh receives Iranian Ambassador Ali Akbar Nazari](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/269ebdab536444818728656f8e3ba653)

Comment (0)