Despite growing international sanctions, Russia's largest independent natural gas producer Novatek has started production at its Arctic LNG 2 project in the Arctic, after five years of construction.

Notably, in just a few weeks, the company could ship its first shipment of liquefied natural gas (LNG) from the Gydan Peninsula in Western Siberia, after successfully replacing Western technology with Chinese imports in its production facilities and overcoming restrictions on transport capacity.

Rapid progress

The departure of Western companies and some sanctions from the US and EU have not been able to prevent Novatek from completing all three production lines of the Arctic LNG 2 project in the next two years.

The T1 production line was assembled on a floating platform near Murmansk and towed to the Utrenny terminal in the summer of 2023, starting liquefying natural gas on December 21 last year. T1 has been producing LNG at a capacity of more than 15,600 cubic meters (7,200 tons) per day since late last month, Upstream Online sources said.

LNG expert Mehdy Touil, who previously served as a senior executive for Novatek’s Yamal LNG project, pointed to the technical modifications Novatek made to complete the T1 production line despite the sanctions.

Specifically, US gas turbine supplier Baker Hughes only managed to deliver four of seven LM9000 turbines to Novatek before the sanctions took effect. This forced the Russian company to modify the configuration of the T1 line and install replacement turbines from Chinese supplier Harbin Guanghan.

T1 was originally designed to use seven LM9000s, three for power generation and four for cooling. However, since there were only four LM9000s, Novatek ran the T1 line at a lower capacity, using two turbines each for power generation and cooling.

T1 began operating in this manner three weeks ago and is running at around 50% capacity. After receiving the CGT30 turbines from Harbin Guanghan, Novatek will revert T1 to its final full-power configuration, using the four available LM9000s for cooling and the five CGT30s for power generation.

The design of T2 and T3 will also be modified to not rely on turbines from US suppliers and instead use products from Chinese suppliers.

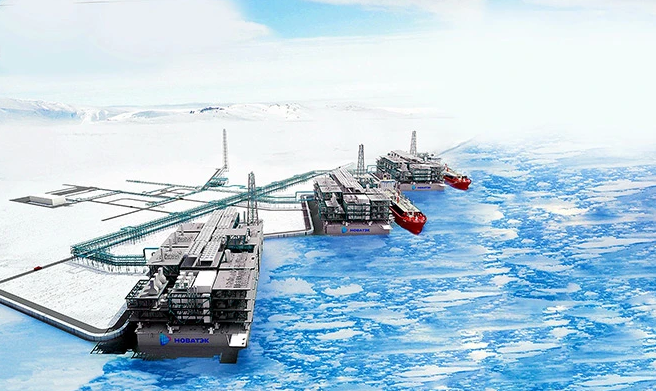

Diagram of the three production lines of the Arctic LNG 2 project provided by Novatek. Photo: Asahi Shimbun

“So all the issues related to Western machinery for T1, T2 and T3 have been resolved. I don’t see any further impact from the sanctions, unless it affects the shipment of the remaining modules from Chinese factories,” Touil said.

Several remaining modules are now en route from China to a construction site outside the Russian city of Murmansk in the Arctic Circle.

While experts, including Mr. Touil, expect the T1 line to run at 50% capacity for most of 2024 until Novatek can install the Chinese turbines, it appears the Russian energy giant has made rapid progress in integrating the CGT30.

Mr. Touil confirmed that the turbines have been successfully received and installed on land, completing the power generation for the T1 production line.

Accordingly, Novatek expects to be able to achieve 100% capacity for T1 in the coming weeks and months ahead of schedule. Each line has a design capacity of about 6.6 million tons of LNG/year.

“However, there is a significant source of logistical uncertainty,” Mr. Touil pointed out.

Logistical challenges

The limiting factor could be the availability of shipping capacity, explained Viktor Katona, senior analyst at Kpler, a commodity market data and analytics firm.

“The first production line may need to run at a lower capacity to avoid overflowing the tanks,” said Mr. Katona, pointing out that the availability of the cargo fleet will be exposed when production rates are faster than the rate at which LNG carriers can absorb it.

Western sanctions have slowed the construction of Novatek’s second-generation LNG fleet, which includes 15 Arc-7 vessels capable of navigating through sea ice – a crucial element for the Arctic LNG 2 project in the Arctic.

At Zvezda, a Russian shipyard in the Far East, a batch of five Arc-7 LNG carriers is under construction. The Russian shipyard could put the first two or three into service in 2024, according to Ben Seligman, an expert on Arctic oil and gas development projects.

But this depends on the availability of some components such as the LNG storage system membrane and the Azipod propulsion system. The French company GTT and the US company General Electric, suppliers of these components, have withdrawn from Russia in 2023.

According to Novatek, the Arc-7 tanker is more capable of navigating through sea ice than the fleet currently used by the Yamal LNG project. Photo: Ship Technology

Zvezda was initially contracted to complete 10 more Arc-7 vessels in cooperation with Samsung Heavy Industries (SHI), which supplied the main hull blocks for final assembly at Russian shipyards.

But under growing pressure from Western sanctions against Moscow, SHI stopped building the hull without formally withdrawing from the partnership.

“Zvezda is now looking to China for help,” said Mr. Seligman.

To address the shortage of transportation, when Novatek starts shipping products from Arctic LNG 2 in the coming weeks, the Russian company will likely rely on ship-to-ship (STS) transfers.

They had originally planned to use the newly deployed floating storage units (FSUs) off Murmansk and Kamchatka, but both units have been under US sanctions since last November and have not been used to date.

“With the sanctions in place, it is unclear to me when Novatek will be able to start operations at the Saam and Koryak floating storage facilities,” Seligman said.

Novatek has resumed STS operations for the Yamal LNG project, transferring the super-chilled fuel from an ice-crossing Arc-7 vessel to a conventional vessel off Kildin Island. Five such operations have taken place in recent weeks.

Convenient Partner

So far, the sanctions have affected the completion of the Arctic LNG 2 production line in the Arctic, the construction of the second generation Arc-7 vessel and the use of two floating storage units (FSUs).

Additional sanctions could further impact Novtek’s ability to secure the necessary shipping capacity or sell its LNG. The EU has been negotiating throughout 2023 to limit Russian LNG flows into the bloc.

In contrast to Russian crude oil shipments, where the country has successfully developed a “shadow fleet” to transport sanctioned oil cargoes, there is no such opportunity for Russian LNG products.

“For Novatek, it will be difficult to hide the origin of its goods and it will be equally difficult to hire LNG carriers,” explained Mr. Katona, an analyst at Kpler.

Jason Feer of consultancy Poten & Partners agrees. “First of all, there are only about 600 LNG carriers in the world, and I would be surprised if any of their owners were willing to allow them to be used to transport sanctioned cargo given the much higher cost of transporting LNG and the risk they face after being used to violate sanctions,” he said.

Chinese President Xi Jinping and Russian President Vladimir Putin announced an “unlimited” partnership in February 2022, weeks before Moscow launched its military operation in Ukraine. Photo: Nikkei Asia

It remains to be seen whether and to what extent the Western sanctions regime will further impact Novatek’s operations at Arctic LNG 2. While the US has made no secret of its desire to “kill” the project, Russia’s Novatek appears to have the wherewithal to get it through the “death gate.”

That’s especially true as long as Novatek continues to make money from Yamal LNG, Russia’s largest LNG project. “Yamal LNG is still a cash cow, and Novatek is working hard to maintain that,” explains LNG expert Touil.

EU countries alone still pay Novatek more than $1 billion per month to buy LNG from the Yamal project.

“Novatek has the financial wherewithal and platform to complete Arctic LNG 2 on its own if necessary. Ultimately, as sanctions become tighter, the likelihood of the project becoming dominated by China increases,” said Katona, a senior analyst at Kpler.

The increasing flow of Russian crude oil to China, including via the Northern Sea Route (NSR) by 2023, suggests that deepening partnership with China is likely to be Russia’s preferred option.

“Doing business with China is the easiest option for sanctioned Russian entities, for business and financial convenience reasons,” Katona concluded .

Minh Duc (According to High North News, Upstream Online)

Source

Comment (0)