Reports from many units all stated that the pressure on maturing bonds will increase sharply in December, then cool down again in the first months of 2025.

Many bondholders are tired of demanding money to buy bonds - Photo: CUONG NGO

According to data from the Vietnam Bond Market Association (VBMA), since the beginning of the year, there have been 362 private bond issuances worth VND342,716 billion and 21 public issuances worth VND32,114 billion.

In the last month of 2024, VBMA estimates that there will be more than VND 42,000 billion of maturing bonds, of which the majority are real estate bonds with VND 14,502 billion, equivalent to 34%.

VNDirect's previous statistics also showed that this December, more than VND38,000 billion of individual bonds will mature, more than double the previous month. However, maturity pressure will decrease significantly in the first months of 2025.

In addition, negotiations to change the terms and conditions of bonds between issuers and bondholders continued in November.

As of December 2, VNDirect said that more than 100 issuers had reached agreements to extend the term with bondholders, with the total value of extended bonds being about VND160,000 billion.

According to VIS Rating - a credit rating company, out of 51 bonds maturing this December, they assess that 15 bonds are at risk of late principal payments. Most of these bonds have been late in paying interest on previous bonds.

"With 30% of bonds maturing in December 2024 at risk of late principal payment, higher than the rate of 20% of bonds late principal payment in the first 11 months of 2024," VIS Rating experts said.

VIS Rating estimates that in the next 12 months, there will be about VND105,000 billion of bonds maturing in the residential real estate sector, accounting for 45% of the total value of maturing bonds. Of these, there may be about VND21,000 billion of bonds at risk of late principal repayment.

In November 2024 alone, a late payment bond was announced from Crystal Bay Joint Stock Company, a company in the tourism and resort industry, with a total late payment principal value of VND 421 billion.

According to VIS Rating, the issuer was late in paying the principal on November 5, 2024. After that, the bondholder - VNDirect - owning 100% of this bond agreed to extend the payment until November 30, 2024. Currently, there is no payment notice for this bond.

However, VIS Rating said that this bond is secured by 78.2 million shares of Crystal Bay Joint Stock Company and VNDirect is also the consultant, underwriter and representative for the bondholder.

"We consider these collateral stocks to be low liquidity because they are shares of unlisted companies. In addition, we assess that the company will continue to have a high risk of late principal/interest payments given its weak credit profile with negative operating cash flow, high leverage and limited cash resources," VIS Rating experts said.

According to the published information, this issuer lost 76 billion VND in the first 6 months of 2024 and 136 billion VND in the first 6 months of 2023.

First-time deferred bonds tend to decline

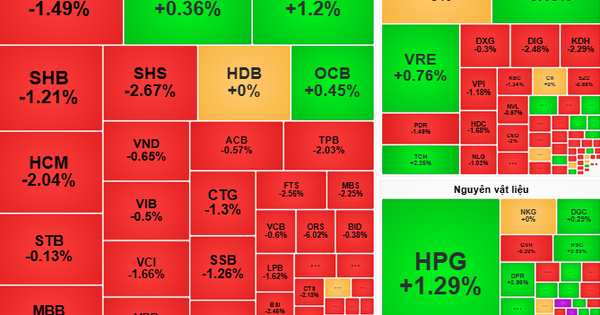

In general assessment of the market, VIS Rating believes that with 43 bonds with delayed principal/interest payments for the first time with a total value of VND 23,200 billion (accumulated in 11 months of 2024), this number has decreased significantly compared to 369 bonds with delayed principal/interest payments with a total value of VND 144,300 billion in 2023.

Accordingly, the cumulative overdue payment rate at the end of November 2024 remained at 15.3%. The energy group had the highest overdue payment rate at 44%, while the residential real estate group accounted for 60% of the total overdue bonds.

Source: https://tuoitre.vn/nhieu-doanh-nghiep-co-nguy-co-cham-tra-no-trai-phieu-cuoi-nam-20241214180131073.htm

![[Photo] General Secretary To Lam receives Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/4bc6a8b08fcc4cb78cf30928f6bd979e)

![[Photo] President Luong Cuong attends the 90th Anniversary of Vietnam Militia and Self-Defense Forces](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/678c7652b6324b29ba069915c5f0fdaf)

![[Photo] Editor-in-Chief of Nhan Dan Newspaper Le Quoc Minh receives Iranian Ambassador Ali Akbar Nazari](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/269ebdab536444818728656f8e3ba653)

Comment (0)