A wave of widespread industrial consolidation has forced Japanese semiconductor makers, which together control 50% of the global market, to take a cautious stance.

Many Japanese companies occupy important links in the chip supply chain, becoming "delicious prey" for foreign companies. Faced with the looming danger, the state-owned enterprise JIC (Japan Investment Corporation) is looking to "unite" everything under one roof to promote the rebuilding of the national semiconductor industry.

To gain an advantage in the coming wave and stay competitive, JSR, a major Tokyo-listed chipmaking materials maker, announced in June that it would accept a takeover bid (TOB) from JIC.

“Japan’s chipmaking sector is not highly concentrated, so companies are not getting the investment efficiency they want,” said Shogo Ikeuchi, managing director at JIC Capital. Due to their relatively small size, Japanese manufacturers spend less on research and development (R&D) than their peers in the US and Europe.

JSR has about 20% of the global market for photoconductors, a material used in the manufacturing of peripheral chips, but was valued at just 850 billion yen ($5.75 billion) at the end of August, a fifth of DuPont, an American company with 10% of the world's optical market. Tokyo Ohka Kogyo, the world's largest spectrometer maker, is valued at even lower 420 billion yen.

Similarly, Kanto Denka Kogyo and Resonac Holdings together account for more than 50% of the global market for etching gas, which is used to clean foreign substances from silicon wafers. But their combined market capitalization is just one-twentieth that of Germany’s Merck, which controls about 20% of the market.

Many Japanese chip material makers have price-to-book ratios below 1, such as Sumitomo Chemical with a PBR of 0.6, Resonac at 0.8, and Kanto Denka at 0.9 (as of the end of June), making them attractive targets for large investors with takeover ambitions.

The game of "tons" of money

The reason why small Japanese manufacturers can own a large share of the market is the discipline to stick to and apply research and development (R&D) programs that take a long time to discover the optimal combination.

“Japanese companies are very good at adopting and sticking to time-consuming R&D programs, and have thus maintained a competitive advantage over foreign companies,” said Akira Minamikawa of UK-based research firm Omdia.

Meanwhile, the reason why the competitiveness of "small but mighty" companies is increasingly weakened is the lack of economies of scale based on the large-scale nature of the semiconductor industry, which is highly capital-intensive.

Japanese companies like NEC and Hitachi dominated the global semiconductor industry in the 1980s. Together they had 50% of the global market share at their peak in 1988, before being overtaken by South Korea and other rivals. Last year, their combined share of the global chip market was just 9%, according to Omdia.

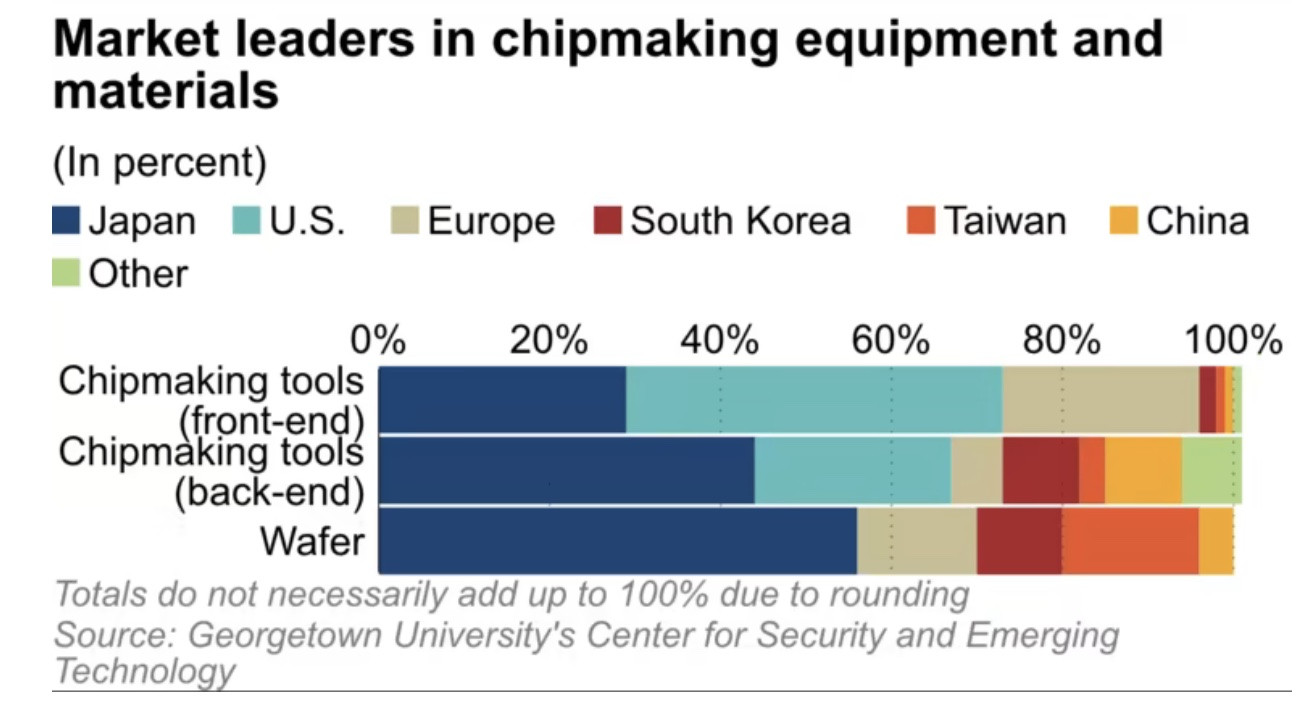

Meanwhile, chipmaking materials are becoming increasingly important amid the escalating US-China conflict. According to the Center for Security and Emerging Technology at Georgetown University (USA), Japanese companies account for 30% to 60% of the market share in this market for manufacturing materials. Data from Omdia shows that Japan accounts for 48%, followed by Taiwan with 17% and South Korea with 13%.

As market competition moves toward consolidation, Japanese chip material makers must move beyond their comfort zones if they want to stay in the game, experts say.

(According to Nikkei Asia)

Source

Comment (0)