According to the State Bank of Vietnam, by 2024, more than 75% of banking transactions will be conducted on digital platforms. In particular, non-cash payments among young people are increasing by 30% per year, reflecting a clear change in financial behavior among Generation Z and Alpha.

Previously, banking services required complicated procedures and only allowed people aged 18 and over to open accounts. However, current regulations allow individuals aged 15 and over to open payment accounts at credit institutions. To meet the needs of young people, many banks in Vietnam have developed digital banking products specifically for students to help them access and manage their personal finances effectively. For example, Techcombank provides digital banking services with many incentives for students. Young people can open accounts and payment cards to use services such as money transfers, online payments and effective spending management. Vietcombank supports students aged 15 and over to open bank accounts with the consent of their legal representatives. Vietcombank's digital banking services help students conduct financial transactions conveniently and safely...

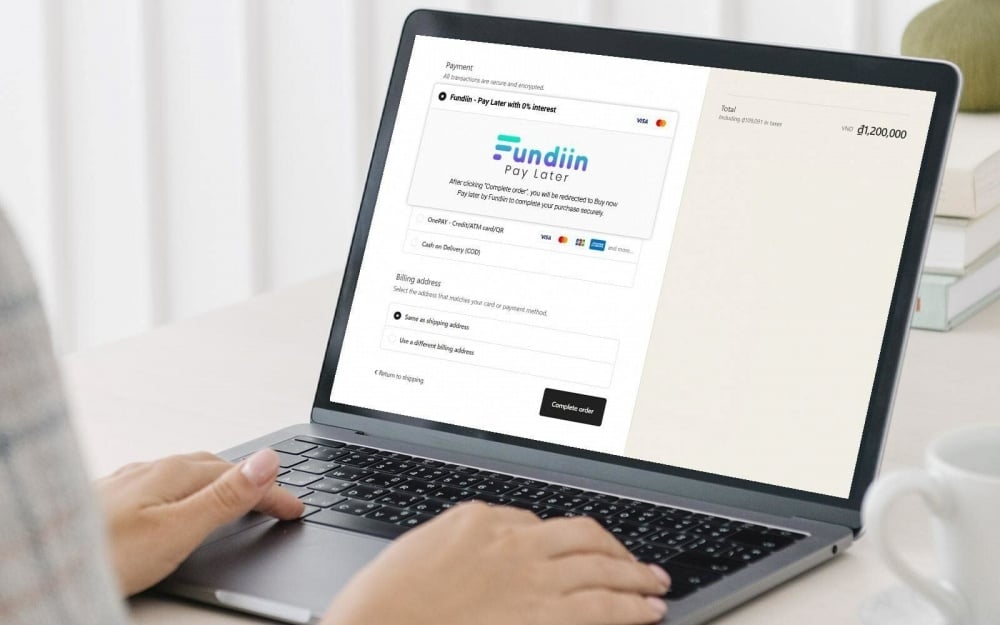

|

| To meet the needs of young people, many banks in Vietnam have developed digital banking products. |

According to TQ Huy, 16 years old - a high school student in Hanoi, he used to not be able to control his pocket money, often spending it all before the end of the month. But since his parents opened a payment account at MB, Huy receives money from his parents via bank transfer instead of cash, helping him track his spending via the banking app and learn how to allocate money reasonably.

Or HT Lan, 19 years old, a first-year student at the National Economics University, wanted to take a soft skills course worth 3 million VND but did not have the money available. Lan used the "Automatic Savings" feature of the VPBank NEO application to set a savings goal for 3 months. Thanks to that, Lan formed a saving habit and achieved her financial goal without having to borrow money.

With more favorable conditions than HTLan, Hoang Minh, 21 years old, a third-year student at the University of Science and Technology, has income from part-time jobs but does not know how to manage cash flow effectively. After researching information, Minh opened two accounts at Techcombank to separate personal finances. This helps Minh control cash flow better, minimize the risk of uncontrolled spending and form professional financial management habits.

It can be seen that with the support from banks, financial products specifically for students have helped young people get acquainted with modern financial platforms, while creating opportunities for them to practice and form financial thinking early. From the above practical examples, it is clear that there is a positive change in the financial habits of young people when they have access to digital banking tools.

To enhance financial education for students, close coordination between banks, schools and parents is essential. In addition, the combination of financial communication programs and digital banking applications in teaching will help students have a more realistic view of personal finance and equip them with solid financial skills, thereby preparing for a stable and smart financial future.

As digital banking services become more and more popular, young people need to be equipped with the knowledge and skills to use these tools effectively. This will not only help them improve their financial management skills but also create a generation of young people who are confident, proactive and responsible in building their financial future.

![[Photo] Prime Minister Pham Minh Chinh meets with the Ministry of Education and Training; Ministry of Health on the draft project to be submitted to the Politburo](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/c0e5c7348ced423db06166df08ffbe54)

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia received the delegation of Nhan Dan Daily](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/cdb71275aa7542b082ec36b3819cfb5c)

![[Photo] Nhan Dan Newspaper Youth Union visits Vietnam Military History Museum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/374e4f70a35146928ecd4a5293b25af0)

![[Photo] General Secretary To Lam chairs the Standing Meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/839ea9ed0cd8400a8ba1c1ce0728b2be)

Comment (0)