Fundiin is a technology company in Vietnam specializing in providing the first free installment payment solution. This service is owned by Fundiin Joint Stock Company. Customers can pay for their orders through three installments, each lasting one month, with 0% interest. This offers customers the best shopping experience even when they are not financially ready.

|

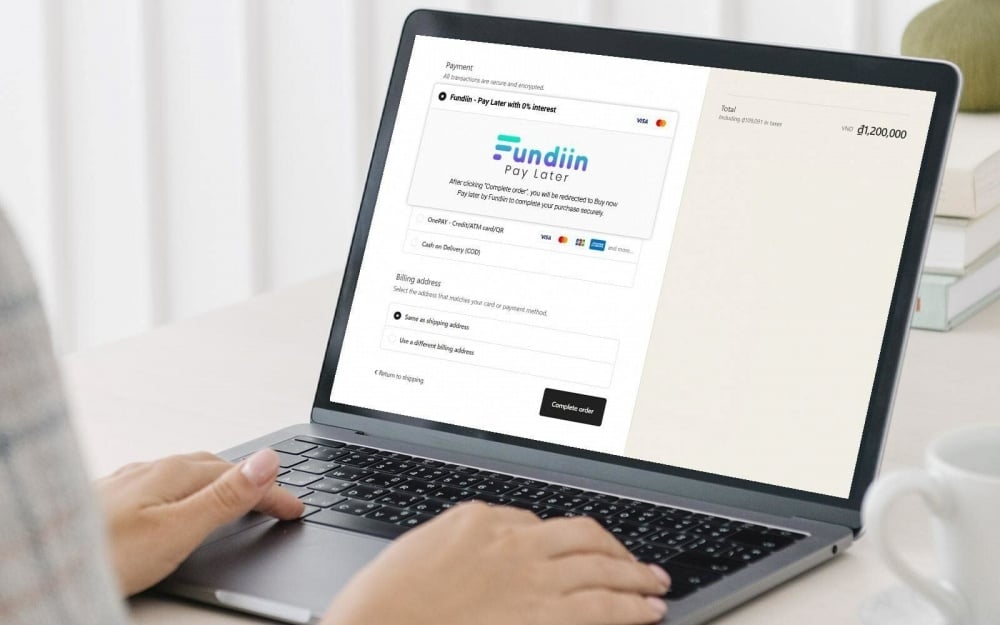

| Fundiin - a popular "Buy now, pay later" solution in Vietnam. |

Therefore, credit scoring is one of the crucial factors in assessing a customer's ability to repay debt. However, for many consumers with little or no credit history, accessing capital remains a significant challenge. Visa's credit scoring solution, combined with Fundiin's data technology, can help improve the accuracy and stability of risk assessment. As a result, credit approval decisions will be made more quickly, increasing approval rates while keeping the bad debt ratio low.

According to Mr. Nguyen Anh Cuong, CEO of Fundiin, the partnership with Visa is a long-term strategic step that helps strengthen the solid foundation for extensive cooperation plans with financial institutions and banks in Vietnam. "We are committed to innovation and applying technology to provide safe, transparent, and cost-effective credit products for consumers," Mr. Cuong shared.

One of the most significant benefits of this collaboration is easier access to finance for consumers, especially those without a credit history. Thanks to the application of modern credit scoring technology, the system can accurately assess risk even without historical credit data. This opens up opportunities to build a personal credit score, enabling consumers to make larger financial transactions in the future, such as obtaining a home loan at a lower cost.

Established in 2019, Fundiin is a pioneer in the Buy Now Pay Later (BNPL) sector in Vietnam. Currently, Fundiin collaborates with over 800 retail partners, providing consumers with a convenient and financially stress-free payment method. Fundiin's biggest differentiator is the absence of a debt collection department from its inception, demonstrating its commitment to providing responsible financial solutions and prioritizing customer experience.

Visa, operating in over 200 countries and territories, provides secure and modern electronic payment technology. The partnership with Fundiin is part of a strategy to expand financial access and foster the digital economy through advanced payment and credit scoring solutions.

This upgrade to the credit scoring model not only helps Fundiin and Visa improve their risk management capabilities but also opens up new opportunities for the digital finance market in Vietnam. As technology continues to develop, flexible and transparent financial solutions like Fundiin - Visa will play a crucial role in promoting financial inclusion, helping consumers access credit more easily and safely.

Source: https://thoibaonganhang.vn/giai-phap-cham-diem-tin-dung-cua-visa-161816.html

![[Photo] Coc Ly market bustling on the eve of Tet](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2026/02/14/1771062261424_baolaocai-br_img-6457-jpg.webp)

Comment (0)