VCCI proposed that the Ministry of Finance postpone the application of online sales tax regulations to July 1, 2025, 3 months later than the draft.

The Vietnam Federation of Commerce and Industry (VCCI) has just sent the Ministry of Finance a document with comments on the draft decree regulating tax management for business activities on e-commerce platforms and digital platforms of business households and individual businesses.

VCCI proposed to postpone the collection of online sales tax to July 1, 2025, 3 months later than the draft (April 1, 2025).

|

| Postpone online sales tax collection to July 1, 2025. Illustration photo |

VCCI said that, according to businesses' feedback, the effective date is relatively urgent, while the document is in the draft stage, businesses need time to build information technology systems, human resources, and propaganda for sellers.

According to VCCI, tax collection is necessary, but it is necessary to develop a tax collection method that ensures minimizing administrative procedures and compliance burdens for businesses and individuals.

At the same time, with the participation of many subjects in the new method, regulations also need to clearly define the responsibilities and obligations of the parties to serve as a legal basis for implementation.

In addition, VCCI also suggested that the drafting agency consider amending in the direction of allowing declaration according to lump-sum tax applicable to business individuals with the number of orders below the threshold (information on the number of orders can be extracted through shipping units).

The draft also requires individuals doing business on e-commerce platforms to declare business expenses. According to VCCI, this is unnecessary because tax is calculated on revenue.

Source: https://congthuong.vn/lui-thoi-gian-thu-thue-ban-hang-online-den-ngay-172025-374753.html

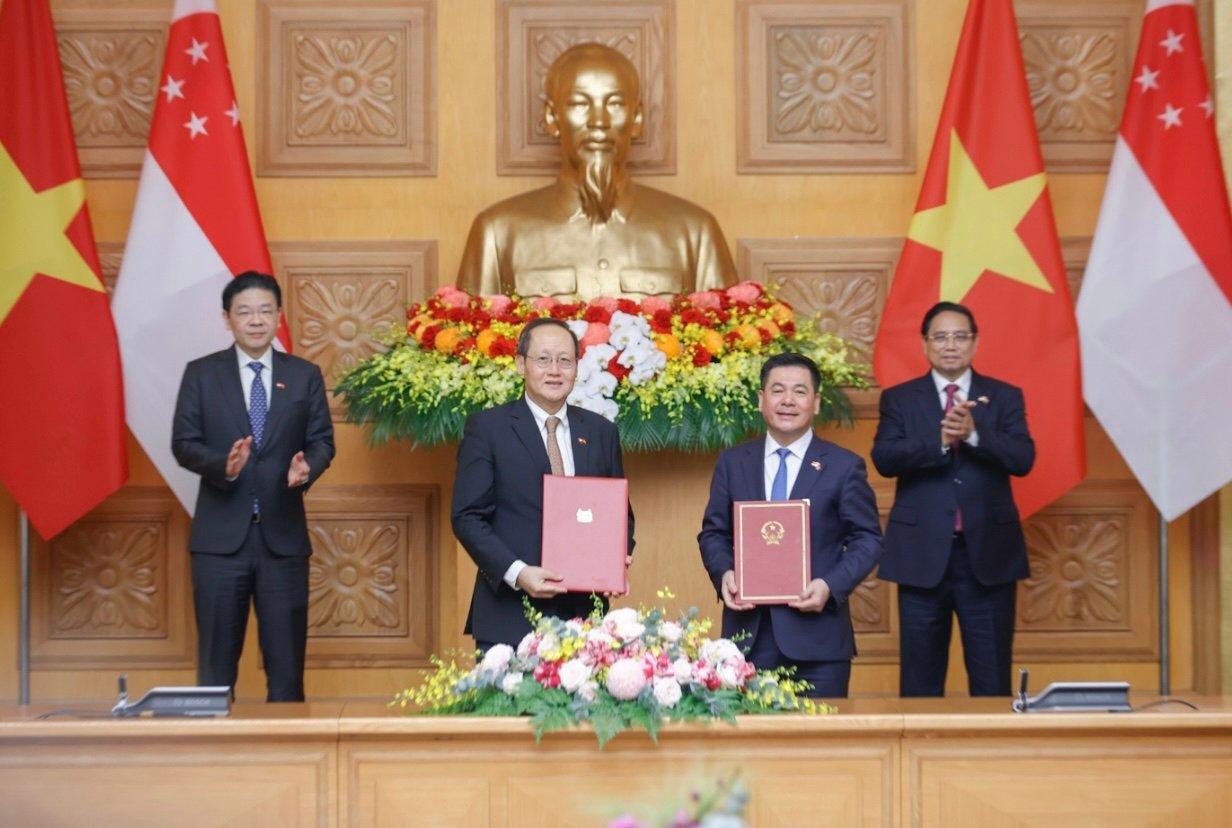

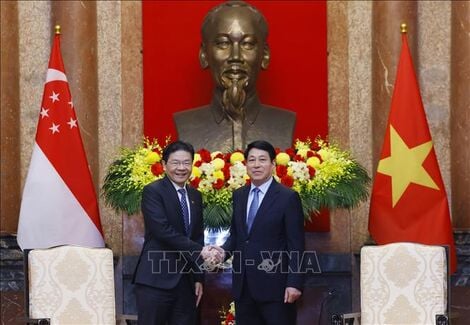

![[Photo] General Secretary To Lam receives Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/4bc6a8b08fcc4cb78cf30928f6bd979e)

![[Photo] Editor-in-Chief of Nhan Dan Newspaper Le Quoc Minh receives Iranian Ambassador Ali Akbar Nazari](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/269ebdab536444818728656f8e3ba653)

![[Photo] Students of the Academy of Posts and Telecommunications visit the editorial office of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/51093483a84448ccb39d59333ead674e)

![[Photo] Prime Minister Pham Minh Chinh attends the launching ceremony of the "Digital Literacy for All" Movement](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/a58cb8d1bc424828919805bc30e8c348)

![[Photo] President Luong Cuong attends the 90th Anniversary of Vietnam Militia and Self-Defense Forces](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/678c7652b6324b29ba069915c5f0fdaf)

Comment (0)