| Commodity market today, October 9: Energy market 'blazing red' pulls MXV-Index to weaken Commodity market today, October 10: Oil price continues to weaken |

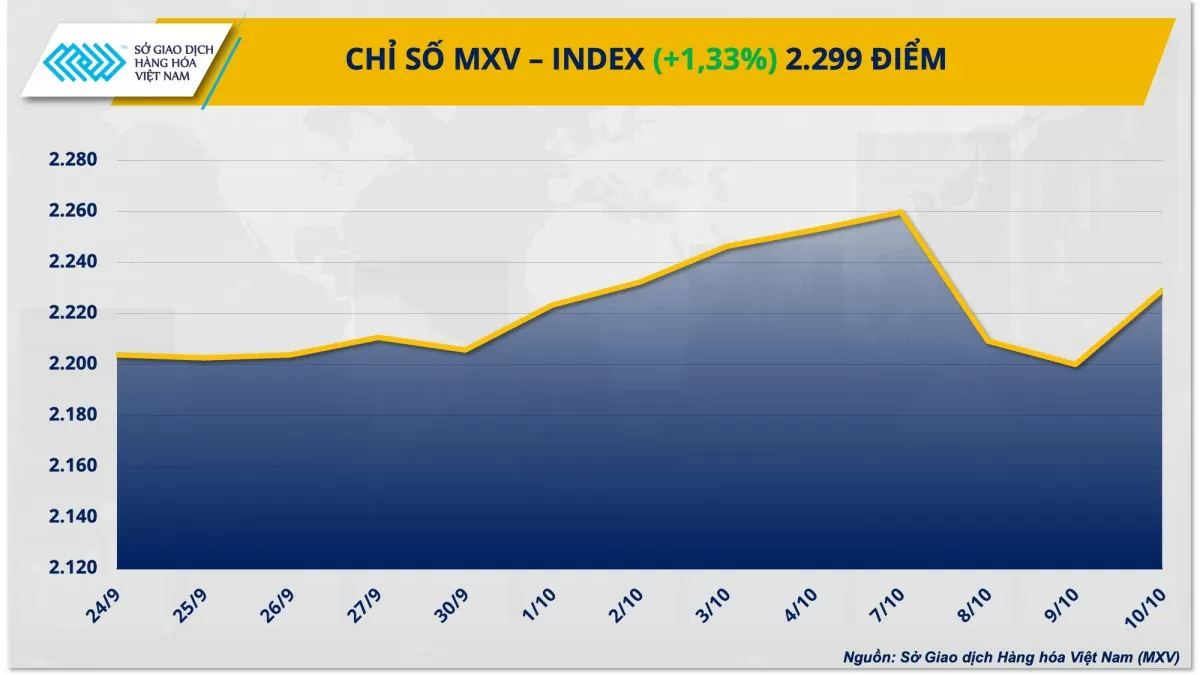

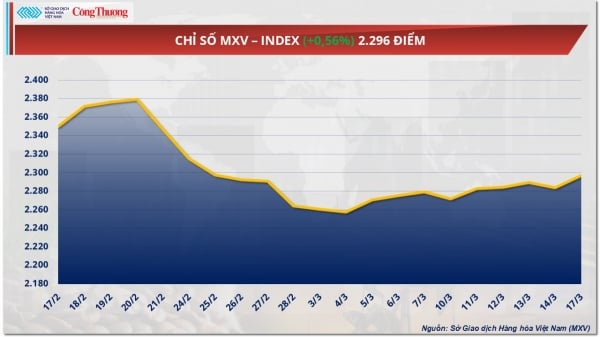

The market paid attention to the metal group when 9 out of 10 items increased in price. On the contrary, the agricultural group experienced a tug-of-war session, corn prices decreased slightly by 0.59% while wheat prices extended their increase to the 4th consecutive session. Closing, the MXV-Index increased by 1.33% to 2,299 points.

|

| MXV-Index |

Precious metal prices rise despite hotter-than-expected CPI data

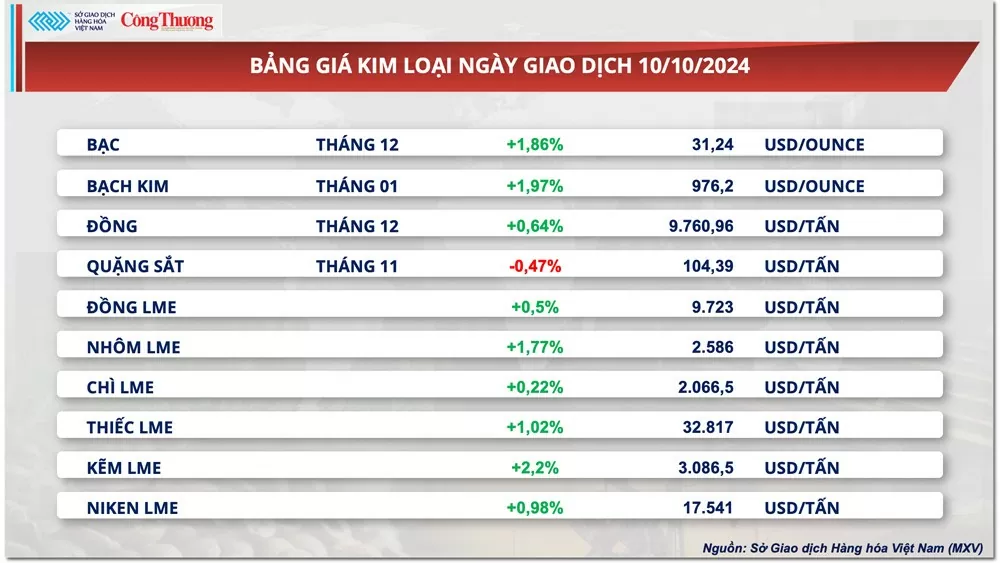

Yesterday's trading session, the metal market improved after the previous sharp decline. For the precious metals group, silver price increased by 1.86%, reaching 31.24 USD/ounce, while platinum recovered nearly 2%, reaching 976.2 USD/ounce, ending a series of 4 consecutive declines.

|

| Metal price list |

Yesterday, the metal market turned its attention to the US consumer price index (CPI) report for September. Specifically, according to data from the US Bureau of Labor Statistics, in September, the country's core CPI increased 0.3% compared to the previous month and increased 3.3% compared to the same period last year. Both figures were 0.1 percentage points higher than forecast, raising concerns that the US Federal Reserve (FED) may pause interest rate cuts due to signs of rising inflation again.

However, after the data was released, several Fed officials gave reassuring speeches, raising expectations for a Fed rate cut. CME Group's FedWatch tool also showed that the market was betting on an 80% chance that the Fed would cut rates by 25 basis points at its November meeting, up from 76% before the data was released. Accordingly, this optimistic sentiment also boosted buying power for precious metals, supporting silver and platinum prices to rise simultaneously in yesterday's session.

Among the base metals, the most notable performance was LME zinc, which jumped more than 2% to $3,086.5 per tonne, leading the group’s gains. Concerns about supply shortages were the main driver behind yesterday’s zinc price increase.

In its supply and demand report released yesterday, the International Lead and Zinc Study Group (ILZSG) warned that the global zinc market is facing a significant supply deficit this year, as raw material shortages force smelters to reduce refined metal output. The group revised its forecast for the zinc market to a deficit of 164,000 tonnes this year, compared to its previous estimate in April of a surplus of 56,000 tonnes.

On the supply side, mine output is expected to decline for the third consecutive year this year. ILZSG also said that profit margins at zinc smelters in China, the country with the world's largest zinc smelter network, are gradually narrowing and refined zinc output there is falling at a faster pace.

Agricultural market moves in opposite directions

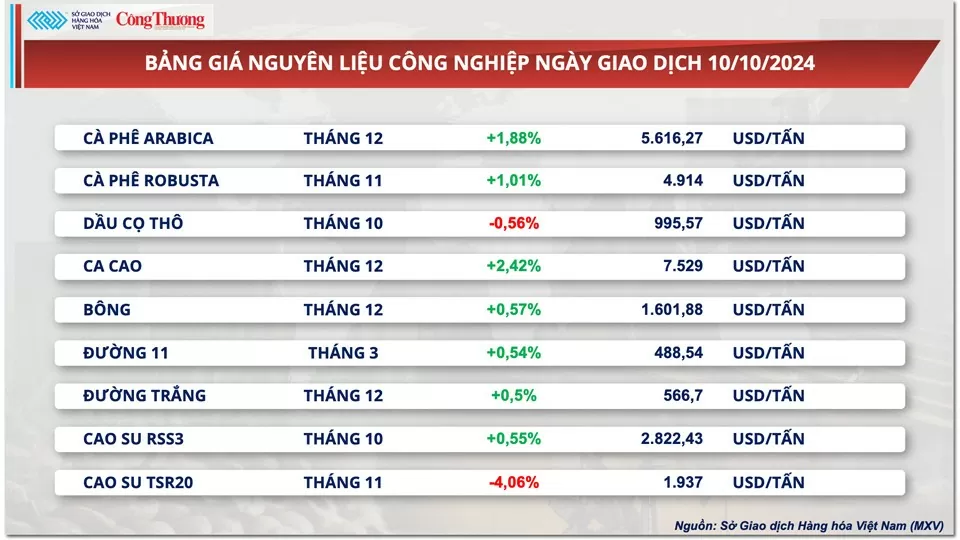

According to MXV, in yesterday's trading session, the agricultural market fluctuated and diversified. Notably, the price of corn futures for December fell nearly 0.6%, completely erasing the increase in the previous session. The market is in a correction phase and there are no signs of recovery.

|

| Agricultural product price list |

In its weekly Export Sales Report, the U.S. Department of Agriculture (USDA) reported that U.S. corn sales for the 2024-2025 crop year were 22 million tons for the week ending October 3, down 27.4% from the previous week. Corn deliveries for the reporting week were 1.06 million tons, down nearly 10% from the previous week. This factor has put pressure on prices.

In addition, the weather during the harvest period in the US and the ongoing first corn planting in Brazil remained relatively favorable. The market is watching where rains appear in South America to assess the current crop situation. This also put pressure on the market yesterday.

In contrast to corn, wheat prices rose nearly 1%, recording a fourth consecutive session of closing in the green. The market was supported by concerns about rising tensions between Russia and Ukraine and persistent drought in grain-producing regions around the world that could affect wheat supplies.

Ukrainian officials say a Russian missile attack on the Odessa region. Ukraine's deputy prime minister has accused Russia of deliberately attacking Black Sea port infrastructure to reduce Ukraine's grain exports, causing a drop in global grain supplies.

The Rosario Grains Exchange (BCR) yesterday lowered its forecast for Argentina's 2024-25 wheat production to 19.5 million tonnes, down from a previous estimate of 20.5 million tonnes. According to BCR, many wheat fields did not receive enough water during the critical growth stage, reducing potential yields.

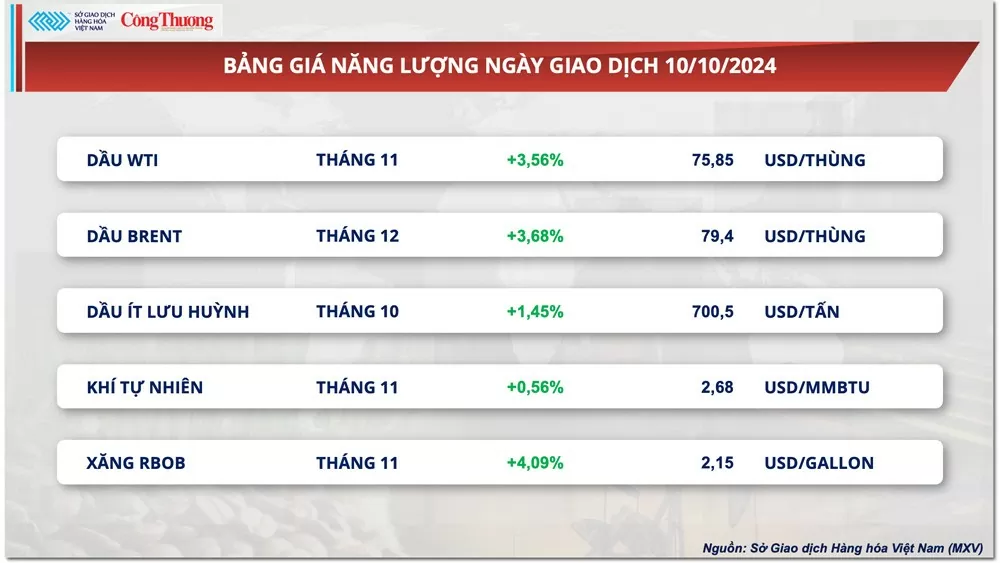

Prices of some other goods

|

| Industrial raw material price list |

|

| Energy price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-1110-luc-mua-manh-me-quay-lai-thi-truong-hang-hoa-nguyen-lieu-the-gioi-351665.html

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)