ANTD.VN - Three important interest rate decisions by the Central Banks of Japan, Europe and Canada are expected to affect gold price trends next week.

Gold prices started the week on a high last week, trading near $2,050 an ounce, boosted by safe-haven demand amid Middle East conflict and market sentiment that an interest rate cut would come soon.

However, hawkish comments from Fed officials have dampened investor demand for the yellow metal, with spot gold ending the trading week at $2,030 an ounce.

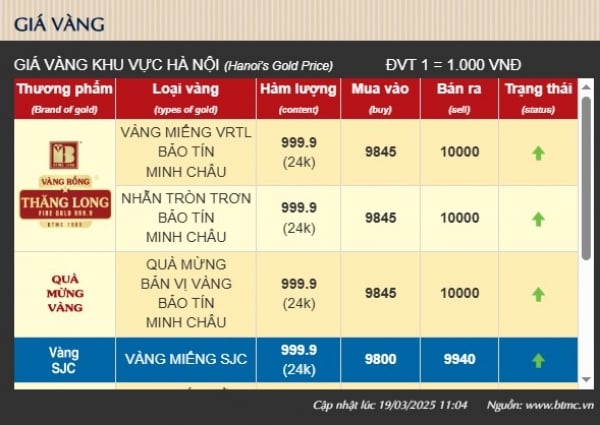

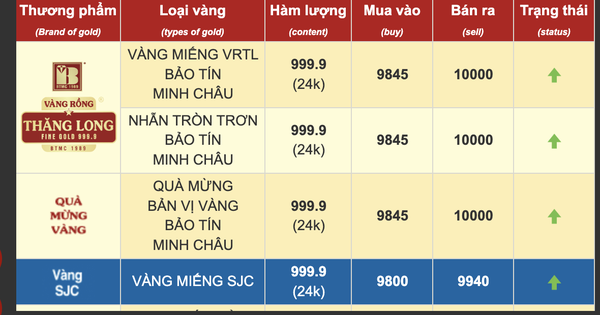

Domestically, after a strong increase last week with an increase of up to 2 million VND/tael, last week, gold prices adjusted again. SJC gold ended the week around 73.60 - 76.70 million VND/tael, a slight decrease of 300 thousand VND/tael for the week.

Meanwhile, ring gold continued to increase by about 250 - 350 thousand VND per tael during the week, with SJC 99.99 ring gold closing the week at 62.65 - 63.85 million VND/tael.

|

Gold prices await new data |

Next week, the strength of the US dollar and high Treasury yields, along with the US stock market at historical highs, will likely continue to act as headwinds for gold prices.

However, on the positive side, some experts believe that with demand for physical gold expected to increase due to seasonal factors, gold will still have momentum to increase until Valentine's Day.

Investors will continue to keep a close eye on the simmering conflict in the Middle East, which continues to heat up. However, central bank interest rate decisions will be in focus, with three key monetary policy decisions from the central banks (Japan, ECB and Bank of Canada).

The Bank of Japan (BOJ) is expected to maintain its dovish stance and negative interest rates on Monday, followed by the Bank of Canada’s rate decision on Wednesday. Thursday morning will see the European Central Bank (ECB) rate announcement, which could bring significant volatility to the US dollar and gold.

As for gold prices next week, 14 Wall Street analysts participated in the Kitco News Gold Survey and they saw last week’s bullish trend weaken significantly. Six experts, or 42%, expected higher gold prices next week, while four analysts, or 29%, predicted lower prices and another four experts, or 29%, were neutral on gold next week.

Meanwhile, 150 votes were cast in Kitco’s online poll of retail investors. The results were similar, with 44% expecting gold to rise next week; 29% predicting lower prices, while 27% are neutral on the precious metal’s near-term outlook.

Source link

Comment (0)