Gold price today, August 30, 2024, increased sharply, decreased sharply, then recovered again, that is the development of the precious metal market these days. Wells Fargo experts believe that gold is just at the beginning of a super cycle of price increase. Why is that?

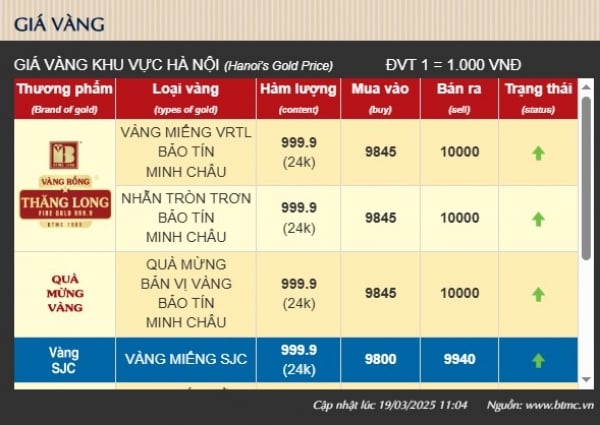

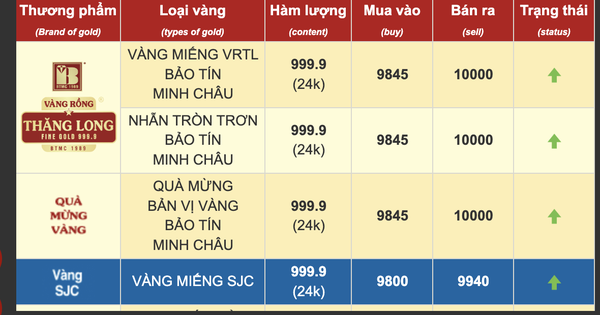

LIVE UPDATE TABLE OF GOLD PRICE TODAY 8/31 AND EXCHANGE RATE TODAY 8/31

| 1. SJC - Updated: 08/30/2024 08:29 - Website time of supply - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 1L, 10L, 1KG | 79,000 | 81,000 |

| SJC 5c | 79,000 | 81,020 |

| SJC 2c, 1c, 5 phan | 79,000 | 81,030 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 77,400 | 78,650 |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 77,400 | 78,750 |

| Jewelry 99.99% | 77,300 | 78,250 |

| Jewelry 99% | 75,475 | 77,475 |

| Jewelry 68% | 50,865 | 53,365 |

| Jewelry 41.7% | 30,284 | 32,784 |

Update gold price today 8/31/2024

World gold prices increased sharply, decreased sharply, then recovered firmly above the threshold of 2,500 USD/ounce.

As gold prices consolidate near record highs above $2,500 an ounce, a Wells Fargo market analyst has warned investors not to try to hold back on the market.

During the session on August 30, there was a time when the gold price dropped deeply to nearly 2,500 USD/ounce, but bottom-fishing demand quickly caused the price of this precious metal to increase sharply again to 2,528 USD/ounce. The fluctuation range of each session of gold price is about 30 USD.

According to the World & Vietnam Newspaper, at 7:00 p.m. on August 30 (Hanoi time), the gold price traded on the Kitco electronic floor was at 2,520.10 USD/ounce, slightly adjusted by 1.50 USD/ounce compared to the previous trading session. Gold futures on the US market increased 0.9% to 2,560.3 USD/ounce.

Gold prices rose about 1% on strong investor expectations that the US Federal Reserve (Fed) will definitely cut interest rates in September, with the market now focusing on US inflation data to predict more details about the scale and level of potential interest rate cuts.

Therefore, Gainesville Coins chief market analyst Everett Millman believes that at least until the next Fed policy meeting, the gold market will be sideways, with strong support likely due to the geopolitical situation. Gold is considered a safe investment in times of economic and geopolitical uncertainty.

Domestic gold prices are quite stable, without many changes this week.

Currently, gold companies list the price of SJC gold bars at 79.00 - 81.00 million VND/tael (buy - sell) - unchanged for many days. The world gold price converted according to the listed exchange rate is around 76 million VND/tael.

The price of plain round gold rings and 24K jewelry gold of all kinds is traded around 77.4 - 78.65 million VND/tael, an increase of about 50,000 VND compared to yesterday.

The Ho Chi Minh City Market Management Department said that the authorities have just conducted a surprise inspection of 4 gold and silver businesses in District 5, discovering many gold products of unknown origin, goods without invoices and documents with a total value of more than 130 million VND. The inspection team has drawn up a record and is clarifying and handling the matter according to the law. The inspection team has disseminated to gold businesses about complying with the law on gold and foreign exchange trading.

|

| Gold price today August 31, 2024: Is gold in a super bull cycle, an investment channel attracting money from both China and the West? (Source: Kitco) |

Summary of SJC gold bar prices at major domestic trading brands at closing times of trading session on the afternoon of August 30:

Saigon Jewelry Company: SJC gold bars 79.0 - 81.0 million VND/tael; SJC gold rings 77.40 - 78.65 million VND/tael.

Doji Group: SJC gold bars 79.0 - 81.0 million VND/tael; 9999 round rings (Hung Thinh Vuong): 77.55 - 78.65 million VND/tael.

PNJ system: SJC gold bars 79.0 - 81.0 million VND/tael; PNJ 999.9 plain gold rings: 77.45 - 78.65 million VND/tael.

Phu Quy Gold and Silver Group: SJC gold bars: 79.0 - 81.0 million VND/tael; Phu Quy 999.9 round gold rings: 77.45 - 78.65 million VND/tael.

The price of SJC gold bars at Bao Tin Minh Chau is listed at: 79.0 - 81.0 million VND/tael; round gold rings of the Thang Long Dragon Gold brand: 77.46 - 78.66 million VND/tael.

The next target for gold price is $3,000.

In a recent interview with Kitco News , John LaForge, Head of Real Asset Strategy at Wells Fargo, said that the precious metals market's latest breakout move, which has seen gold prices rise 23% this year and set a new record high - more than 20 times.

LaForge noted that trying to predict where this rally will end is futile. This rally is just the market catching up to the bull trend at the beginning of a bull supercycle. “In the first few years of the bull market cycle — 2020 and 2021 — gold underperformed relative to other commodities, with most commodities doubling. Now, “gold has finally responded, and this rally confirms that we are in a supercycle.”

Looking ahead, with gold up more than 20% this year, the rally could start to slow as we head into the final months of the year. However, LaForge said he doesn’t see a reversal in the near term. “We may have some pullbacks, or gold may continue to move higher, but the overall trend is up. While the rally may slow, $2,500 an ounce seems like the next stop.”

The Wells Fargo strategist added that a big reason he sees gold's move as a sustainable rally is because not only has it outperformed the US dollar, but gold has hit new record highs against all major currencies in recent times.

While not an official target, LaForge believes gold could hit $3,000 in the next few years. That level would be significant because it would represent a record inflation-adjusted high for gold. At current prices, gold is less than 20% away from that target.

Meanwhile, on the demand side, observers say that not only China and India, but also Western investors have recently actively participated in the long-term gold market, a trend that has contributed to supporting rising prices globally.

The reality is that “there is a shift going on where gold is not just attractive in Asia, it is becoming more and more attractive in the West,” said Sakhila Mirza, deputy chief executive of the London Bullion Market Association. Western investors are not just looking at gold as a short-term opportunity, but are also in it for the long term, she added.

China’s gold buying will push prices higher over the next decade, according to Capital Economics. While the People’s Bank of China (PBoC) has recently curbed its purchases, the pause in gold accumulation is likely to be temporary, as “China’s gold rush remains robust” amid rising global tensions, economic uncertainty and continued efforts to move away from the US dollar, they said.

China appeared to be the main driver behind the global gold price rally earlier this year amid strong central bank buying, strong physical gold demand and rising ETF holdings.

Source: https://baoquocte.vn/gia-va-ng-hom-nay-3182024-gia-va-ng-trong-mot-sieu-chu-ky-tang-gia-kenh-dau-tu-nay-dang-hut-tien-tu-ca-trung-quoc-va-phuong-tay-284433.html

Comment (0)