(Dan Tri) - World gold prices continue to rise. Major banks have raised their expectations for the price of precious metals amid strong demand and potential fluctuations in monetary policy.

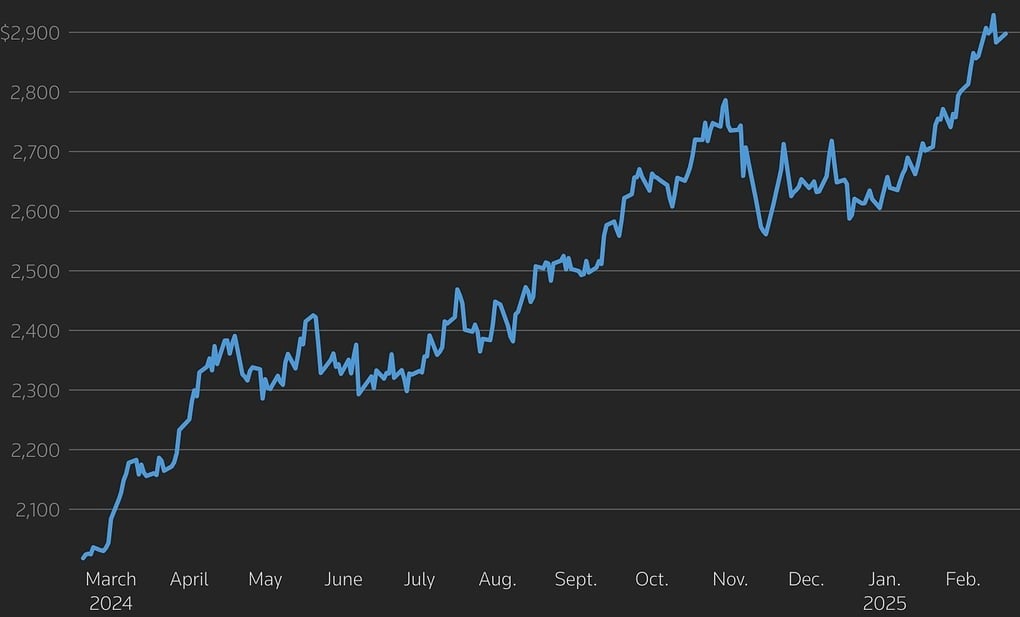

The world gold price has continuously set new peaks, reaching 2,918 USD/ounce in today's trading session. Since the beginning of the year, the gold price has increased by 10%. According to the technical chart, the precious metal has been in an uptrend for the past 16 months and has increased by 63% since October 2023.

Notably, major banks around the world have continued to raise their forecasts for precious metal prices this year.

Specifically, UBS Bank forecasts that gold prices will reach $3,200/ounce by the end of the year, then decline slightly and end above $3,000. This unit also points out that investors are still not fully interested in gold, which means that the precious metal still has a lot of room to increase in price.

Goldman Sachs has also just raised its forecast for world gold prices this year to $3,100/ounce, up from $2,890 previously. The bank believes that high demand from central banks will help the precious metal increase by 9% by the end of the year and ETFs will also increase their purchases of gold when interest rates fall.

That would offset any reduction in buying interest as investors adjust positions as uncertainty eases, Goldman Sachs said. However, if policy uncertainty remains high, especially concerns about U.S. import tariffs, the bank said gold could rise to $3,300 on speculation.

Central bank hoarding has supported the precious metal in recent years. According to the World Gold Council (WGC), central banks bought 1,044 tonnes of gold last year. The Polish Central Bank was the biggest buyer, adding 90 tonnes to its reserves.

Goldman Sachs has again recommended buying gold. The bank believes that while volatility may ease and cause gold prices to fall, holding the asset for the long term still offers hedging benefits.

This is especially meaningful in the context of escalating global trade tensions, risks from the US Federal Reserve's monetary policy and the risk of recession in many countries.

World gold prices fluctuate strongly (Photo: Reuters).

The bank also revised its forecast for gold demand from central banks to 50 tonnes per month, significantly higher than its previous forecast of 41 tonnes per month.

If central banks average 70 tonnes per month of purchases, gold could hit $3,200 an ounce by the end of 2025, assuming investment positions return to normal. Conversely, if the Fed keeps rates unchanged, Goldman Sachs forecasts gold to hit $3,060 an ounce over the same period.

Last week, Citi Research raised its gold price forecast for the next three months, from $2,800 to $3,000 an ounce.

Gold has seen unprecedented market volatility and will peak in 2024, according to UBS Bank expert Joni Teves. However, the growth trend may not stop this year.

This expert believes that the gold market is shaping an optimistic investment sentiment as this precious metal is seen as a safe haven asset in the context of economic and political instability.

“After missing out on many opportunities to buy gold in 2024, investors may not want to repeat this mistake and tend to take advantage of quicker price corrections,” she said in the report.

Source: https://dantri.com.vn/kinh-doanh/gia-vang-the-gioi-tang-khong-ngung-sap-toi-se-ra-sao-20250218202624400.htm

![[Photo] National Assembly Chairman Tran Thanh Man attends the Policy Forum on Science, Technology, Innovation and Digital Transformation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/c0aec4d2b3ee45adb4c2a769796be1fd)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Podcast]. Kites and Childhood](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/a4697c2294a843f39084a21134c3feb0)

Comment (0)