DNVN - On the morning of March 18, the domestic gold ring price continued to increase strongly, reaching an all-time high of 97.5 million VND/tael in the selling direction.

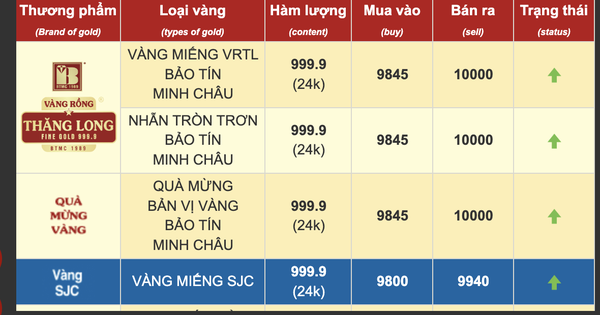

At 9:10 a.m., Bao Tin Minh Chau Company announced the price of gold bars and gold rings at 95.9 - 97.5 million VND/tael (buy - sell), an increase of 700 thousand VND/tael compared to the previous trading session.

DOJI Gold and Gemstone Group and Saigon Jewelry Company (SJC) listed the price of gold bars at 95.4 - 96.9 million VND/tael (buy - sell), with an increase of 600 thousand VND/tael for buying and 800 thousand VND/tael for selling compared to yesterday's trading session.

The price of gold rings announced by Saigon Jewelry Company (SJC) this morning fluctuated at 95.3 - 96.8 million VND/tael (buy - sell), recording an increase of 600 thousand VND/tael in buying and 800 thousand VND/tael in selling compared to the previous session's close.

In the international market, gold prices tended to increase in the trading session on March 17, fluctuating near 3,000 USD/ounce, in the context of investors closely monitoring tariff policies and the policy meeting of the US Federal Reserve (Fed).

At 0:30 a.m. on March 18, Vietnam time, spot gold price increased by 0.5%, reaching 2,998.14 USD/ounce, while gold futures price closed the session with an increase of 0.2%, reaching 3,006.10 USD/ounce.

The Fed will release new economic forecasts this week, providing a clearer view of officials’ views on the impact of President Donald Trump’s policies. US Treasury Secretary Scott Bessent said on March 16 that “there is no guarantee” that a recession in the US can be avoided.

High Ridge Futures metals trading director David Meger said gold prices could correct in the coming time, as the market remains in a "waiting" state for a decision from the Fed.

Investors expect the Fed to keep interest rates unchanged on March 19, with the next cut likely in June. Gold, a non-yielding asset, is seen as a safe haven during economic uncertainty and tends to rise when interest rates are low.

The latest report showed that U.S. retail sales rebounded less than expected in February, reflecting slowing economic growth despite the impact of import tariffs and federal layoffs. Experts at Heraeus Metals said that if economic indicators continue to decline and global trade tensions escalate, gold prices will continue to benefit.

Cao Thong (t/h)

Source: https://doanhnghiepvn.vn/kinh-te/gia-vang-ngay-18-3-2025-vang-nhan-xac-lap-muc-cao-ky-luc-97-5-trieu-dong-luong/20250318093943902

Comment (0)