Mark Leibovit, publisher of VR Metals/Resource Letter, said there is no reason to doubt that precious metals could rise this week.

Michael Moor, founder of Moor Analytics, sees further upside potential if gold can hold above $2,500 an ounce. Kitco senior analyst Jim Wyckoff shares the view, seeing the technical picture favoring further gains this week.

"Gold prices are going higher because the chart is bullish," said Jim Wyckoff.

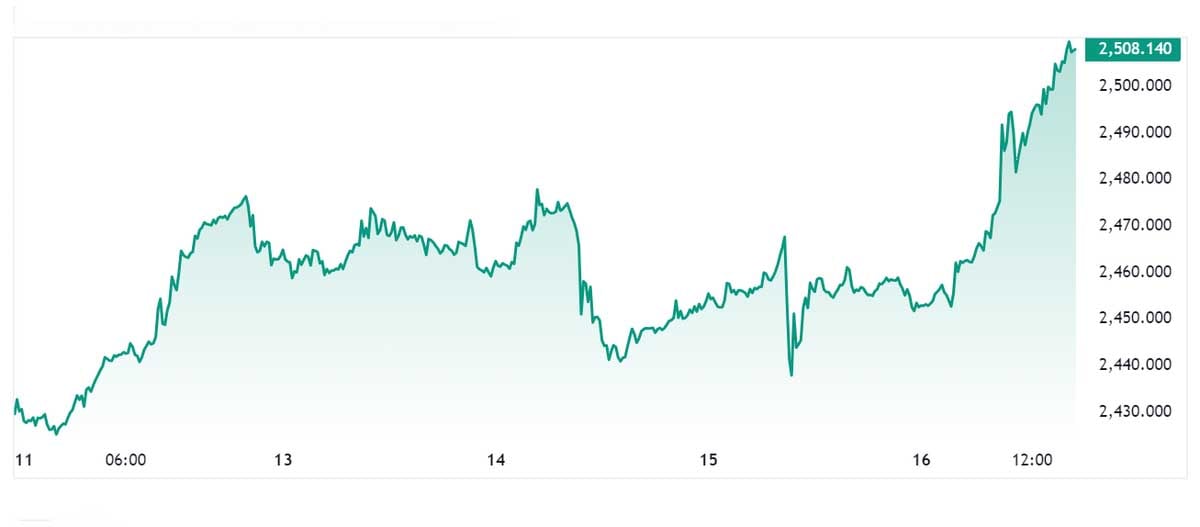

Gold has been on a steady rise since October last year, according to Phil Carr, head of trading at The Gold & Silver Club. From just under $1,800 an ounce, the precious metal has skyrocketed and hit record highs multiple times this year, posting a 38% gain since October.

Carr noted that the strong breakout of gold is closely related to the government debt in the US. He cited that during the period when the US national debt skyrocketed from 5,000 billion to 35,000 billion USD, the price of gold increased 8-fold since 2000.

“This is where things really start to get interesting. If history repeats itself, gold could hit $5,000 an ounce as the U.S. national debt hits $70 trillion,” he said.

RJO Futures senior commodities broker Bob Haberkorn said that the world gold price will reach the $ 2,600 / ounce mark when the US Federal Reserve (FED) cuts interest rates. However, in the short term, the price of this precious metal will go sideways or decrease.

According to Haberkorn, the market may have anticipated the Fed's 50 basis point cut too early. He said the US central bank may not rush to cut at the upcoming meeting because although inflation has fallen a bit, it is still higher than the Fed's target level.

Haberkorn asserted that the gold market is in an uptrend. However, the $2,500/ounce level that was just broken is a high level and it is difficult to attract new buyers to the market at such high levels.

Sharing the same view, Anuj Gupta - Head of Commodities and Currencies at HDFC Securities, said that the upward trend of gold prices is still in place and the direction of the precious metal will depend on the policy direction of the FED. He said that the speech of FED Chairman Jerome Powell at the Jackson Hole Symposium next week will show a clearer picture of the policy path of the US Central Bank.

Accordingly, if Mr. Powell appears concerned about economic growth or emphasizes falling inflation, this could strengthen the case for a more aggressive rate cut. Conversely, if he is optimistic and does not make a specific commitment, the market may have to adjust current expectations.

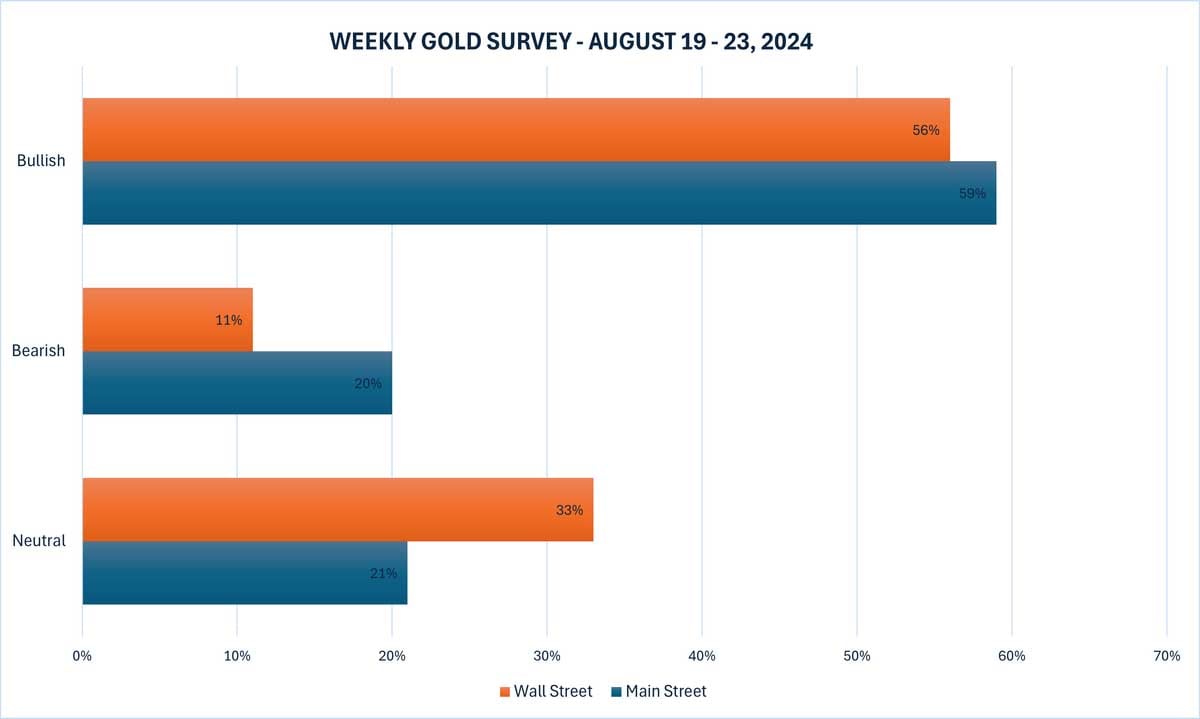

The latest Kitco News weekly gold survey shows that a majority of industry experts and investors believe gold prices could surpass this week’s all-time high.

Nine analysts took part in the Kitco News Gold Survey, with the majority still seeing upside potential beyond all-time highs.

Five experts expect gold prices to rise, while three analysts see it moving sideways this week. Only one predicts the price of the precious metal will fall.

219 votes were cast in Kitco’s online poll. 130 traders expect gold prices to rise this week. Another 44 expect the precious metal to fall. Meanwhile, 45 respondents said prices are likely to trend sideways this week.

Source: https://laodong.vn/tien-te-dau-tu/gia-vang-huong-toi-muc-cao-nhat-moi-thoi-dai-1381586.ldo

Comment (0)