Gold price today November 12, 2024, Gold price decreased for the second consecutive session, affected by the market after Mr. Donald Trump won the US presidential election. Russia's gold reserve ratio is at a record high in 25 years. Domestic gold price is on the decline.

| 1. PNJ - Updated: 11/11/2024 23:30 - Time of website supply - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 83,100 ▼300K | 84,900 ▼300K |

| HCMC - SJC | 81,900 ▼100K | 85,400 ▼400K |

| Hanoi - PNJ | 83,100 ▼300K | 84,900 ▼300K |

| Hanoi - SJC | 81,900 ▼100K | 85,400 ▼400K |

| Da Nang - PNJ | 83,100 ▼300K | 84,900 ▼300K |

| Da Nang - SJC | 81,900 ▼100K | 85,400 ▼400K |

| Western Region - PNJ | 83,100 ▼300K | 84,900 ▼300K |

| Western Region - SJC | 81,900 ▼100K | 85,400 ▼400K |

| Jewelry gold price - PNJ | 83,100 ▼300K | 84,900 ▼300K |

| Jewelry gold price - SJC | 81,900 ▼100K | 85,400 ▼400K |

| Jewelry gold price - Southeast | PNJ | 83,100 ▼300K |

| Jewelry gold price - SJC | 81,900 ▼100K | 85,400 ▼400K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 83,100 ▼300K |

| Jewelry gold price - Jewelry gold 999.9 | 83,000 ▼300K | 83,800 ▼300K |

| Jewelry gold price - Jewelry gold 999 | 82,920 ▼300K | 83,720 ▼300K |

| Jewelry gold price - Jewelry gold 99 | 82,060 ▼300K | 83,060 ▼300K |

| Jewelry gold price - 916 gold (22K) | 76,360 ▼280K | 76,860 ▼280K |

| Jewelry gold price - 750 gold (18K) | 61,600 ▼230K | 63,000 ▼230K |

| Jewelry gold price - 680 gold (16.3K) | 55,730 ▼210K | 57,130 ▼210K |

| Jewelry gold price - 650 gold (15.6K) | 53,220 ▼200K | 54,620 ▼200K |

| Jewelry gold price - 610 gold (14.6K) | 49,870 ▼180K | 51,270 ▼180K |

| Jewelry gold price - 585 gold (14K) | 47,770 ▼180K | 49,170 ▼180K |

| Jewelry gold price - 416 gold (10K) | 33,610 ▼130K | 35,010 ▼130K |

| Jewelry gold price - 375 gold (9K) | 30,180 ▼110K | 31,580 ▼110K |

| Jewelry gold price - 333 gold (8K) | 26,400 ▼100K | 27,800 ▼100K |

Update gold price today 11/12/2024

Domestic gold price decreased on the morning of November 11

Opening the trading session, Saigon Jewelry Company (SJC) announced the price of SJC gold bars at 82 - 85.5 million VND/tael (buy - sell), keeping the listed price for buying and decreasing 1 million VND/tael for selling compared to the previous session's closing price.

DOJI Gold and Gemstone Group announced the selling price of SJC gold bars at 82 - 85.8 million VND/tael (buy - sell), keeping the listed price in both buying and selling directions unchanged compared to the previous session's closing price.

Similarly, the price of gold rings also decreased. Saigon Jewelry Company SJC announced the price of gold rings at 82 - 84.5 million VND/tael (buy - sell), keeping the listed price for buying and decreasing 300 thousand VND/tael for selling compared to the previous session's closing price.

|

| Gold price today November 12, 2024: Gold price decreased, reacting to the 'red wave' after the US election, domestic trend was favorable, Russia continued to accumulate. (Source: Reuters) |

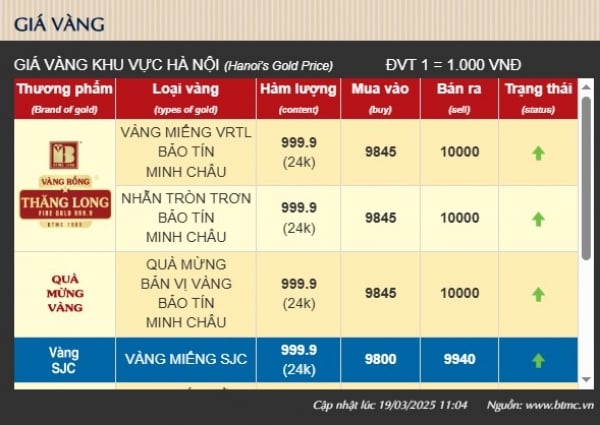

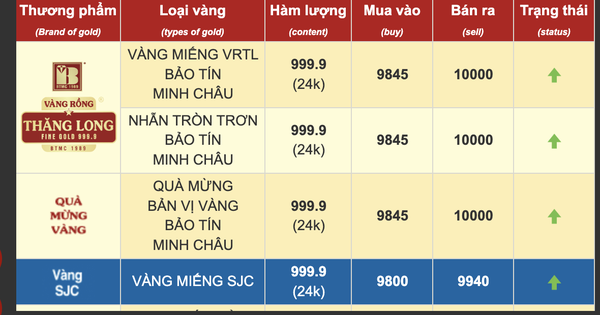

Summary of gold prices at major domestic trading brands at closing times of trading session on the afternoon of November 12:

Saigon Jewelry Company SJC: SJC gold bars 81.9 - 85.4 million VND/tael; SJC gold rings 81.8 - 84.3 million VND/tael.

Doji Group: SJC gold bars 81.9 - 85.4 million VND/tael; 9999 round rings (Hung Thinh Vuong) 83.15 - 84.95 million VND/tael.

PNJ system: SJC gold bars 81.9 - 85.4 million VND/tael; PNJ 999.9 plain gold rings: 83.1 - 84.9 million VND/tael.

Phu Quy Gold and Silver Group: SJC gold bars 82.1 - 85.4 million VND/tael; Phu Quy 999.9 round gold rings: 83.1 - 84.9 million VND/tael.

The price of SJC gold at Bao Tin Minh Chau is listed at 82.1 - 85.4 million VND/tael. The price of round gold rings at Vang Rong Thang Long is listed at 83.08 - 84.93 million VND/tael.

Thus, compared to the morning session of November 11, the afternoon session of the same day, the price of gold bars and gold rings at businesses tended to decrease, in which, Saigon Jewelry Group (SJC) listed the price of gold rings down 200 thousand VND/tael in both buying and selling directions; while the price of gold bars decreased 100 thousand VND/tael in both directions.

According to the World & Vietnam Newspaper , information on Kitco News , as of 6:45 p.m. Vietnam time on November 11, the world gold price was listed at 2,665.50 USD/ounce, down 19.2 USD/ounce compared to the previous trading session.

Converted according to USD price at Vietcombank on November 11, 1 USD = 25,476 VND, world gold price is equivalent to 81.81 million VND/tael.

World gold price falls due to USD increase

Gold prices fell for a second straight session on Monday (November 11), weighed down by a stronger US dollar and rising risk appetite, as markets expect the US Federal Reserve (Fed) to adopt a cautious approach under the administration of President-elect Donald Trump.

Spot gold fell 0.8% to $2,662.59 an ounce as of 1112 GMT. US gold futures fell 0.9% to $2,669.40 an ounce.

“Gold prices fell mainly due to a stronger US dollar, rising Treasury yields and increased risk appetite in financial markets – a trend that has accelerated since Donald Trump’s victory in the US presidential election last week,” said Ricardo Evangelista , senior analyst at ActivTrades.

The dollar index rose 0.3% after posting a weekly gain last week, making gold less attractive to holders of other currencies, while the S&P 500 closed on Friday with its biggest weekly gain in a year.

Meanwhile, gold posted its worst week in more than five months as Mr Trump's victory raised the prospect of higher tariffs, which could push interest rates higher.

“Trump’s election as US president-elect has directly led to some rate cut expectations in 2025, with a potential ‘red wave’ meaning less resistance to his tax cuts and spending plans, coupled with his stance on more tariffs,” said IG market strategist Yeap Jun Rong.

“Overall, this could complicate the Fed’s fight against inflation and we can expect the bank to be more cautious in its upcoming easing. This suggests upward pressure on yields and a stronger US dollar, which could limit gold prices,” the analyst said.

Traders now see a 65% chance the Fed will cut rates by 25 basis points in December, compared with about 83% before Mr Trump's victory, according to CME's Fedwatch tool.

Several Fed officials, including Chairman Jerome Powell, are scheduled to speak this week. US consumer price and producer price data, weekly jobless claims and retail sales figures are also due this week.

In the afternoon trading session on November 11, gold prices in the Asian market also decreased, marking the second consecutive decline.

Gold is often seen as a safe haven against political risks, but some investors may sell gold in the short term if the election ends more quickly than expected, said Yeap Jun Rong, an expert at IG Financial. In addition, the rise of the US dollar also puts pressure on gold prices.

The dollar index continued to rise in this session after rising 0.6% last week, mainly against the euro. The stronger dollar makes gold less attractive to holders of other currencies.

Investors may be anticipating the Fed's cautiousness in cutting interest rates in the near future, Yeap said.

Russia's gold reserves hit historic milestone

Russia's gold reserves exceeded $200 billion for the first time in history, the share of gold in the country's international reserves is now at 32.9%.

According to the Central Bank of Russia, the country's gold reserves hit a record $207.7 billion in October. The achievement comes after the Russian Finance Ministry's recent announcement to increase daily currency and gold purchases by 35.5%.

The increase in gold holdings pushed the share of the precious metal in Russia's international reserves to 32.9%, up from 31.5% in September. This is the highest share of gold in the country's reserves since November 1999, when it stood at 34%.

The current gold allocation represents a significant change from June 2007, when gold accounted for just 2.1% of reserves – the lowest level in Russia’s modern history. However, it is still below the all-time high of 56.9% recorded on January 1, 1993.

The gold reserve build-up fits into Russia’s broader financial strategy. The Finance Ministry said earlier it would increase daily purchases of currency and gold to 4.2 billion rubles to shore up the country’s financial position.

Source: https://baoquocte.vn/gia-vang-hom-nay-12112024-gia-vang-giam-phan-ung-voi-lan-song-do-hau-bau-cu-my-nga-khong-ngung-tich-tru-trong-nuoc-thuan-chieu-293359.html

Comment (0)