Should only have a maximum of 20% gold in total assets

In recent years, many Vietnamese people tend to buy gold on God of Wealth Day with the hope of having a lot of money in the year, praying for wealth and good luck. In terms of finance, the market today sells many different types of gold and gold products to serve people's shopping needs on God of Wealth Day. Therefore, depending on the needs of use as well as economic conditions, each person should choose to buy the appropriate type of gold.

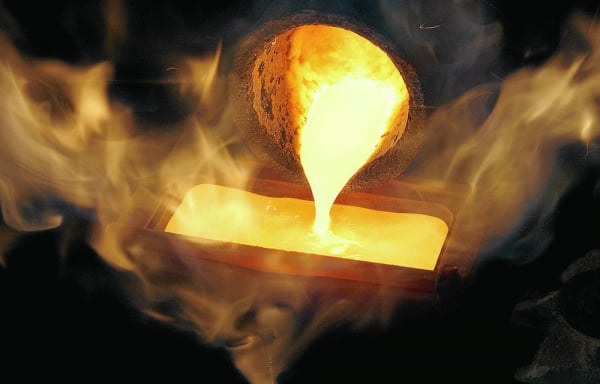

Talking to Lao Dong, Mr. Ta Thanh Tung - a personal financial planning expert at FIDT JSC - said that people can access the following two popular types of physical gold: gold bars (from licensed sources such as SJC, PNJ, DOJI...) and more commonly, gold rings (cast into ring shape and provided by gold shops).

"To invest in any type of gold, you must first understand the characteristics of each type. In terms of liquidity, these two products are almost the same. In terms of quality, gold bars are much better. However, this is also the reason why gold bars are more expensive than gold rings. But this huge and somewhat unreasonable difference makes accumulating gold rings in the long term much better because it is closer to the international gold price," said Mr. Tung.

According to Mr. Tung, people need to confirm that gold is a defensive asset class and portfolio diversification, so we should have it but not too much, the minimum can be 5% and the maximum, according to asset management experience for individual investors, 20% is appropriate.

Because in the long term, real estate still gives much more potential profit performance. Not to mention that in the Vietnamese market, stocks and bonds are also increasingly popular, especially for the younger generation from 8x onwards thanks to the profit performance that is also somewhat better than gold in some investment strategies.

The expert emphasized: "You should only accumulate a lot when the price drops especially sharply. If the gold price suddenly increases by 15% or more, selling and waiting to buy back is highly recommended. The history and characteristics of gold have proven and guaranteed this trend."

Gold prices have a big difference in buying and selling near the God of Wealth's day.

According to the latest update, the difference between buying and selling prices of domestic gold is higher than last year, unintentionally pushing risks to investors. However, many gold and gemstone shops in Hanoi are still crowded with customers coming to trade.

Currently, the gold price listed by Bao Tin Minh Chau is 76.35 million VND/tael for buying; 78.25 million VND/tael for selling. The difference between the buying and selling price of SJC gold is 1.9 million VND/tael.

Compared to the opening of the previous trading session, the gold price at Bao Tin Minh Chau decreased by 600,000 VND/tael for buying and decreased by 700,000 VND/tael for selling.

Meanwhile, DOJI Group listed the buying price at 76.1 million VND/tael; the selling price at 78.6 million VND/tael. The difference between the buying and selling price of SJC gold at DOJI is up to 2.5 million VND/tael.

Compared to the opening session on February 16, the gold price at DOJI Group decreased by 650,000 VND/tael for buying and 300,000 VND/tael for selling.

Source

Comment (0)