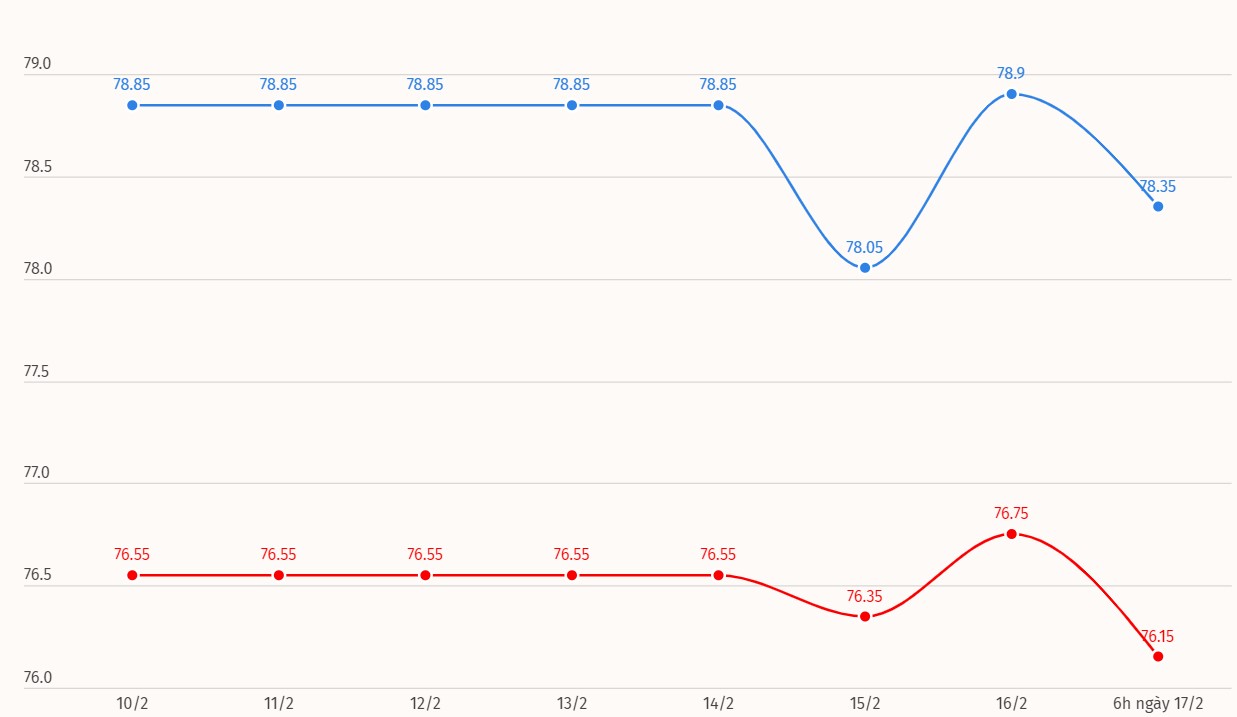

Domestic gold price

Every year, the difference between buying and selling gold is around 700,000 VND/tael. On the day of God of Wealth (the 10th day of the first lunar month), this difference is pushed up to around 1-1.5 million VND/tael. However, just a few sessions later, the gold price quickly cooled down, and the difference between buying and selling also decreased rapidly.

This year, the difference has been pushed up very high. Despite the large difference, many gold and gemstone shops in Hanoi are crowded with customers.

Sharing about buying gold on God of Wealth day, economic expert Nguyen Tri Hieu said: "Many people believe that if they buy gold on God of Wealth day, they will be supported and bring luck. In this case, they can buy. However, in my opinion, this is just a superstitious concept that has appeared recently. Therefore, if you decide to buy gold for investment, as a dowry... then you should not buy on God of Wealth day because buying on this day is very risky.

From an economic perspective, buying gold before and on God of Wealth Day will bring disadvantages to investors. Instead of choosing to buy gold on a day with very high prices like God of Wealth Day, buyers should choose a later time, when gold prices plummet, to catch the bottom.

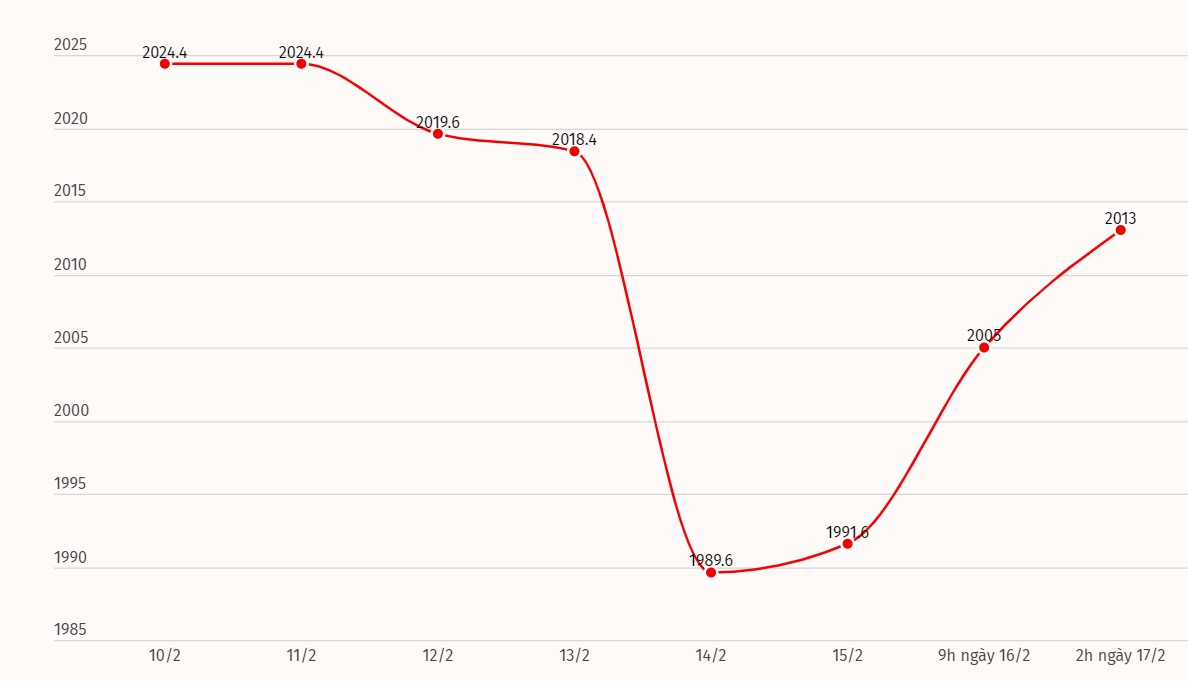

World gold price

Gold Price Forecast

Gold prices rose sharply amid a decline in the US dollar. At 2 a.m. on February 17, the US Dollar Index, which measures the greenback's movements against six major currencies, stood at 104.085 points (down 0.11%).

Gold prices rose after the U.S. Labor Department said Friday that its producer price index (CPI) rose 0.3% last month after rising 0.1% in December. The latest inflation data was hotter than expected as economists were expecting a 0.1% increase. Core inflation was significantly hotter than expected as the consensus forecast showed a 0.1% increase.

The gold market is now seeing some renewed selling pressure in an initial reaction to the latest inflation data. Economists pay close attention to producer prices as they are considered a leading indicator. Rising wholesale prices mean companies will be pressured to pass on higher costs to their customers.

Rising inflation fears sparked by the latest PPI data are prompting investors to push back the timing of a Federal Reserve rate cut. A March rate cut has yet to materialize and the market sees a less than 30% chance of a May rate cut. However, expectations for a June cut remain.

Persistent inflation, which will force the Fed to maintain a higher ceiling on longer-term monetary policy, will continue to weigh on gold, analysts said. However, analysts do not expect to see major selling pressure as central bank demand helps support the market.

Source

Comment (0)