Although it satisfies the P/E criteria according to the new index rules, SSI Research believes that MWG shares do not satisfy the conditions on foreign investor ownership ratio (FOL), so they will not be included in the VNDiamond portfolio in the fourth quarter.

|

| Vincom Retail shares are at risk of being removed from the VNDiamond basket at the April 2025 restructuring period. |

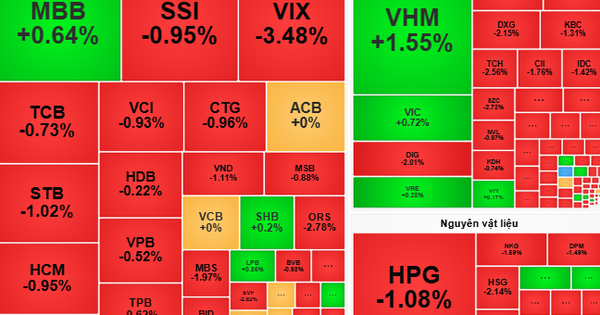

SSI Securities Corporation (SSI Research) recently released a report forecasting changes to the VNDiamond Index portfolio in the fourth quarter of 2024. According to SSI Research, the Ho Chi Minh City Stock Exchange (HoSE) has issued the VNDiamond Index rule version 3.0 to replace version 2.1, effective from the October 2024 review period. ETFs will restructure their portfolios in the fourth quarter of 2024 according to the new rules and are expected to complete the portfolio restructuring on November 1.

Accordingly, the new index rules are changed to tighten the liquidity conditions of stocks, while loosening the conditions on the foreign investor holding ratio (FOL) to ensure the number of stocks eligible for the index. In addition, the new rules also amend the P/E filtering conditions (the coefficient reflecting the relationship between stock price and net income per share (EPS), add rules to determine the official stock basket, and add the wS parameter to limit fluctuations in the index.

With provisional data as of September 5, SSI Research forecasts that the VNDiamond Index portfolio will not change its composition this period, with 18 stocks including 10 banking stocks and 8 non-bank stocks.

In addition, there are some notable points raised by SSI Research that VRE has a FOL falling below 65% and is not eligible to retain the index. According to the new rules, VRE is put into the pending elimination group and applied a wS coefficient of 50%, equivalent to a 50% reduction in the stock weight.

In the next period, if FOL cannot be improved to above 65%, VRE may be completely removed from the index. Since VRE is still retained in the index in this period, the number of non-Bank stocks is still enough 8 stocks, so there is no need to select new stocks to replace.

Regarding MWG, SSI Research said that this stock has satisfied the P/E criteria according to the new index rules (

In addition, NLG, KDH, VPB and BMP are forecast to increase their weights due to the adjustment of the wFOL coefficient scale. Meanwhile, the remaining stocks will have their weights reduced to balance the portfolio.

Among the ETFs on the market, there are currently 5 ETFs using the VNDiamond index as a reference, including DCVFMVN Diamond, MAFM VNDiamond, BVFVN Diamond, KIM Growth Diamond and ABF VNDiamond with a total net asset value of about VND 12,600 billion as of September 5, 2024. The DCVFMVN Diamond fund alone currently has a total asset value of about VND 12,100 billion.

SSI Research has also estimated the index portfolio weight and transactions of the DCVFMVN Diamond fund, in which VPB is expected to buy 9.9 million shares. KDH and NLG are expected to buy 8.4 million shares and 6.6 million shares, respectively. On the other hand, VRE is forecasted to be able to sell 8.9 million shares, OCB can also be sold 3.4 million shares.

Source: https://baodautu.vn/du-bao-thay-doi-danh-muc-vndiamond-index-ky-quy-iv2024-d224897.html

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)