The portfolio restructuring of two foreign ETFs will be completed on March 21.

Portfolio structure in the first quarter of 2025: Two foreign funds may buy a large amount of VJC shares

The portfolio restructuring of two foreign ETFs will be completed on March 21.

On March 7, 2025, FTSE will announce the list of stocks that will be part of the FTSE Vietnam All-share and FTSE Vietnam Index indexes.

Next, as planned, on March 14, 2025, MarketVector will announce the Marketvector Vietnam Local Index portfolio. Forecasting the FTSE Vietnam Index and Marketvector Vietnam Local Index portfolios, analysts from BIDV Securities (BSC) believe that there will be 2 new stocks added to the MarketVector Vietnam Local Index portfolio that is being referenced by the VanEck Vectors Vietnam ETF fund.

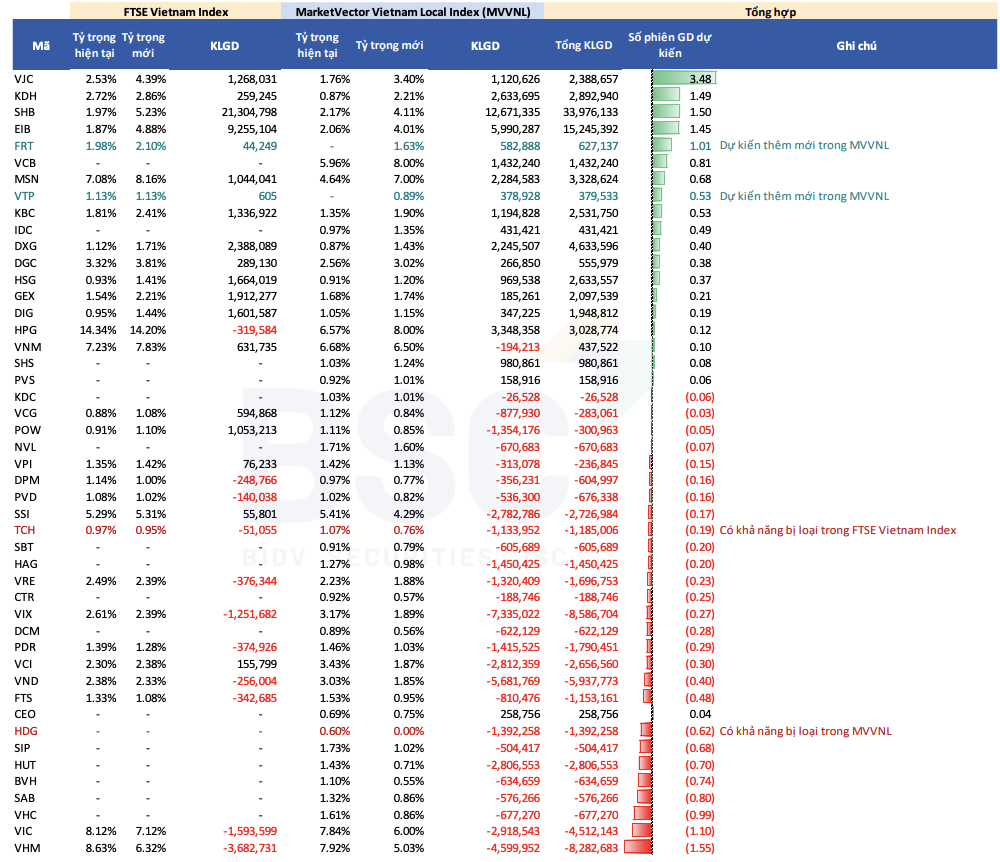

Specifically, in the first portfolio reversal in 2025, according to BSC's calculations, shares of FPT Retail (FRT ), Viettel Post (VTP) may be added to the MarketVector Vietnam Local Index because they satisfy the criteria of the index basket. Meanwhile, shares of HDG of Ha Do Group may be removed because they are at the threshold of 98% of the index basket's capitalization.

For the FTSE Vietnam Index portfolio being referenced by the FTSE ETF, BSC forecasts no new additions while excluding TCH shares of Hoang Huy Financial Services Investment Joint Stock Company because they do not satisfy the investable capitalization criteria of the FTSE Vietnam Index according to BSC's calculations.

March 21, 2025 is expected to be the date to complete the restructuring of the entire portfolio of the above foreign ETFs. Although there may be errors due to the date of application of data, free-float ratio, investment weight, BSC's calculations show that the two new stocks can be purchased with more than 627,000 FRT shares and more than 379,000 VTP shares.

|

| Forecast of trading volume of two foreign ETFs in the portfolio restructuring period in early 2025. |

The stock with the largest expected purchase volume is VJC. Vietjet Air's shares may be purchased by an additional 1.12 million units, thereby increasing the proportion from 2.53% to 4.39%. On the other hand, two Vin stocks, VIC (Vingroup) and VHM (Vinhomes), are expected to be sold by two foreign funds, 4.5 million units and 8.28 million units, respectively.

Source: https://baodautu.vn/co-cau-danh-muc-quy-i2025-hai-quy-ngoai-co-the-mua-luong-lon-co-phieu-vjc-d250532.html

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)