While making transactions and payments, sometimes we will discover that the money we use in circulation is torn or damaged. The cause may come from objective or subjective factors. The law has regulations on the case of exchanging torn or damaged money. These regulations are shown in Circular No. 25/2013/TT-NHNN.

According to Article 3, Circular 25/2013/TT-NHNN, money that does not meet the standards for circulation is paper money (cotton money and polymer money), metal money issued by the State Bank, in circulation but is torn, damaged or deformed according to the regulations on standards for money that does not meet the standards for circulation as prescribed in this Circular.

The State Bank publishes typical samples of money that do not meet circulation standards as a basis for collecting, exchanging, selecting and classifying money.

Standards for money not eligible for circulation (according to Article 4, Circular 25/2013/TT-NHNN):

-First, money is torn or damaged due to the circulation process (objective causes): Paper money has changed color, faded images, patterns, letters, numbers; is wrinkled, torn, smudged, dirty, old; torn or intact pieces are glued together but the money is still intact; Metal money is worn, rusted, damaged in part or in whole, the images, patterns, letters, numbers and plating on the money are damaged.

- For torn or damaged money due to storage (subjective causes): Paper money with holes or torn parts; money that is pasted; burned or deformed due to contact with high heat sources; printing paper, color, security specifications of money are changed due to the impact of chemicals (such as detergents, acids, corrosive substances, etc.); writing, drawing, erasing; money that is rotten or deformed for other reasons but not due to acts of destruction. Metal money that is bent, warped, has changed format, design image due to the impact of external forces or high temperatures; or is corroded due to contact with chemicals is also not eligible for circulation.

-Money has technical errors due to the printing and minting process of the manufacturer such as folded printing paper causing loss of image or color, dirty printing ink and other errors in the printing and minting process.

The exchange of money that does not meet circulation standards is regulated in Article 6 of Circular 25/2013/TT-NHNN, specifically:

For torn or damaged money due to circulation and money with technical errors... the State Bank branches, State Bank Transaction Offices, and exchange units are responsible for collecting and exchanging money immediately for customers in need, without quantity restrictions and without requiring paperwork.

For torn or damaged money due to storage, customers must submit the physical items to the State Bank branches, State Bank Transaction Offices, or exchange units. Units will accept and consider exchange according to the following conditions:

- Torn or damaged money not caused by acts of destruction;

- In case a banknote is burned, punctured, or torn, the remaining area must be equal to or larger than 60% of the area of the same type of banknote; if it is pasted, it must have a minimum area of 90% of the area of the same type of banknote and ensure the original, original layout of a banknote (front, back; top, bottom; right, left), and at the same time identify the security elements;

For polymer money that is burned or deformed and shrunk due to exposure to high heat, the remaining area must be at least 30% of the area of the same type of banknote and still retain the original layout of a banknote, and at least two of the following security elements must be identifiable: hidden image element in a small window, fluorescent colorless ink, fluorescent serial number, security thread, IRIODIN element, portrait of President Ho Chi Minh.

Based on the above mentioned conditions for exchange, the State Bank branch, the State Bank Transaction Office, and the exchange unit will exchange for the customer. If the conditions for exchange are not met, the State Bank branch, the State Bank Transaction Office, and the exchange unit will return the money to the customer and notify the reason.

Thus, people can bring torn or damaged money to State Bank branches, State Bank Transaction Offices, or exchange units to exchange money completely free of charge.

Minh Hoa (t/h)

Source

![[Photo] Admiring orange cotton flowers on the first "Vietnam heritage tree" in Quang Binh](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7476a484f3394c328be4ac8f9c86278f)

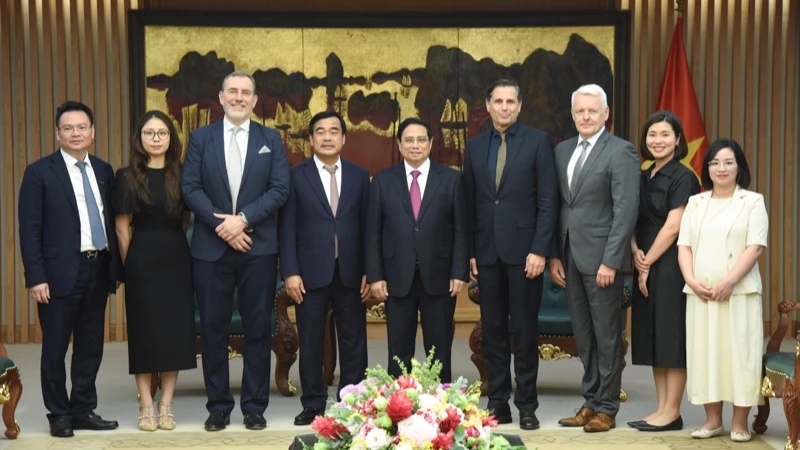

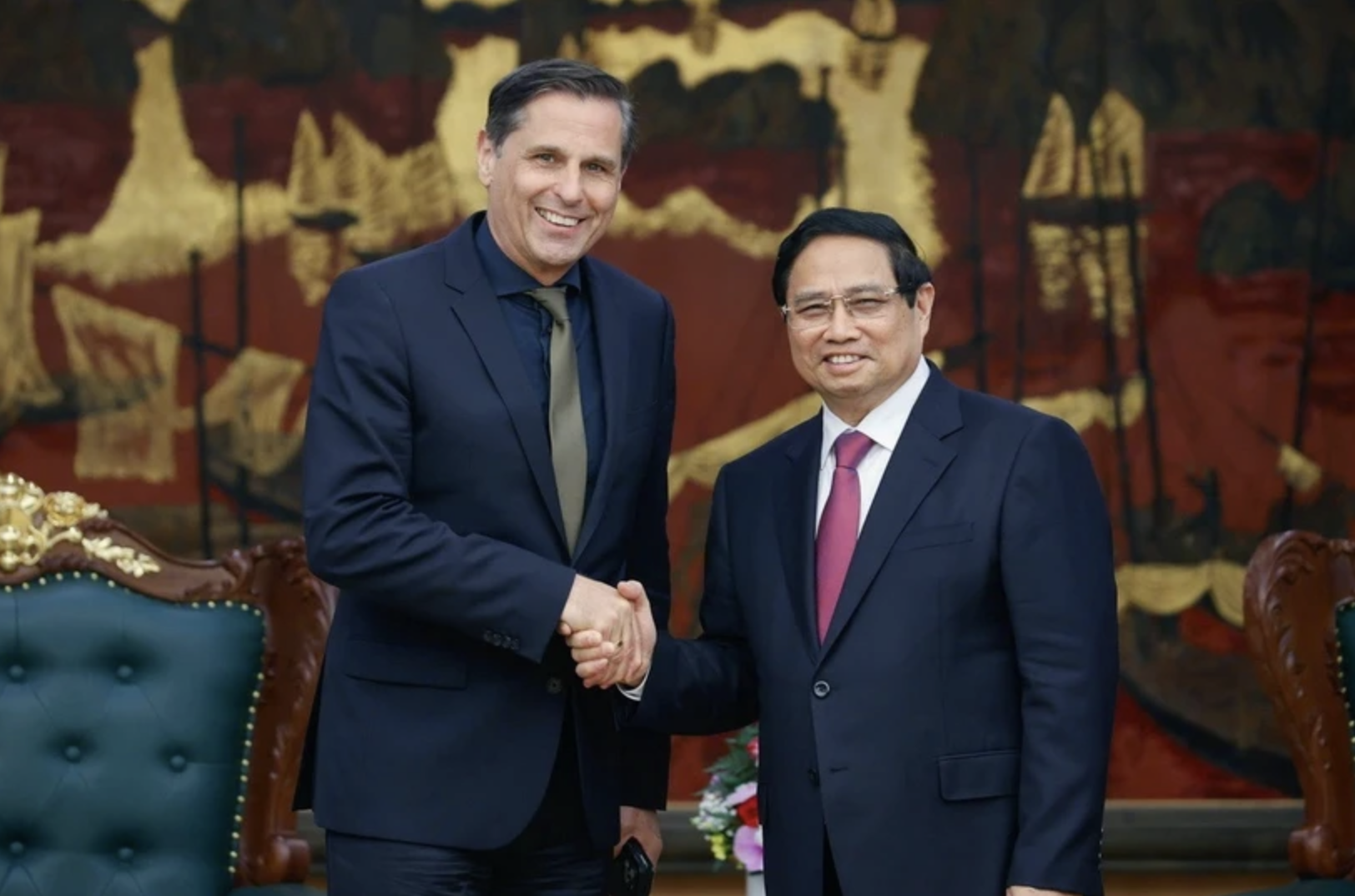

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

Comment (0)