Vietnam can absolutely find bright spots and opportunities to rise up. (Photo: Vietnam+)

Vietnam can absolutely find bright spots and opportunities to rise up. (Photo: Vietnam+)

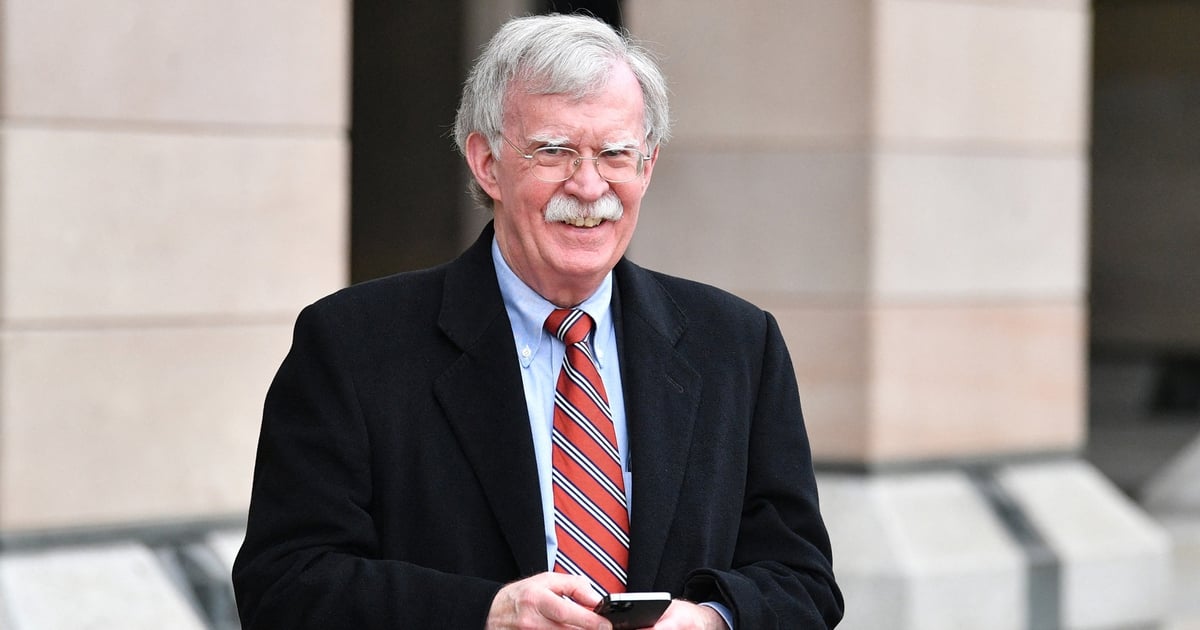

According to experts, Vietnam is facing a "crossroads" in the face of a volatile international economic reality with the rise of protectionism, especially the risk of a re-emergence of the US-China trade war under the administration of President Donald Trump.

Prepare for multiple scenarios

Accordingly, Mr. Thomas Nguyen, Director of Global Markets of SSI Securities Company, said that in the context of a volatile world, countries need to proactively adapt instead of passively responding. Vietnam is no exception, it also needs to prepare for many different scenarios.

Mr. Thomas Nguyen pointed out that Vietnam is likely to face potential risks. First is the issue of tariffs and inflation. Specifically, the US increasing import tariffs will put pressure on inflation in the US, affecting consumer demand and possibly disrupting the global supply chain. Next is the level of competition, in which Vietnam may face fiercer competition from other countries in exporting to the US.

Sharing the same view, Mr. Frank Kelly, Founder and Managing Partner at Fulcrum Macro Trading Platform, emphasized that President Trump's trade policy is not only a bilateral issue but also affects the global supply chain, where Vietnam plays an increasingly important role.

“In 2024, Vietnam's exports to the United States will reach 120 billion USD. Currently, the Trump administration has no specific policies or measures, but it does not rule out the possibility of negotiations with Vietnam regarding the goal of more balanced trade. This is not only between Vietnam and the United States, but also the possibility of exports from China through Vietnam, then to the United States,” Mr. Frank Kelly analyzed.

Looking at the risk from a financial perspective, Ms. Eva Huan Yi, Chief Economist at Huatai Securities (USA) commented that in the coming time, the VND/USD exchange rate may be under pressure due to the US monetary policy and fluctuations in the international financial market, affecting the competitiveness of export goods. Therefore, the State Bank needs to have a flexible and proactive exchange rate management policy to stabilize the macro economy.

In addition, the prices of imported goods may increase due to tariffs and may put pressure on domestic inflation. Therefore, the Government needs to control inflation and ensure price stability to protect people's purchasing power.

Vietnam can take advantage of free trade agreements to expand its export markets and reduce its dependence on a single market. (Photo: Vietnam+)

In danger there is opportunity

However, Mr. Thomas Nguyen emphasized that in every danger there is opportunity. Multinational companies can move production out of China to avoid tariffs and this creates an opportunity for Vietnam to attract investment and improve production capacity.

“Vietnam can join the ‘game’ with investors around the world. Last week, I read a survey from Japan showing that about 800 Japanese manufacturers and companies left China, of which about 200 companies have moved to Vietnam,” Mr. Thomas Nguyen shared.

According to Mr. Thomas, Vietnam has a lot of room for development and domestic production. Currently, foreign investors are seeing opportunities in Vietnam. This is a potential, an advantage for national development.

Vietnam can take advantage of free trade agreements to expand its export markets and reduce its dependence on a single market. In the new context, Vietnam can also affirm its role as an important production and export center in the region, attracting the attention of international investors.

Regarding the above comment, Ms. Eva Huan Yi added that China is likely to have adaptive reactions to the US trade policy, so Vietnam needs to proactively seize opportunities from these changes.

VND may be under pressure due to US monetary policy and fluctuations in the international financial market, while the State Bank needs to have a flexible and proactive exchange rate management policy to stabilize the macro economy. (Photo: Vietnam+)

VND may be under pressure due to US monetary policy and fluctuations in the international financial market, while the State Bank needs to have a flexible and proactive exchange rate management policy to stabilize the macro economy. (Photo: Vietnam+)

According to Ms. Eva Huan Yi, the fact that export turnover may increase due to the shift of production and demand from the US is a favorable factor for Vietnam. However, the Government also needs to be cautious about China avoiding taxes and competition from other countries. In the new context, Vietnam can attract more foreign direct investment (FDI) thanks to its attractive investment environment and strategic location, but it needs to improve infrastructure and human resources to meet the needs of investors.

To overcome challenges and take advantage of opportunities, Mr. Pham Luu Hung, Chief Economist at SSI Securities Company, recommended that Vietnam should focus on domestic growth drivers to cope with external fluctuations.

Mr. Hung commented that Vietnam's growth remains quite stable in a challenging global context, but more efforts are needed to achieve economic development goals.

He stressed the importance of improving the competitiveness of domestic enterprises, especially in the processing and manufacturing industries. In addition, Vietnam needs to focus on market development, including promoting domestic consumption./.

(Vietnam+)

Source: https://www.vietnamplus.vn/cuoc-chien-thue-quan-cua-my-co-hoi-va-rui-ro-voi-viet-nam-post1010936.vnp

Comment (0)