|

| The group of stocks of the top 7 technology corporations in the US includes Meta, Microsoft, Alphabet, Apple, Amazon, Nvidia and Tesla. (Source: Investopedia) |

Six of them saw their shares fall, with Tesla leading the way with a decline of up to 40%. Meta Platforms was the only exception, but its gain was small.

The move comes just two months after tech leaders flocked to Washington for President Donald Trump’s inauguration. Notably, many of the companies in the group peaked in value shortly after Trump won the election.

But macroeconomic uncertainty, recession fears and the impact of tariffs have triggered a wave of investor selling that has left most companies in dire straits. In early March, the super stocks lost more than $750 billion in market value in a single day, marking the Nasdaq Composite’s worst day since 2022.

Nvidia, despite its leadership in semiconductors and AI, has not escaped the market turmoil. The world’s largest maker of AI chips has lost 14% of its value in 2025. Once a $3 trillion company, Jensen Huang’s Nvidia has lost more than $767 billion in market value since January.

Alphabet, Google’s parent company and one of the world’s AI giants, has also suffered, falling more than 15%, losing about a fifth of its value in just a month. Microsoft is on an eight-week losing streak, its longest since February 2008.

Tesla has been the hardest hit, losing about $780 billion in market value since its peak in December 2024. CEO Elon Musk’s close relationship with President Trump hasn’t helped either, with Tesla’s stock now down for its ninth straight week.

Apple has lost nearly $700 billion in market value since December 2024. Amazon has not fared much better, suffering a seven-week losing streak, losing 18% of its value. Meta, meanwhile, has seen a slight gain but is still down about a fifth from its February 14 peak.

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia works with key political press agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/3020480dccf043828964e896c43fbc72)

![[Photo] Close-up of old apartment building waiting to be renovated](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/bb2001a1b6fe478a8085a5fa20ef4761)

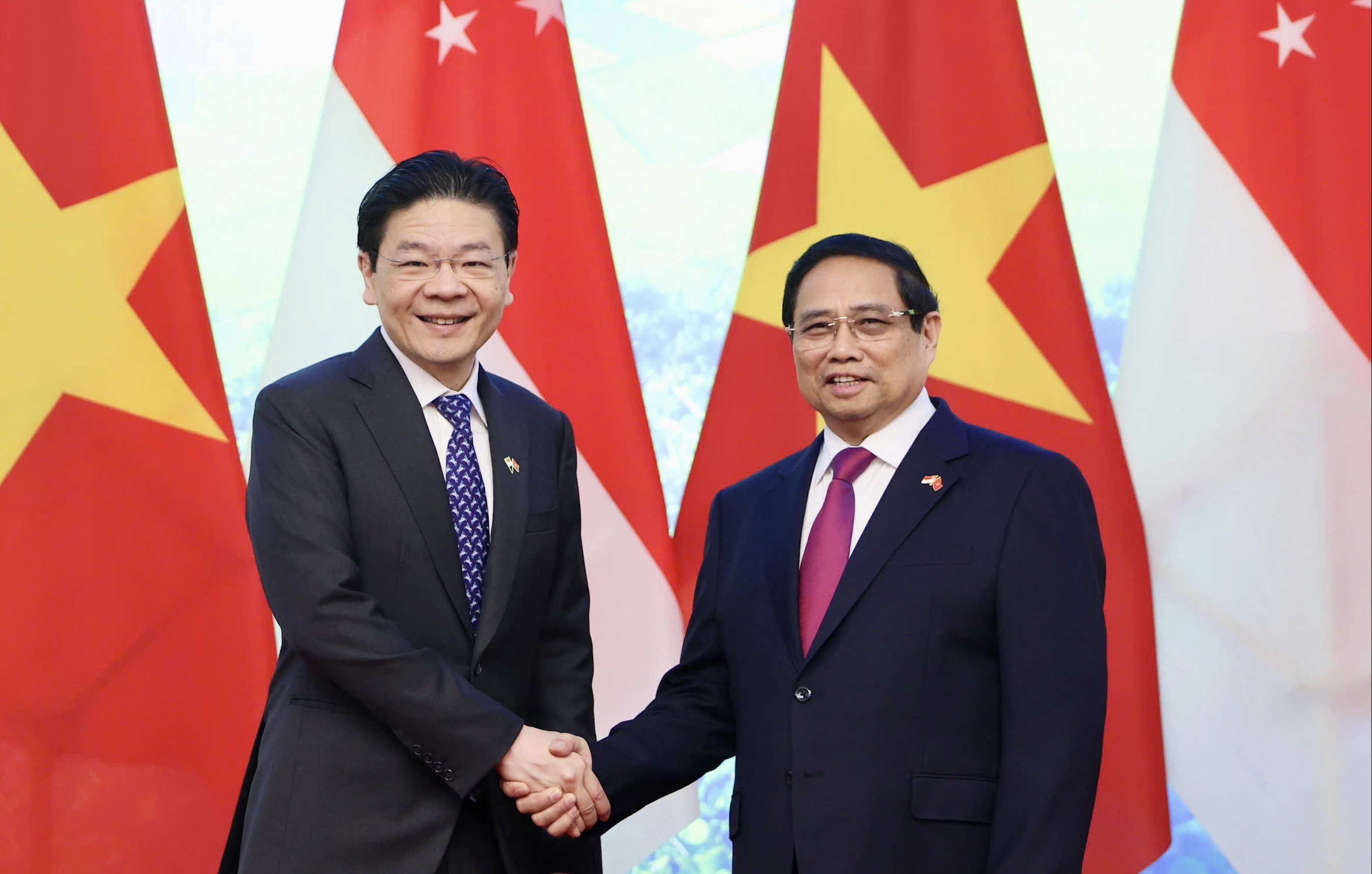

![[Photo] Prime Minister Pham Minh Chinh holds talks with Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/04f6369d4deb43cfa955bf4315d55658)

![[Photo] Welcoming ceremony for Prime Minister of the Republic of Singapore Lawrence Wong on an official visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/445d2e45d70047e6a32add912a5fde62)

Comment (0)