The liquidity of the stock market this morning (October 18) improved compared to previous sessions, reaching 330.97 million shares, equivalent to VND7,196.22 billion on HoSE. This figure on HNX was 17.21 million shares, equivalent to VND335.06 billion, and on UPCoM market was 18.14 million shares, equivalent to VND190.29 billion.

While VN-Index still increased slightly by 0.47 points, equivalent to 0.04%, to VND1,286.99 billion, HNX-Index adjusted by 0.12 points, equivalent to 0.05%, and UPCoM-Index adjusted slightly by 0.02 points, equivalent to 0.02%.

Market breadth was slightly tilted towards the gainers with 351 stocks increasing in price, 31 stocks hitting the ceiling compared to 300 stocks decreasing, 14 stocks hitting the floor. In general, the fluctuation range of stocks on the floor is still quite narrow, investors are still cautious in making buying and selling decisions.

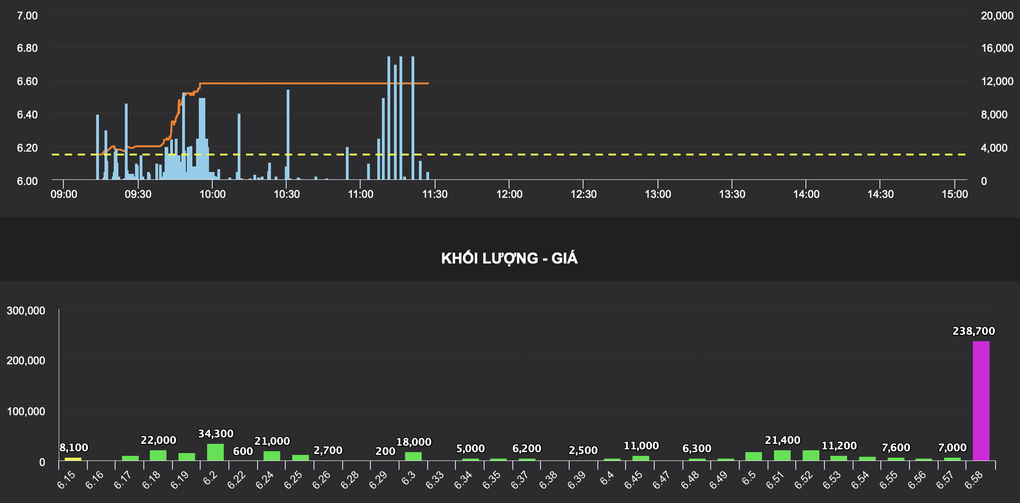

SMC stock price movements this morning (Chart: VDSC).

SMC shares this morning unexpectedly hit the ceiling price of 6,580 VND after a series of days of strong selling and price reduction. This morning, SMC had no remaining sell orders and had remaining buy orders at the ceiling price of 560,200 units. SMC's ceiling price increase comes in the context of the third quarter financial report announcement season of enterprises in a rather exciting period and it is unclear whether the stock price movement is an indicator of investors' expectations for the third quarter results or not.

Previously, SMC Investment and Trading Joint Stock Company had suffered consecutive losses in 2022-2023. By the end of 2023, the company had accumulated losses of nearly 169 billion VND.

The company incurred debts to a number of large enterprises in the real estate and construction sectors such as Novaland Group, Hung Thinh Incons or Hoa Binh Construction Group.

As of June 30, the company had short-term bad debts of more than VND1,288 billion for companies in the ecosystem of Novaland, Hung Thinh Incons and other entities. The company had to set aside nearly VND557 billion in provisions for these bad debts. The provisioning affected the company's profits.

Most banking stocks maintained their upward momentum this morning and provided significant support to the index. SSN, EIB, VIB increased by more than 1%; HDB, STB, SHB, OCB, TCB, NAB, BID, LPB, VCB increased slightly. Some stocks adjusted such as TPB, CTG, MBB, ACB, MSB, VPB but the decrease was not large.

After yesterday's soaring session, many real estate stocks have adjusted this morning. LDG decreased by 2.1%; SCR decreased by 1.6%; HPX decreased by 1.5%; DIG decreased by 1.4%; HDC decreased by 1.3%; TCH decreased by 1.2%; DXS decreased by 1.2%.

However, on the contrary, there are still stocks that maintain a positive growth status such as SZC up 3.5%; QCG also increased by 1%. TLD, CRE, SGR, VIC, BCM, KBC, NLG, VRE increased in price.

Financial services stocks were slightly differentiated with TVS, VCI, ORS, VIX, TVB, DSE, VDS, FTS on the decline and AGR, HCM, APG, CTS, VND, BSI on the increase.

Source: https://dantri.com.vn/kinh-doanh/co-phieu-dai-gia-buon-thep-chu-no-cua-novaland-hoa-binh-dot-ngot-tang-tran-20241018131207786.htm

Comment (0)