Ms. Minh Thu (28 years old, Dong Da District, Hanoi) said: Last weekend, the stock market increased strongly again, so I felt secure. Unexpectedly, at the beginning of the week, VN-Index dropped 60 points, so I was not able to react in time.

Vietnam's stock market has had its biggest drop in the past 2 years. The sell-off trend suddenly appeared in the second half of this afternoon's session, April 15, 2024. Vietnam's stock market has the biggest drop in the world today.

Starting the morning session, VN-Index remained at the recovery level of last weekend. However, a negative development suddenly appeared at around 1:30 this afternoon (April 15).

The sudden increase in selling pressure caused the stock market to widen its decline. After 2:00 p.m., the VN-Index fell freely to 1,216.61 points, losing 60 points . The decrease was equivalent to 5%, making the Vietnamese stock market the world's biggest drop today.

Market liquidity also skyrocketed compared to previous sessions. The total value traded reached nearly VND33,000 billion, of which. On the HOSE floor alone, liquidity accounted for nearly VND29,000 billion, up nearly 80% compared to the previous session.

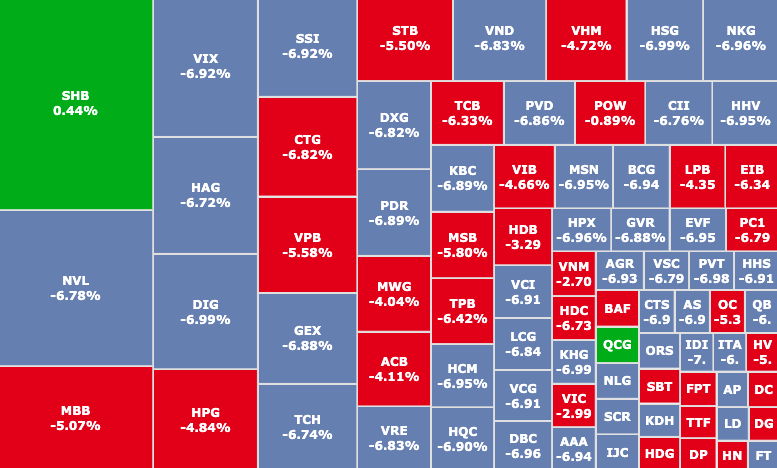

Although liquidity was high, it was heavily tilted towards the selling side, with nearly 900 stocks falling and 134 stocks rising. Notably, nearly 160 stocks hit the floor, with 111 stocks on the HOSE floor alone. The decline was quite large, mostly ranging from 4-7% down.

A series of stocks massively "dropped shockingly", reaching the floor price

The VN30 group also could not survive when 6 codes hit the floor: BID (BIDV Bank, HOSE), SSI (SSI Securities, HOSE), VRE (Vincom Retail, HOSE),...

A series of large stocks fell to the floor price, the securities, real estate, oil and gas, chemical, banking groups, etc. were all under strong selling pressure. Specifically, the real estate, banking and securities groups were strongly changed hands with: 7,200 billion VND, 6,500 billion VND and 4,700 billion VND respectively.

Large-cap stocks push market growth back (Source: SSI iBoard)

The group of stocks with the strongest negative impact on the market mainly comes from banks, along with real estate and retail.

Typically, TCB (Techcombank, HOSE) contributed the strongest negative direction (3.79 points) with a decrease of 6.33%. Next was VPB (VPBank, HOSE) down 5.58%, HPG (Hoa Phat Steel, HOSE) down 4.84%, MSN (Masan Group, HOSE) down 6.95%,...

The "bright spot" appeared at SHB (SHB Bank, HOSE) with a slight increase of 0.44% in market price to VND 11,350/share. In addition, the positive trend was mainly in the group of small stocks.

Notably, the stock of female CEO Nhu Loan, QCG (Quoc Cuong Gia Lai, HOSE) continued to be pushed up strongly by 4.17% in today's session. Previously, QCG started its increase streak from last week despite unfavorable information from the Van Thinh Phat case.

VN-Index "plummeted" unusually this afternoon

Faced with this development, many investors expressed panic as the market suddenly "collapsed" .

Ms. Minh Thu (28 years old, Dong Da District, Hanoi) said: "Recently, the market has been increasing positively. Although I was warned in advance that the VN-Index would enter a correction period according to normal rules, last week, the market decreased slightly and then increased strongly again at the end of the week, making me feel secure, so I did not expect that at the beginning of the week, the VN-Index would drop 60 points, so I did not have time to react."

Luckier than Ms. Thu, Ms. Minh Trang (34 years old, Hoang Mai District, Hanoi) managed to use a market order (MP - order to match the closest possible price) to push the "goods" away as quickly as possible: "I have never witnessed such a sharp drop in the market. From the beginning of the afternoon session, I saw the VN-Index plummeting sharply, which somewhat affected my psychology, so I quickly sold as soon as possible."

It is known that this is the sharpest decline in nearly 2 years , causing many new investors to be unable to react, and for many long-term investors, this reminds them of the "gloomy" years of 2021-2022, when the COVID-19 pandemic took place, affecting the entire economy, the stock market was no exception.

Source

Comment (0)