Stocks on August 18 fell "uncontrollably", investors fled

Even before the stock market opened on August 18, the world received shocking news. That was the second largest real estate company Evergrande filing for bankruptcy. This was a foretold ending because since 2021, Evergrande has caused the global stock market to fluctuate because of the risk of bankruptcy. Since then, Evergrande has tried to escape but failed.

Although this was a foregone conclusion, its consequences were still so great that they were difficult to predict. In the morning trading session of the stock market on August 18, the VN-Index fell quite sharply, but demand appeared, helping investors still hope for a miracle.

But after the lunch break, investors’ hopes were completely dashed when the VN-Index began to “free fall” with investors “selling at all costs”. A widespread sell-off occurred at the end of the afternoon session of the stock market on August 18.

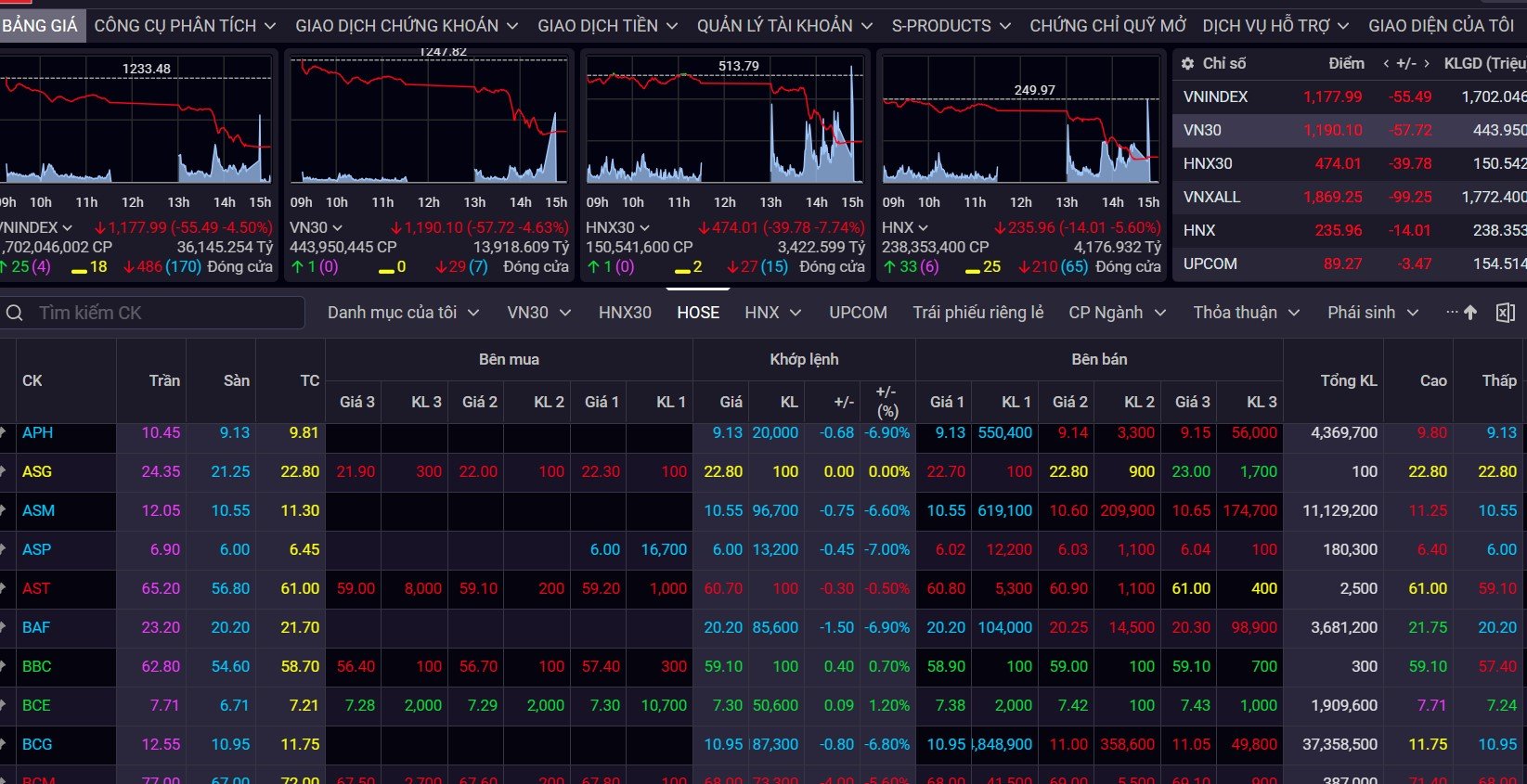

Stocks on August 18 fell "uncontrollably" as investors fled at all costs, causing liquidity to reach 34,000 billion VND, an unprecedented high. Screenshot

As a result, the stock market on August 18 became a “Black Friday” when the VN-Index set a record in both “falling” speed and liquidity.

At the close of the August 18 stock market session, the VN-Index fell 55.49 points, or 4.5%, to 1,177.99 points. The 1,200-point mark was easily breached. The VN30-Index fell 57.72 points, or 4.63%, to 1,190.1 points. The entire floor recorded only 25 stocks increasing in price, 18 stocks remaining unchanged, and 486 stocks decreasing in price (168 stocks hitting the floor).

The liquidity of the stock market on August 18 recorded an unprecedented high when 1.7 billion shares, equivalent to VND36,145 billion, were successfully traded. The VN30 group had 444 million shares, equivalent to VND13,920 billion, transferred.

In the August 18 stock market session, VN30 had 7 stocks hitting the floor. They were GVR, MWG, POW, SHB, VHM, VIC and VPB. The only blue-chip that successfully “weathered the storm” was VCB. VCB increased by 100 VND/share, equivalent to 0.1% to 89,500 VND/share.

On the Hanoi Stock Exchange, the indices fell even more sharply. Closing the stock market session on August 18, the HNX-Index fell 14.01 points, equivalent to 5.6%, to 235.96 points; the HNX30-Index fell 39.78 points, equivalent to 7.74 points, to 474.01 points.

Liquidity on the 18/8 stock market session on the Hanoi Stock Exchange also increased dramatically. Up to 239 million shares, equivalent to 4,177 billion VND, were successfully traded. The HNX30 group had up to 15 stocks hitting the floor.

Global stocks fall in shock

Asia-Pacific markets fell on Friday as investors assessed Japan's July inflation data and fresh blows to China's property sector.

Japan's core inflation rate fell to 3.1%, down from 3.3% in June. Headline inflation remained at 3.3%.

Meanwhile, troubled Chinese real estate giant Evergrande has filed for bankruptcy protection in US bankruptcy court.

The company has sought protection under Chapter 15 of the US bankruptcy code, which shields non-US companies undergoing restructuring from creditors.

Hong Kong's Hang Seng index fell 1.97% in its final hour of trading, while the mainland's CSI 300 index lost 1.23% to close at 3,784.

Japan's Nikkei 225 index fell 0.55% to recoup four days of losses in the past five sessions, ending at 31,450.76 while the Topix closed down 0.7% at 2,237.29 after the inflation reading was released.

In Australia, the S&P/ASX 200 edged up slightly to end at 7,148.1. South Korea's Kospi ended 0.61% lower at 2,504.5, marking its sixth straight day of losses, and the Kosdaq lost 0.98% to close at 877.32.

European markets fell as global investors remained cautious as traders assessed the future of monetary policy and fresh concerns about China's property sector.

The pan-European Stoxx 600 index fell 0.9% in early trade, with retail stocks down 1.7% leading losses on weak UK retail sales figures as all major sectors and stock markets were in the red.

European blue chips closed down 0.9% on Thursday and were on track for a negative week, after minutes from the US Federal Reserve's July meeting showed that the possibility of another interest rate hike was off the table.

European stocks on Friday looked set to follow Asia-Pacific markets, where markets fell across the board.

Source

![[Photo] Dong Ho Paintings - Old Styles Tell Modern Stories](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/317613ad8519462488572377727dda93)

![[Photo] Prime Minister Pham Minh Chinh and Brazilian President Luiz Inácio Lula da Silva attend the Vietnam-Brazil Economic Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/f3fd11b0421949878011a8f5da318635)

Comment (0)