(Dan Tri) - Nearly 51 million DXG shares were matched this morning in the context of negative market developments, of which 20 million units were matched at the floor price, with nearly 15 million units remaining for sale at the floor price.

The market took a turn for the worse in this morning's trading session (December 24). Rising selling pressure caused most stocks to fall in price, with indexes adjusting simultaneously.

VN-Index lost 7.24 points, equivalent to 0.57%, to 1,255.52 points, once again breaking the important support level of 1,260 points. VN30-Index decreased by 6.31 points, equivalent to 0.48%; HNX-Index decreased by 1.23 points, equivalent to 0.54%, and UPCoM-Index slightly adjusted by 0.04 points, equivalent to 0.05%.

The emergence of low-price demand has significantly improved liquidity compared to yesterday's session, reaching 333.75 million shares, equivalent to VND7,258.36 billion, on HoSE. HNX had 26.51 million shares traded, equivalent to VND535.35 billion, and this figure on the UPCoM market was 31.07 million shares, equivalent to VND370.64 billion.

The entire market recorded 778 stocks that had not yet made any transactions. Meanwhile, the number of stocks that decreased in price was overwhelming with 465 red stocks compared to 248 green stocks in the overall picture of the market.

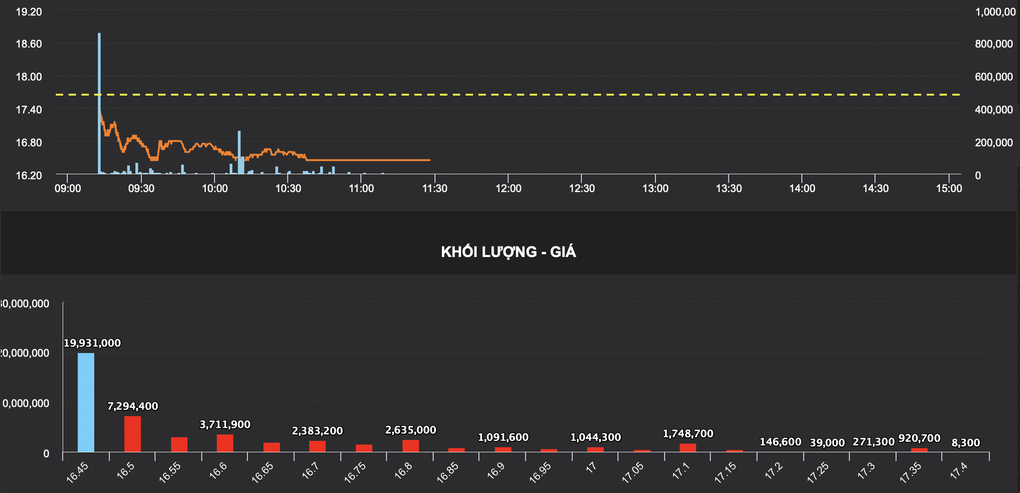

Trading performance of DXG shares this morning (Source: VDSC).

Dat Xanh's "family" stocks attracted attention when they were sold off heavily from the beginning of the session, hitting the floor with a sudden volume of orders matched. While the rest of the market traded modestly, even the most heavily traded codes matched orders below the threshold of 10 million units, DXG matched nearly 50.8 million shares.

The sell-off was triggered, causing floor-price sell orders to pile up. At the end of the morning session, there were still over 14.6 million floor-price sell orders for DXG. The market price of DXG after hitting the floor was VND16,450 and approximately 20 million shares were traded at the floor price.

In a related development, on December 23, Dat Xanh Group announced the offering of 150.1 million shares to existing shareholders at a price of VND12,000 per share, with an exercise ratio of 24:5 (shareholders who own 1 share receive 1 purchase right, and for every 24 purchase rights, they can buy 5 new shares). The time for registration and payment for shares is from January 14 to February 14, 2025.

The total estimated mobilized capital value of nearly VND 1,801.8 billion will be used to contribute capital to Ha An Real Estate Investment and Trading Joint Stock Company and pay obligations and payable expenses of Dat Xanh Group.

Along with DXG, DXS stock this morning also "cleaned the floor" with a dramatic decrease on the HoSE floor to 7,200 VND, matched orders of nearly 5.9 million shares, with a surplus of floor sales.

Several other stocks in the same real estate industry were also under great pressure from supply. DTA hit the floor, TN1 hit the floor at one point before recording a loss of 4.1%; PDR fell 3.4%; HDC fell 3.4%; SCR fell 3.3%; CRE fell 3%.

In the opposite direction, TDH maintained its ceiling price increase to VND2,710, with no sellers. Matching orders at TDH reached 359,300 shares and there was a ceiling price buy surplus of 943,700 units. HTN, PTL, HAR, HQC also increased in price.

Some construction and material stocks went against the market trend. PHC hit the ceiling, BCE rose 6.6% and at one point hit the ceiling. HVX rose 4%. BMC shares in the basic resources sector also hit the ceiling, DHM rose 4.1%, PTB rose 3.4%.

Similarly, in the electricity, water, and petroleum and gas industry groups, SMA hit the ceiling, SFC increased by 5.5%; S4A increased by 4.2%; NT2 increased by 3%; CHP and TTA increased in price.

However, liquidity in the above-mentioned group of stocks with increased prices was insignificant. The market was mostly strongly adjusted, especially clearly in the group of stocks in the finance and banking sectors. APG, VDS, ORS, VCI in the securities group lost value sharply; most of the banking stocks were adjusted, including large codes such as BID, HDB, VPB, CTG.

Source: https://dantri.com.vn/kinh-doanh/ban-thao-tai-ho-dat-xanh-khop-lenh-dot-bien-hon-50-trieu-co-phieu-dxg-20241224131241463.htm

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)