|

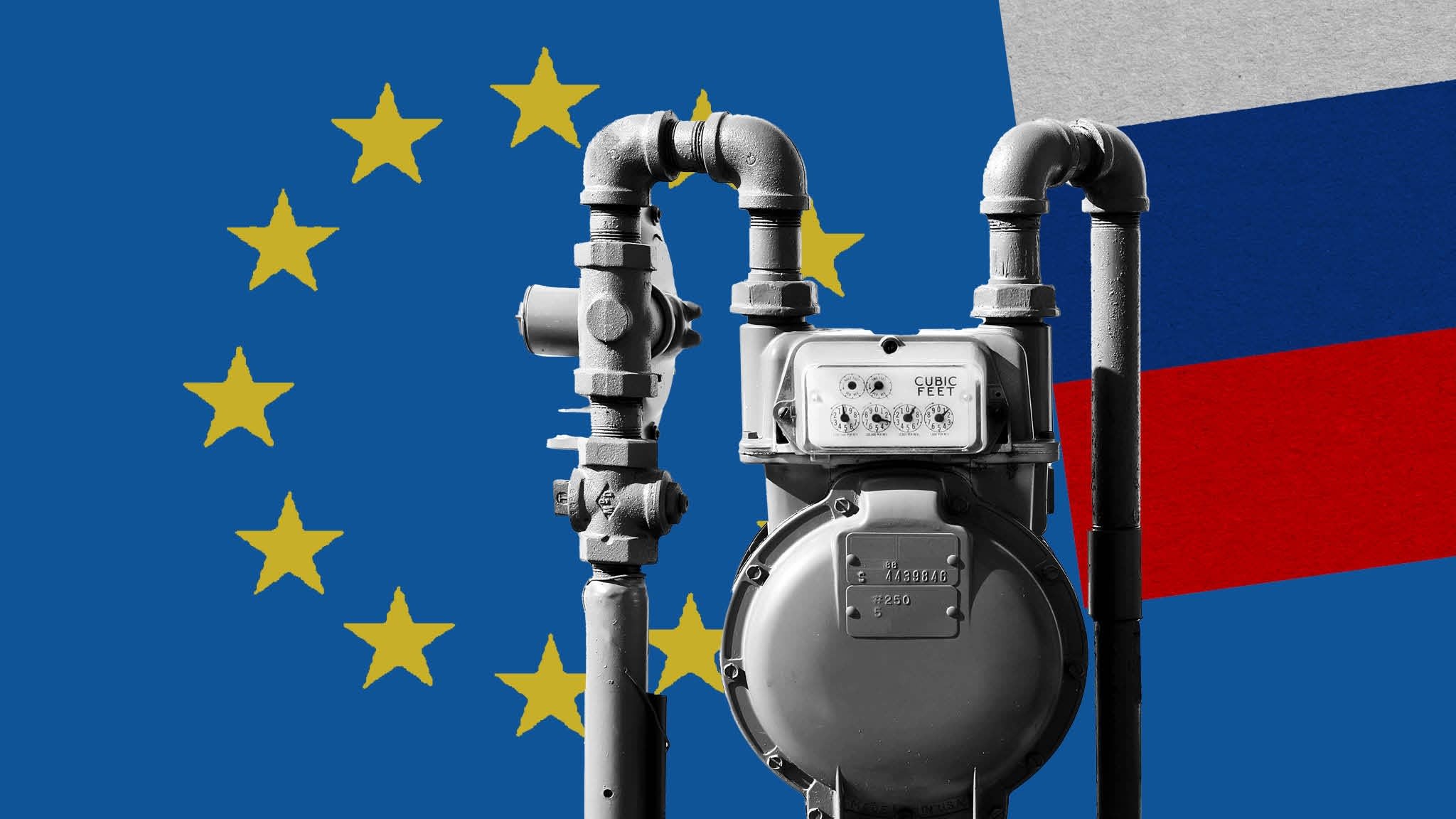

The loss of gas supplies from Russia is forcing Europe to look further afield for imported energy. (Source: Getty) |

“Make friends” with Qatar

The Gulf state’s national energy company has recently signed three major contracts to supply liquefied natural gas (LNG) to European countries including France, Italy and the Netherlands over the next few decades. Meanwhile, Germany already has an energy deal with Qatar.

Those partnerships have helped leaders from Paris to Berlin wean their countries off Russia on gas. But the deals have now left Europe facing another country – one with ties to the closely watched Hamas group.

Specifically, within two weeks, state-owned QatarEnergy announced agreements with TotalEnergies, Shell and Eni to supply France, the Netherlands and Italy with millions of tonnes of LNG from 2026 onwards.

The value of the contracts is huge. The agreements with France and the Netherlands will last for 27 years, while the agreement with Italy will last for 26 years.

Accordingly, Qatar will transport 3.5 million tons of LNG to France each year, equivalent to nearly 14% of the country's total fuel imports by 2022.

“The loss of Russian gas has left a huge gap in the market,” said Carole Nakhle, CEO of UK-based energy company Crystol Energy.

Initially, Europe turned to the United States for alternative supplies. However, Qatar is geographically closer and willing to make longer-term deals. The Gulf state sits on one of the world's largest natural gas reserves and its economy is fueled by fossil fuels.

“These new contracts are an early sign that Europe is moving away from the US as a major gas supplier,” said Bill Weatherburn, commodities analyst at Capital Economics.

But buying Qatari gas comes with its own strings attached. The Israel-Hamas war is putting Qatar’s ties to Hamas in the spotlight, and there is a great risk that the conflict will spread across the Middle East.

Hamas leader Ismail Haniyeh, is believed to be living in Qatar. Doha said Mr Haniyeh and other Hamas officials have been given homes in Qatar to promote diplomatic activities.

Qatari Prime Minister Sheikh Mohammed Bin Abdulrahman Al Thani said at a press conference last week that the Hamas leadership office “is used as a means of communication and to bring peace and stability to the region, not to incite any war.”

A Qatari official said the Hamas office was established in 2012 “in coordination with the US government, following Washington’s request to open a communication channel.”

However, the Counter Extremism Project, a non-profit organization, has called for a boycott of hotels in Qatar, including the Ritz, because they house and work Hamas leaders.

Europe's growing dependence on gas means the continent will find it difficult to take a stand against Qatar if there is any pressure over gas export sanctions, analysts warn.

“There is absolutely no way Europe can impose sanctions on Qatar’s gas industry,” said Mr Weatherburn.

Sharing the same view, Professor of Global Energy Michael Bradshaw at Warwick Business School (UK) commented: "Europe not importing LNG from Qatar would be a disaster for global gas prices."

Whether or not European leaders want to take a stand on Qatar’s Hamas ties, reliance on LNG gives the Gulf state powerful leverage.

Europe doesn't have many options.

But the risks are not just political. Qatar exports LNG through the Strait of Hormuz, a narrow waterway that runs through Iran. Iran also has ties to Hamas and could threaten to close the shipping route if the conflict escalates.

“It's a major bottleneck,” said Mr Bradshaw.

“That’s what people are thinking about right now,” Weatherburn added. “There’s a possibility of the Strait of Hormuz being closed due to military conflict. A war means prices are more likely to rise, even if the supply itself isn’t disrupted.”

Ultimately, Europe has very few good options left.

Of the world's four largest LNG suppliers, Russia is unable to participate and Australia is too far away to deliver.

“There are really only two countries that can solve Europe’s problem,” said Weatherburn. “They are Qatar and the United States. In September, they supplied 19.9% and 21.7% of the world’s LNG exports, respectively.”

LNG shipments to Europe are set to rise 66% in 2022 to replace lost Russian supplies, according to the International Gas Alliance. Much of the increase will come from the US, but supplies from the Middle East are also rising.

New contracts with Qatar show Europe is looking east for long-term supplies.

The surge in demand from the old continent comes at an opportune time for Qatar. The Gulf state has invested billions of dollars to increase production by nearly two-thirds by 2027 from the North Field East (NFE) and North Field South (NFS) expansion projects. Combined, the two projects will supply 48 million tonnes of LNG a year.

“They are planning one of the biggest expansions in the next few years,” said Ms Nakhle of Crystol Energy.

Not only is the European Union (EU) strengthening its relationship with Qatar, the Middle Eastern country was until last year the UK's largest supplier of LNG.

According to statistics, although it has lost its position as the UK's No. 1 LNG supplier to the US, this Gulf country still supplies 30% of the UK's needs.

The UK also plays a key role in LNG exports to Europe as it has the second largest regasification infrastructure on the continent, and acts as a land bridge for imports from the US and Qatar to Europe.

Ultimately, officials in both the EU and Britain seem comfortable with “marrying” the Qataris, because it is a calculated risk.

Source

Comment (0)