|

Price drop

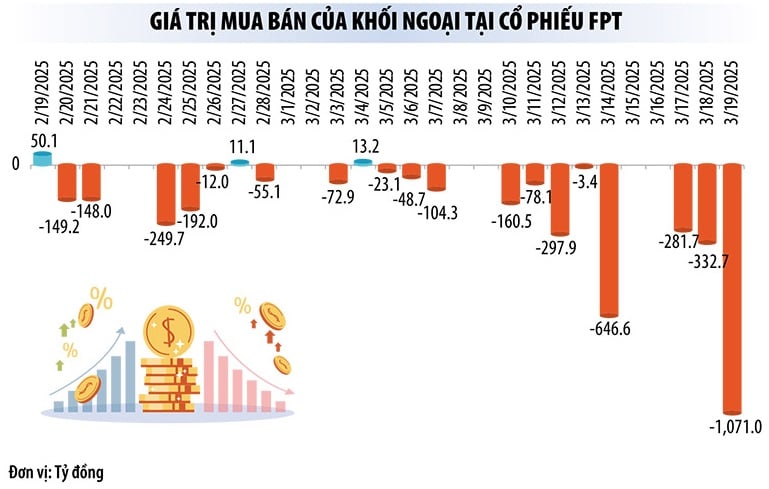

The trading session on March 19, 2024 marked the strongest selling session of foreign investors in FPT shares of FPT Joint Stock Company. Foreign investors sold more than 10 million shares, while only buying more than 2 million units, pushing the net selling value to exceed thousands of billions of VND and making it the stock with the strongest selling on the market.

This is the strongest net selling session of foreign investors at FPT in over a year. The most recent net selling session exceeding a thousand billion was on March 7, 2024, with a value of over VND 1,436 billion.

Under this strong pressure, FPT fell more than 5.4 points, equivalent to -4.15% and became the stock that weighed down the VN-Index the most during the day.

Previously, on March 14, 2025, foreign investors also sold a large amount of FPT shares. Foreign investors sold more than 53.5 million FPT shares, while only buying nearly 5 million shares. With this difference, the net selling value at FPT reached 646.4 billion VND in just one session.

FPT shares have been continuously net sold by foreign investors since the session on March 5. The most recent net buying session was on March 4, with a net buying value of more than VND27 billion. Meanwhile, from the session on February 19 to March 18, the net selling value reached VND3,852 billion.

Foreign room at FPT also dropped to only 43.96% at the end of the session on March 18, creating a large gap of up to 5% and also the largest room gap in many years. Previously, foreign room was often filled to a maximum of 49%.

The withdrawal of foreign investors from this leading technology stock has created considerable concerns about FPT's investment prospects, while domestic capital is not enough to reduce the pressure from foreign investors' net selling.

FPT's highest price to date was set in the session on January 23, 2025, with the closing price at VND 154,300/share, up 87% compared to the beginning of 2024. However, investors who bought FPT shares in this historic session are suffering significant losses, because afterwards, FPT shares continuously decreased in price and showed no signs of stopping.

Right after the Lunar New Year holiday, in the first trading session of the year of the Snake, FPT fell by 5.15%, causing the market capitalization of this technology giant to lose more than VND11,000 billion. This downward pressure occurred at FPT in particular and technology stocks on the stock exchange in general, after the launch of China's low-cost artificial intelligence (AI) model DeepSeek, causing concerns about fierce competition.

Up to now, at the end of the trading session on March 19, after another session of decline, FPT's market price fell to VND 124,600/share, down 19% compared to the peak at the end of January 2025 and returned to the price range in July 2024.

Risks and opportunities

In fact, the wave of cheap AI is still putting pressure on the technology industry in general. Market sentiment is affected by the emergence of cheap AI models, raising concerns about the decline in the value of the AI market - a field in which FPT is investing heavily.

Faced with such pressure, FPT’s Board of Directors affirmed that models like DeepSeek do not significantly affect the efficiency of FPT AI Factory. However, investors’ dumping shows their fear of fierce competition and the possibility of FPT’s profit margin decreasing in the future. Globally, many other technology “giants” such as NVIDIA have also been significantly affected.

FPT can be considered a "rare commodity" on the Vietnamese stock market, when the proportion of technology stocks is still low and the market lacks the presence of "big names" in the technology industry on the stock exchange.

FPT can be considered a "rare commodity" on the Vietnamese stock market, when the proportion of technology stocks is still low and the market lacks the presence of "big names" in the technology industry on the stock exchange.In 2024, FPT "made waves" by continuously conquering new price peaks, with each increase creating a new price record. Despite the profit-taking declines, the upward trend at FPT lasted quite a long time, until the end of January 2025.

Cheap AI can create fierce competition, but it is also an opportunity for technology companies. FPT set a record for revenue and profit in 2024, continuing to set a revenue target of VND75,400 billion and pre-tax profit of VND13,395 billion for 2025, equivalent to a growth rate of 20-21%. This target will be presented to FPT's 2025 Annual General Meeting of Shareholders.

Recently, KBSV still gave positive assessments about FPT's prospects. The strong trend of using generative AI in businesses and organizations to improve business performance will boost global spending on software and IT services. According to Gartner, total global spending on software/IT services will grow by 14% and 9.4% respectively by 2025, as businesses accelerate digital transformation to apply new technologies. Therefore, according to KBSV, FPT is expected to continue to catch up with new trends, in order to boost investment activities in key markets.

The AI Factory project with a total investment of 100 million USD is expected to complete FPT's product ecosystem, helping businesses seize opportunities to expand the Japanese market. Estimated revenue here in 2025-2026 is 15,700 - 20,060 billion VND, equivalent to a growth rate of 27-29% year-on-year.

In the US and European markets, the management service contracts that FPT has signed will ensure work for FPT in the next 3-5 years and will be the driving force for revenue growth to remain high, reaching 15-20%. Therefore, KBSV expects FPT's information technology segment to grow by over 24%.

Previously, SSI had reduced its revenue estimates for the FPT AI Factory Project and the education segment, due to slower-than-expected project implementation progress and difficulties in enrollment at the FPT education system in 2024. However, SSI still forecasts double-digit growth for FPT in 2025 (revenue increases by 19%), in which the technology segment continues to be the main growth driver.

![[Photo] General Secretary To Lam and Prime Minister Pham Minh Chinh attend the first Congress of the National Data Association](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/22/5d9be594d4824ccba3ddff5886db2a9e)

Comment (0)