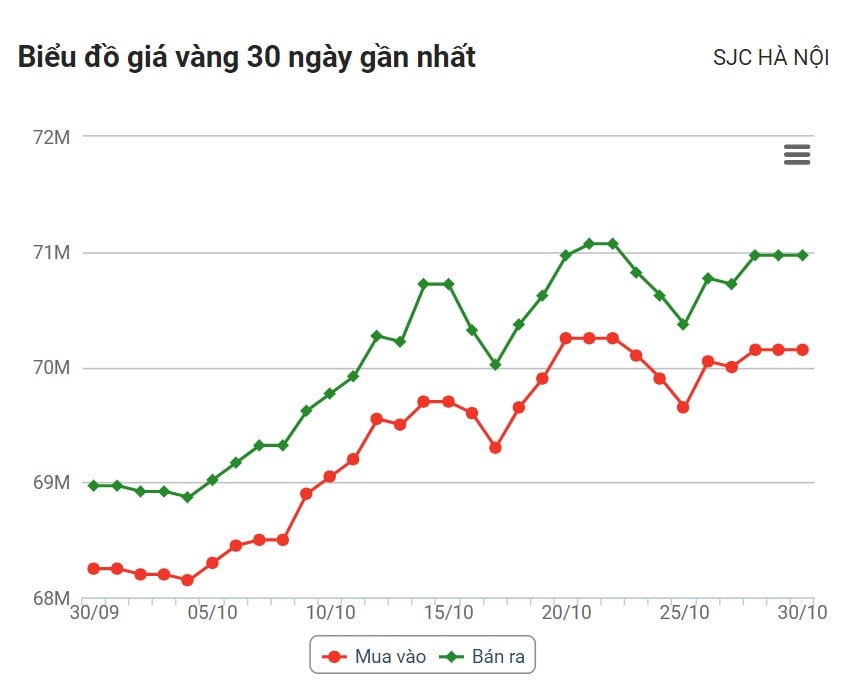

Domestic gold price

Domestic gold price developments

World gold price developments

Gold prices plunged amid a flat USD. At 6:15 p.m., the US Dollar Index, which measures the greenback's movements against six major currencies, stood at 106.332 points (down 0.04%).

The US Bureau of Economic Analysis (BEA) has released its PCE inflation report for September. Accordingly, the report recorded that the US PCE inflation index reached 3.4% compared to the same period last year in September.

Risks in the credit system are also creating safe-haven demand for gold, according to Ryan McIntyre, managing partner at financial firm Sprott Inc. Gold prices have held steady while bond yields hit 5%, a 16-year high.

In addition, many investors are worried about the financial outlook of the US government. The government's defense debt is increasing, exceeding 33 trillion USD.

The Fed's interest rate decision on Wednesday will be the most anticipated economic event of the week. According to the CME FedWatch Tool, the market sees a nearly 100% chance that the Fed will leave rates unchanged at 5.25% to 5.5%. At the same time, the Fed is expected to maintain its restrictive monetary policy for the foreseeable future.

Kitco senior analyst Jim Wyckoff believes gold prices are likely to continue their upward trajectory this week. “Gold is holding steady and higher as technicals remain bullish and safe-haven demand remains evident,” he said.

Source

Comment (0)