STRATEGIC GUIDELINES |

In the context of climate change, social inequality and pressure for transparency and governance that are challenging global financial institutions, ESG is no longer a trend but has become a core criterion for assessing sustainable development. With a leading mission in the agricultural and rural sector, Agribank has quickly recognized the importance of this trend. Adapting to the trend, Agribank has launched an ESG strategy with three pillars: Environment - Reducing negative impacts, promoting green credit and encouraging renewable energy; Society - Enhancing financial inclusion, supporting social security and ensuring workers' rights; Governance - Focusing on financial transparency, risk control and optimizing business management. This is an extremely important factor for the long-term development of a financial institution, because ESG is not only a trend but has become a core element in the strategy of every business today. With the ESG strategy, Agribank is committed to creating a financial ecosystem that helps enhance social prosperity and protect the environment, especially in areas related to green credit and financing for agricultural projects, renewable energy technology and environmental protection. |

|

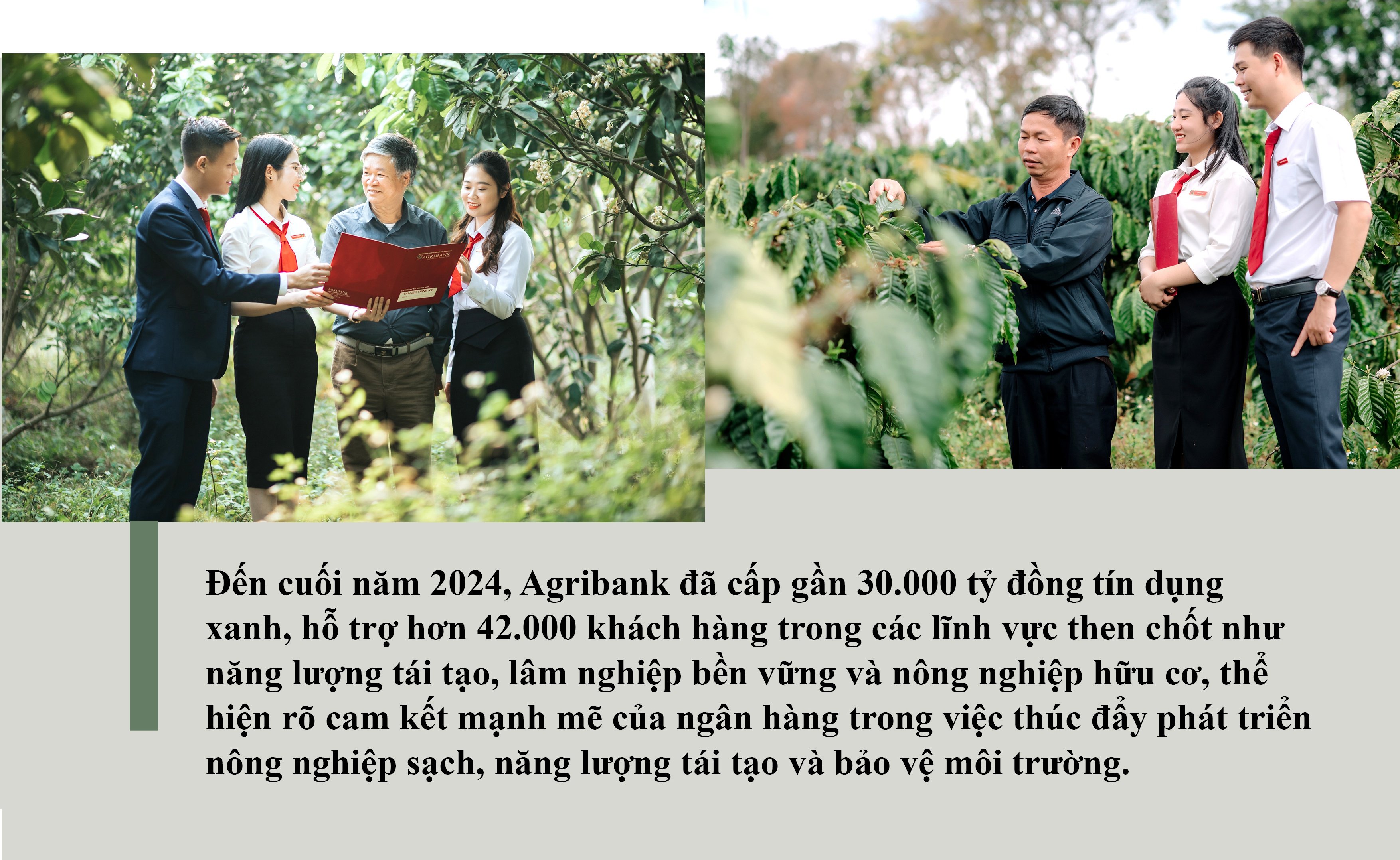

To implement the strategy, Agribank has issued directives, established an ESG Steering Committee and outlined a detailed Action Plan. This is not only Agribank's response to the urgent demands of the times but also a deep, long-term commitment to creating outstanding economic, social and environmental values. In the Specific Action Plan, Agribank sets out clear goals, including issuing a list of industries that are not in line with green development criteria and will be excluded or restricted from providing credit. Instead, Agribank will prioritize financing green projects, encourage environmental protection initiatives and develop renewable energy, along with sustainable agriculture and forestry. With each loan, Agribank does not simply see it as a financial transaction, but as a seed for the future, bringing long-term values to the community and the environment. Identifying its role as one of the key financial pillars of the Vietnamese economy, with great responsibility in promoting green transformation in the financial sector, Agribank recognizes that green credit is not only a financial tool, but also a decisive key to the sustainable development of the economy in the current context. Agribank has implemented green credit packages with the aim of supporting renewable energy projects, clean agriculture and sustainable production models. These loans not only come with preferential interest rates and simple loan procedures but also provide consulting support, helping small and medium-sized enterprises easily access capital to implement environmental protection initiatives. Agribank is not only a bank providing financial services, but also a reliable companion in supporting creative and sustainable initiatives. The bank proactively provides flexible financial products, helping farmers and businesses apply clean, high-quality agricultural models, as well as invest in green projects, organic agriculture and renewable energy. Thanks to Agribank's support, many sustainable production models have been successful and developed strongly.

The clean agricultural farm in Long An is a typical example. After receiving a green credit loan from Agribank, this farm switched to growing clean vegetables according to organic standards, minimizing the use of chemicals, while increasing productivity and product quality. As a result, the farm's agricultural products have been exported to international markets, bringing high added value to Vietnamese agricultural products. One of the successful cases is credit support for a solar power development enterprise in Ninh Thuan province. This enterprise received a preferential loan from Agribank to install a large-scale solar power system. After completion, the project has helped this enterprise not only save on electricity costs but also contribute to reducing CO2 emissions, towards sustainable development. In addition to large projects, Agribank has implemented special green credit packages to support cooperatives, farms and small businesses participating in the OCOP (One Commune One Product) program. This is a government initiative to develop agricultural products typical of each locality. An Phu Agricultural Products Cooperative (Hanoi) is a typical example of success thanks to Agribank capital. After participating in the OCOP program and receiving a loan from Agribank, the cooperative has improved product quality, expanded its consumption market and increased the income of its workers. Their clean agricultural products have been exported to demanding markets such as Japan and Korea. The success stories from green projects that Agribank has supported show that the bank not only creates economic value but also contributes to sustainable development and environmental protection. These projects are not just financial loans, but concrete steps to help rural communities develop, improve the quality of life and protect natural resources for future generations. Inclusive financial initiatives, typically the VND10,000 billion green credit package with interest rates starting from only 3.5% per year, have created opportunities for thousands of small businesses in rural areas, helping them start businesses, improve their livelihoods and contribute positively to local economic development. |

|

INCREASING ATTRACT OF "FORE CAPITAL" |

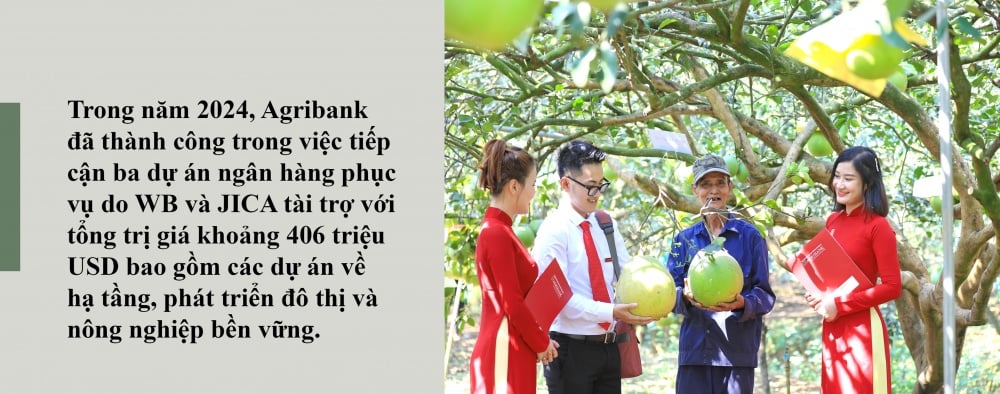

Not only focusing on domestic resources, Agribank also actively connects with international partners to expand new capital sources and implement breakthrough green initiatives, affirming its leading position in the field of sustainable finance. In 2024, the bank signed cooperation agreements with international organizations such as the French Development Agency (AFD), the World Bank, and the Luxembourg Development Cooperation Agency (LuxDev). These agreements open up opportunities for cooperation in green finance projects, creating long-term capital to implement environmental protection initiatives. For example, Agribank cooperates with AFD to issue a green credit worth 50 million EUR to promote clean and high-tech agricultural development. In addition, projects such as “Financing for resilience – Promoting climate-smart agriculture” in Thua Thien Hue will contribute to mitigating the impact of climate change and sustainable development in areas at high risk of natural disasters. The cooperation with the Luxembourg Development Cooperation Agency (LuxDev) to implement two key projects in Thua Thien Hue province marks the first time the organization has cooperated with a Vietnamese commercial bank, which is expected to promote smart agriculture and improve resilience to climate change. |

|

In addition, Agribank signed the AGREENFI Project Agreement, marking an important step forward in international cooperation. At the same time, Agribank cooperated with the World Bank to issue green bonds, develop a green financial framework and a set of criteria for selecting environmental protection projects. Through these cooperations, Agribank affirms its strong commitment to sustainable development, contributes to environmental protection initiatives and enhances its reputation and image as a financial institution responsible to society and the environment. In particular, green bonds are an important financial tool that helps Agribank mobilize long-term capital from investors interested in green and sustainable projects. Issuing green bonds not only helps the bank meet capital needs for environmental protection initiatives but also optimizes capital mobilization costs, contributing to the bank's sustainable development strategy. Agribank is demonstrating its strong commitment to sustainable development by implementing 25 banking service projects (NHPV) worth 1.23 billion USD and a total of 184 projects worth 9.6 billion USD. In addition, Agribank has received support from the State Bank in implementing ODA loan programs and projects worth about 400 million USD, especially within the framework of the Sustainable Development Project in the Mekong Delta. These efforts not only help Agribank expand its green capital sources but also strengthen the bank's position as a leader in sustainable finance globally. |

SUSTAINABILITY COMMITMENT AND COMPREHENSIVE “GREENING” STRATEGY |

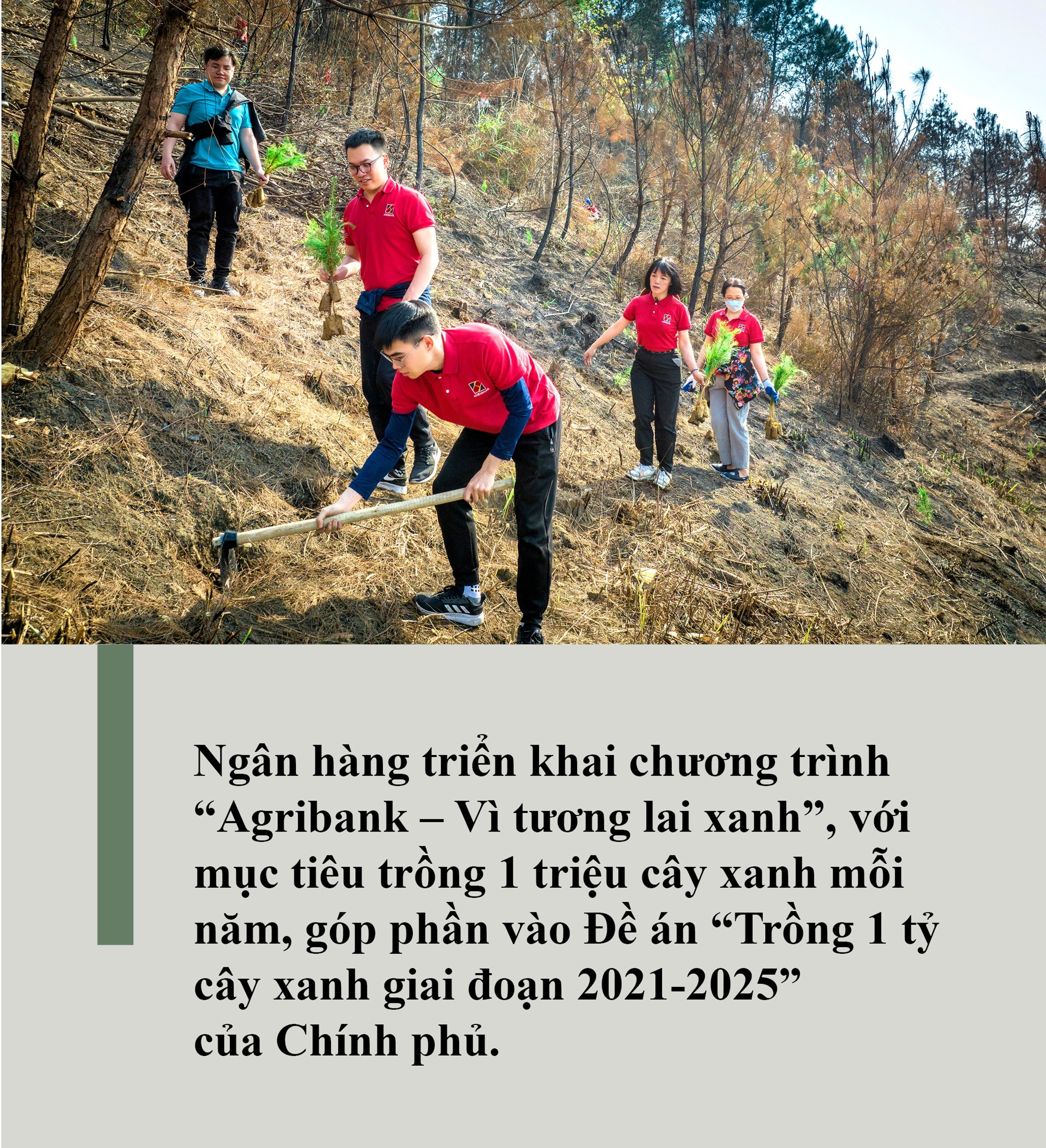

Agribank not only demonstrates its commitment to sustainability through credit products but also applies the philosophy of sustainable development to all internal activities, affirming its strong transformation in every step. As the largest commercial bank in Vietnam, with more than 2,300 branches and transaction offices spread across all regions, Agribank is always at the forefront of agricultural and rural development and supporting people, while fulfilling its commitments to "greening" its operations. To realize this commitment, Agribank is implementing a program to “green” the working process at all branches nationwide. Specifically, the bank will use energy-saving LED lights, deploy automatic watering systems and replace disposable plastic items with recycled materials. Agribank is also implementing solutions to protect resources and minimize environmental impacts through the application of “green” criteria in the construction investment process, to ensure that new projects meet green building standards and use environmentally friendly materials. Agribank not only focuses on sustainable development but also actively spreads the spirit of environmental protection through practical programs. In particular, the bank has implemented the program "Agribank - For a green future", with the goal of planting 1 million trees each year, contributing to the Government's Project "Planting 1 billion trees in the period of 2021-2025". These activities take place across the country, from mountainous areas to islands, helping to green bare land and hills, prevent landslides and improve air quality in large cities. At the same time, Agribank also participates in movements such as "Say no to plastic waste" and "Join hands to clean up the marine environment", to raise community awareness and demonstrate deep social responsibility, in line with the National Strategy on green growth. These initiatives not only protect the environment but also create long-term value for the country's green economy. At the same time, Agribank promotes the digitization of transactions, replacing paperwork with electronic banking, thereby not only cutting costs but also minimizing carbon emissions. This strongly supports the bank's digital transformation strategy, while contributing to environmental protection and optimizing transaction processes.

With its wide influence, Agribank continues to play the role of a comprehensive financial bridge, especially supporting disadvantaged groups such as farmers, women and small businesses. Agribank pays special attention to access to capital for disadvantaged groups, through the loan group model and comprehensive financial products such as account opening fee exemptions and reductions, and money transfers for low-income groups. At the same time, the bank also organizes financial training programs for people in remote areas, helping them improve their financial knowledge and skills. In addition, Agribank is committed to enhancing transparency and social responsibility, publishing an annual Sustainability Report that provides detailed information on environmental, social, employee and ESG governance impacts. Internally, Agribank continuously improves employee welfare, provides ESG training to more than 40,000 employees, and builds gender equality policies, promoting the advancement of female employees. These policies not only create a fair and professional working environment but also serve as a solid foundation for the bank's sustainable development strategy. Through specific steps in internal operations, Agribank not only aims to increase its competitive advantage but also actively contributes to the country's green economy. With a detailed action plan and a continuous commitment to sustainability, Agribank is gradually affirming its position as a symbol of sustainable development in Vietnam, where every action today is a step towards a brighter and greener future. |

|

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia received the delegation of Nhan Dan Daily](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/cdb71275aa7542b082ec36b3819cfb5c)

![[Photo] Nhan Dan Newspaper Youth Union visits Vietnam Military History Museum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/374e4f70a35146928ecd4a5293b25af0)

![[Photo] Prime Minister Pham Minh Chinh meets with the Ministry of Education and Training; Ministry of Health on the draft project to be submitted to the Politburo](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/c0e5c7348ced423db06166df08ffbe54)

![[Photo] General Secretary To Lam chairs the Standing Meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/839ea9ed0cd8400a8ba1c1ce0728b2be)

Comment (0)