Tien Phong Securities Corporation (HoSE: TPS) has just announced its reviewed semi-annual financial report (SAR) with many outstanding information.

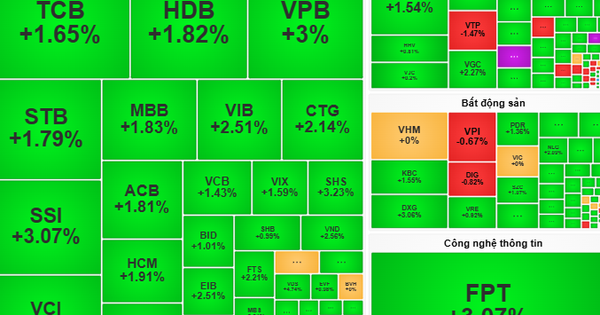

In the first half of the year, TPS's operating revenue reached VND1,621 billion, up 10% year-on-year, while operating expenses decreased slightly to VND1,223 billion. After deducting financial and administrative expenses, TPS earned VND137 billion in pre-tax profit, up 16% year-on-year.

With this result, TPS has completed 57% of the revenue plan and 60% of the annual profit plan.

The financial statements show that TPS continues to focus on the corporate bond market. In the first half of the year, while investor transactions were only nearly VND14,000 billion, mainly in stocks, TPS's bond trading reached more than VND95,000 billion (stock trading was only VND450 billion).

TPS's total assets have grown impressively to VND9,370 billion, 40% higher than at the beginning of the year, and is the securities company with the highest growth rate in the first 6 months of the year according to this criterion. The main structure of total assets is cash and equivalents (VND2,431 billion), FVTPL assets (VND1,564 billion), or receivables from services provided by securities companies (VND3,878 billion).

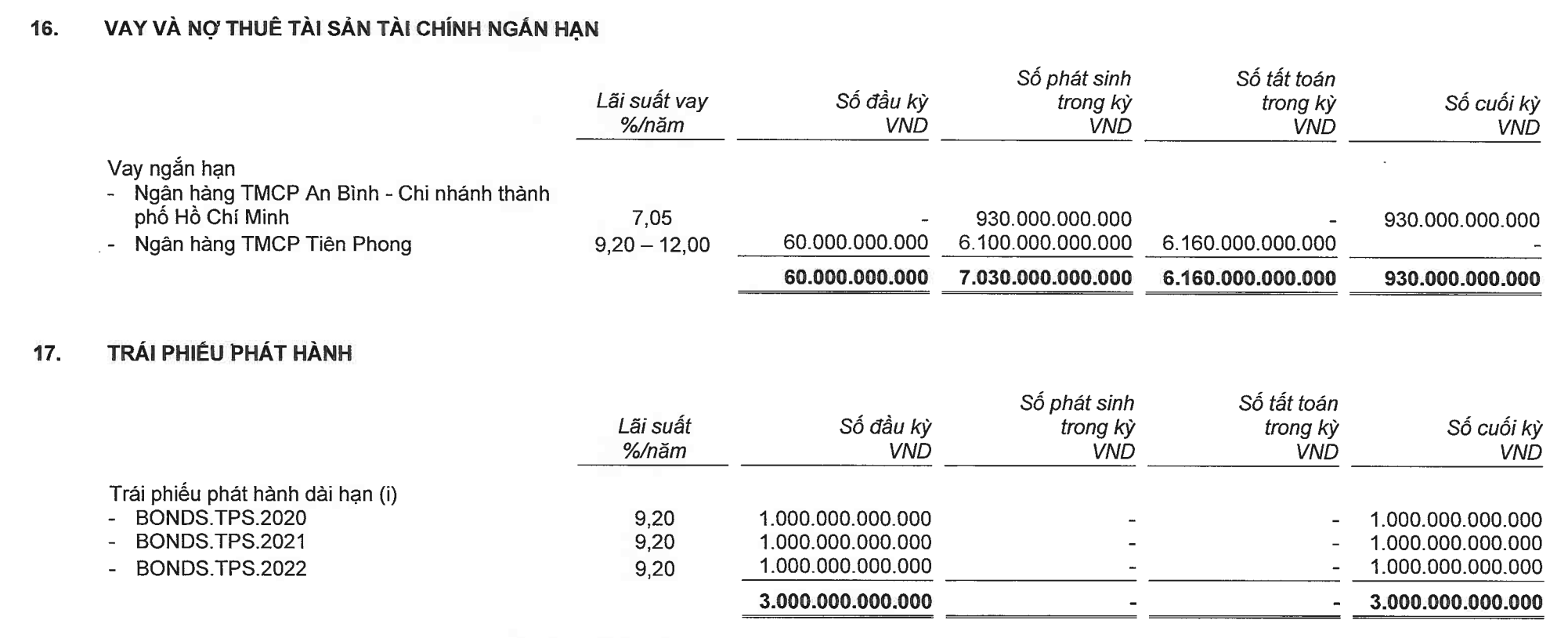

On the other side of the balance sheet, the increase in equivalent resources came from short-term bank loans of VND930 billion, and other short-term payables increased from VND852 billion to VND2,656 billion. TPS still maintains a bond loan of VND3,000 billion, while charter capital is stable at VND2,000 billion.

This year, TPS plans to double its charter capital to VND4,000 billion, through offering to existing shareholders and/or private issuance.

TPS still maintains a bond loan of VND 3,000 billion, while charter capital is stable at VND 2,000 billion (Source: Financial statements).

TPS's only major shareholder is currently Tien Phong Commercial Joint Stock Bank (TPBank) with a 9.01% stake. Although its stake is not too large, far from the veto threshold (35%), as mentioned in a previous article, the influence of TPBank, or more precisely, the bank's owners, at TPS is almost absolute. The abundant resources from TPBank are also the main driving force for TPS's rise over the years.

In mid-March 2023, TPS Board of Directors passed a resolution to borrow capital from TPBank with a maximum credit limit of VND 2,100 billion. Three months later, on June 14, 2023, TPS Board of Directors passed a resolution to borrow from An Binh Commercial Joint Stock Bank (ABBank) with a limit of VND 1,400 billion. The loan is guaranteed by TPBank.

By the end of June, ABBank had disbursed a loan to TPS with a balance of VND930 billion. This was also TPS's only credit balance by the end of the second quarter.

However, in the first half of the year, the total amount of TPS borrowing from TPBank was VND 6,100 billion, plus VND 930 billion borrowed from ABBank (which was also guaranteed by TPBank), accounting for almost the entire total amount of TPS borrowing during the period (VND 7,280 billion) as explained in the Cash Flow Statement.

Notably, by the end of June 2023, TPBank's payment deposit balance at TPS increased dramatically to VND 2,428 billion, compared to only VND 13.5 billion at the beginning of the year.

This figure is equivalent to 11% of TPBank's charter capital, and if the loan guaranteed by TPBank at ABBank is added, it accounts for 15.3% of TPBank's charter capital. Meanwhile, current regulations limit a bank from providing credit to a customer exceeding 15% of its equity.

On the balance sheet, the source of capital that had a sudden change during the period was short-term payables with a balance of VND 2,656 billion, more than 3 times higher than at the beginning of the year. Of which, the amount to pay for purchasing bonds was VND 2,187 billion.

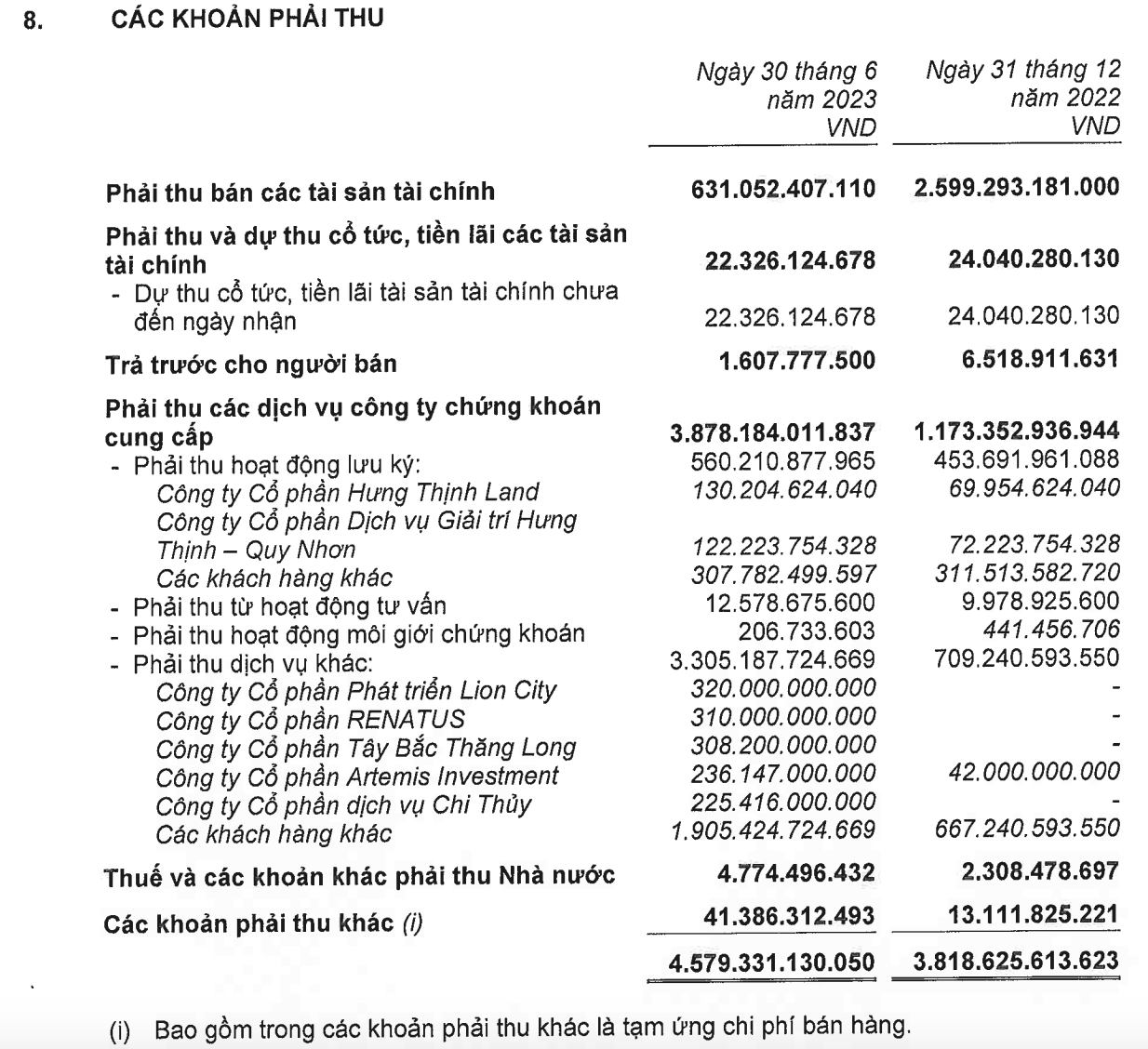

In terms of assets, the item with a notable balance is receivables with VND 4,579 billion, 2.3 times higher than TPS's charter capital.

Of which, other service receivables increased sharply from VND 709 billion to VND 3,305 billion. The majority of this number is from Groups that TPS - TPBank group arranged to issue large amounts of bonds in previous years, such as Tay Bac Thang Long JSC (VND 308 billion), a legal entity related to R&H Group JSC, or nearly VND 1,100 billion of 4 enterprises related to a multi-industry corporation listed on HSX, namely Lion City Development JSC (VND 320 billion), Renatus JSC (VND 310 billion), Artemis Investment JSC (VND 236 billion), or Chi Thuy Service JSC (VND 225 billion).

TPS's receivables (Source: Financial statements).

On the R&H Group side, the financial statements of Vinahud Housing and Urban Development JSC show that by the end of June 2023, TPBank had disbursed a total of VND 1,710 billion for Vinahud to buy shares in 2 project enterprises from R&H Group.

Previously, TPBank - TPS was the arranger for the issuance of more than VND 8,000 billion of bonds of R&H Group in the period of 2020-2021. As analyzed in a previous article, a large amount of these are due to mature this year, leading to considerable pressure not only on the issuer R&H Group, but also on the arranger TPBank - TPS, in the context of increasingly narrowing debt restructuring tool space.

Not long after TPBank disbursed more than VND 1,700 billion to Vinahud, the State Bank of Vietnam recently issued Circular 06/2023 regulating lending activities of credit institutions, requiring banks not to lend to pay for capital contributions, purchase, or receive transfers of capital contributions of LLCs and partnerships; contribute capital, purchase, or receive transfers of shares of JSCs that are not listed on the stock market or have not registered for trading on the UPCoM trading system.

Credit institutions lending for this capital need in many cases is potentially risky. This is a capital need that is difficult to control the purpose of using the loan, because the credit institution cannot control the use of capital by the capital recipient, there is no basis for regular assessment of the financial situation, operating situation, and debt repayment ability of the capital recipient.

In particular, this is also one of the forms that customers can use to conceal the form of mutual ownership .

Hualien

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)