Signs of trouble

Vietnam's export activities in the first months of 2025 recorded many remarkable changes, reflecting both opportunities and challenges in the context of global economic fluctuations. Data from the General Statistics Office (Ministry of Finance) showed that total export turnover in the first two months of the year reached 64.27 billion USD, up 8.4% over the same period last year and only about half of the growth rate in the first two months of 2024.

According to Dr. Andrea Coppola - Chief Economist of the World Bank in Vietnam, Cambodia and Laos, global demand is very strong in 2024, but is expected to slow down in 2025. Sharing the same view, Mr. Sacha Dray - Economist of the World Bank in Vietnam said that the positive export recovery momentum achieved in 2024 is expected to slow down this year due to uncertainties such as forecasts of slower global growth and the risk of trade disruptions between Vietnam's major partners.

In addition, the Vietnam Manufacturing Purchasing Managers’ Index (PMI) also showed signs of weakening demand. After reaching only 48.9 points in January, S&P Global’s report showed that the PMI in February 2025 continued to be below the average threshold of 50, reaching only 49.2 points, with output and new orders continuing to decline. Although it is only the “start-up” period of the year and the above signs should not be considered too negative for the export outlook for the whole year, these developments also partly show that exports are facing difficulties, especially the impact from the world market.

According to experts, the trade war between major economies continues to have a two-way impact on Vietnam's exports. On the positive side, the shift in supply chains helps Vietnam benefit as many international businesses seek new production locations. This brings opportunities to attract investment and expand exports to markets affected by tariff measures.

However, on the other hand, the trade war also creates many challenges. Increasing trade barriers, applying protection measures, taxes and stricter standards from major partners can make it difficult for Vietnamese export enterprises to maintain orders. Dr. Can Van Luc, Chief Economist of BIDV, said that with the view that international trade must be balanced and observing some recent policies of US President Donald Trump, the possibility of Vietnam being taxed may have to be considered.

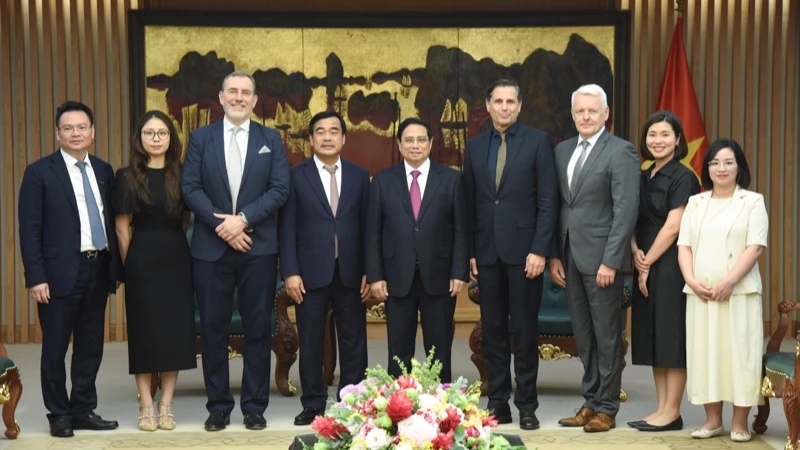

| Recently, at the headquarters of the United States Trade Representative (USTR) in Washington DC, Special Envoy of the Prime Minister, Minister of Industry and Trade Nguyen Hong Dien had a meeting with Chief of the United States Trade Representative Jamieson L. Greer. The two sides agreed that this is the time for Vietnam and the United States to work closely together to create a fair and sustainable business environment through proactively reviewing and considering the removal of trade barriers that hinder investment and business activities. At the end of the meeting, the two sides agreed to conduct regular consultations at the technical level to promptly resolve specific issues that arise in order to build a harmonious, sustainable, and stable economic and trade relationship in line with the comprehensive strategic partnership between the two countries. |

Efforts to maintain growth, towards balanced trade

BIDV Research Group assessed the possibility of Vietnam being taxed under three scenarios. In the base scenario (with a probability of 50%), the US could impose a tax rate corresponding to the rate Vietnam is imposing on imports from the US, according to the "reciprocal" tax policy. Accordingly, the US could increase the average tax on goods exported from Vietnam from 2.2% (according to the weighted average tax calculation method) to 5.1% (the rate Vietnam is imposing on goods imported from the US). At that time, the estimated additional tax amount would be about 4 billion USD, unless Vietnam proactively reduces the reciprocal tax for imports from the US (then, the estimated tax reduction would be 0.53 billion USD, assuming that imports from the US to Vietnam in 2025 increase by about 20%).

However, expert Can Van Luc said that the timing of this reciprocal tax (if any) will be difficult to take place immediately, because the US needs to calculate with more than 200 global partners and the application time may be earlier for countries that are applying reciprocal tax rates much higher than the US (such as India, South Korea, Brazil...).

In the negative scenario (25% probability), the US could increase tariffs to 10% on imports from Vietnam, similar to some other countries following President Trump's previous policy. As a result, exports to the US could fall by 3-5% in 2025, causing Vietnam's export growth to fall by 1.5-2 percentage points, and GDP could fall by 0.2-0.3 percentage points. If this policy lasts longer, the negative impact could be stronger in the following years.

In the positive scenario (with a probability of 25%), the US will not impose additional taxes or only adjust higher tax rates on some specific items such as steel and aluminum. At that time, Vietnamese goods will compete more fairly with other countries and still have the opportunity to maintain export targets.

According to experts, in addition to the direct impact on exports and economic growth, increased trade tensions can push up prices, cause inflationary pressure, affect exchange rates and cause strong fluctuations in the financial market, requiring more flexible management policies. To minimize negative impacts, the participation of both the State and enterprises is needed. In particular, it is necessary to focus on measures to promote mutually beneficial cooperation with the US in many fields, strengthen foreign channels, and consider implementing a number of measures to balance trade with the US. At the same time, it is necessary to steadfastly diversify markets, partners and products; and make better use of signed FTAs.

For the business community, especially those exporting to the US, it is necessary to be proactive and coordinate with state management agencies, Vietnamese trade offices abroad, embassies, international organizations, and importers to grasp the situation and developments of the market, thereby having timely and appropriate response measures. Relevant ministries and sectors need to promptly develop specific solutions for key export sectors; proactively work with partners in the US and related countries; provide information, guidance, and resolve difficulties for businesses.

In order to achieve the target of 12% growth rate of total export turnover in 2025, striving for 14% (according to Resolution 01/NQ-CP), the General Statistics Office proposes to promote trade promotion, expand and diversify supply chains, production chains and import/export markets associated with improving product quality; participate more deeply and widely in regional and global supply chains; promote exports to large, key markets and increase exploitation of new, potential markets, Middle Eastern, Halal, Latin American, African markets... In addition, it is necessary to promote digital transformation programs in trade promotion, connecting supply and demand; regularly update information on foreign market situations, especially regulations, standards and conditions that may affect Vietnam's import and export activities.

![[Photo] Nearly 2,000 people enthusiastically participated in the Olympic Running Day - For the security of the Fatherland](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/33bed26f570a477daf286b68b14474d4)

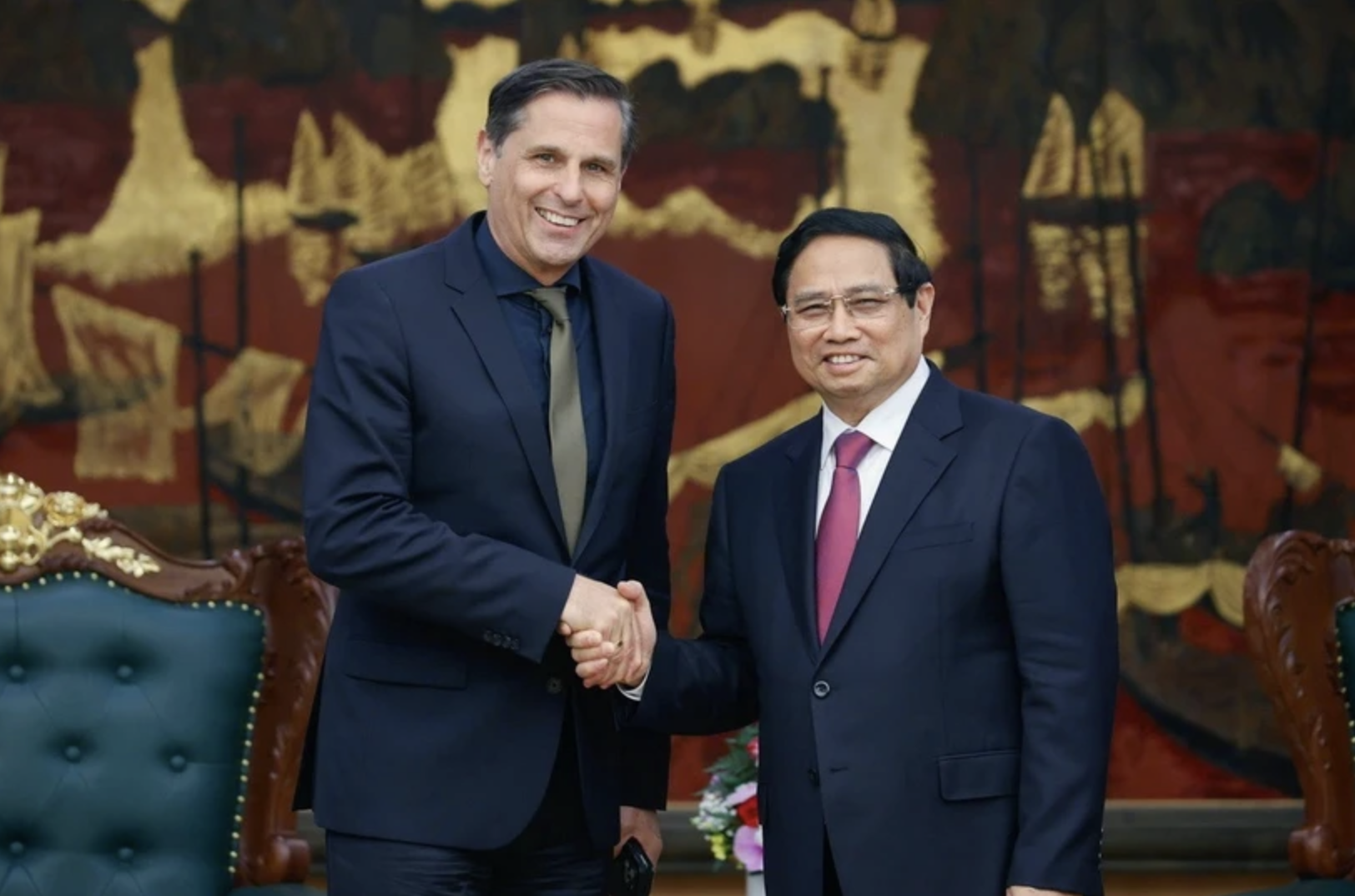

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

Comment (0)