Article 1: Vietnamese people are getting rich fastest in the world, looking forward to 'money printing machines'

Article 2: Mr. Nguyen Dang Quang returns to the list of USD billionaires: Waiting for a breakthrough of the decade

Assets doubled

According to Forbes, as of February 24, Mr. Tran Dinh Long, Chairman of Hoa Phat Group (HPG), had assets of 2.4 billion USD, double that of November 2022.

The reason billionaire Tran Dinh Long's assets increased sharply again is because recently HPG shares of Hoa Phat Group continued to increase strongly, from about 22,800 VND/share at the end of October 2023 to 29,000 VND/share as of now.

Previously, in October 2022, HPG shares fell to nearly 11,000 VND/share, at which time Mr. Tran Dinh Long's assets fell to 1.2 billion USD according to Forbes' calculations. This was also the darkest time for HPG due to the sluggish real estate market, the price of raw coal increased 3 times higher than normal, the price of USD skyrocketed...

In the first two weeks of the Year of the Dragon, HPG shares recovered and reached a 21-month peak amid the increase in steel volume and steel prices in recent quarters, as domestic and global steel demand, although still weak, has recovered significantly.

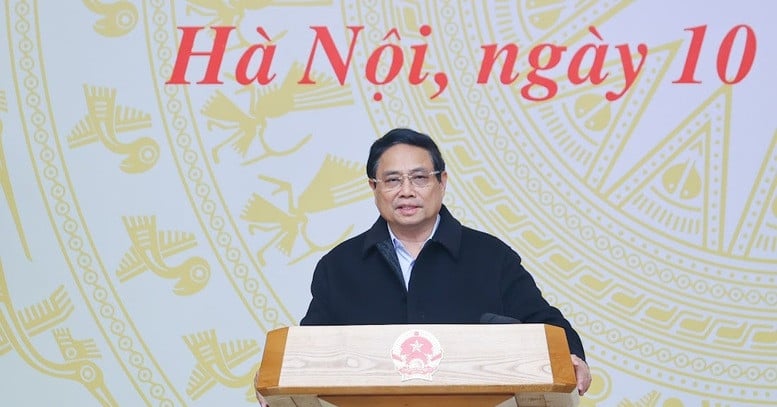

Domestically, public investment has been strongly promoted with a series of infrastructure projects being vigorously promoted, many key projects being implemented such as Long Thanh airport, highways, and beltways in Hanoi, Ho Chi Minh City, etc.

Although Hoa Phat's profits have not really broken through again, Hoa Phat's revenue has increased, market share has also tended to increase, further consolidating its No. 1 position in Vietnam.

In the fourth quarter of 2023, Hoa Phat recorded revenue of nearly 35 trillion VND, up 23% over the same period. Accumulated revenue for the whole year of 2023 reached more than 120 trillion VND, still down 16% compared to the previous year.

Currently, Hoa Phat has a crude steel capacity of 8.5 million tons/year, the largest in Vietnam and Southeast Asia.

Although still on the recovery path and profits are still far below the record set in 2021, HPG shares of Hoa Phat Group have recently attracted large cash flows from foreign investors, domestic organizations and individuals. This is contrary to the strong selling trend of foreign investors in 2022 and the first half of 2023.

The number of shareholders of HPG has also increased sharply, adding tens of thousands each year, to about 180 thousand shareholders. This is the enterprise with the largest number of shareholders on the stock exchange. That is why HPG is considered a "national stock".

The expectation of many investors lies in the fact that Hoa Phat's leadership, headed by Mr. Tran Dinh Long, is very determined in implementing production and business activities and is considered to be the most transparent and honest among listed enterprises on the stock exchange.

The push to make billionaire Long richer

Now, investors are expecting a new cycle of revenue and profit growth for Hoa Phat thanks to the Dung Quat 2 mega project. Many people expect that profits could double as predicted by billionaire Tran Dinh Long.

This means that HPG's stock price will skyrocket, and Chairman Tran Dinh Long's assets could double compared to present, to nearly 5 billion USD - equal to, or even more than, Vietnam's number 1 billionaire Pham Nhat Vuong.

In a recent report, SSI Research forecasts that the shortage of domestic supply along with increased exports will help Hoa Phat boost the HRC steel segment in the next few years, when the Dung Quat 2 project comes into operation.

The report said that steel demand will recover in 2024, growing more than 6% year-on-year.

Vietnam's economy is showing many positive signs and is forecast to grow better in 2024. In the first month of the year, Vietnam's exports increased sharply. Foreign investment in Vietnam continues to increase.

The real estate market has positive signals and is expected to continue to have bright spots.

In 2024, the loose monetary policy orientation will continue to be an important factor helping the real estate market maintain its recovery momentum. A large amount of residential deposits from late 2022 and early 2023 will return to production when they mature. A part of them will find investment channels. In which, real estate investment is always a priority. When the management policy is stable and investor confidence returns, the real estate market tends to warm up.

The National Assembly's official approval of three important laws that directly affect the real estate industry, namely the Housing Law (amended); the Real Estate Business Law (amended) and the Land Law (amended), officially applied from January 1, 2025, is expected to be a boost for the real estate market to flourish and develop sustainably.

Meanwhile, according to the World Steel Association forecast, global steel demand is expected to increase by 1.9% in 2024. Steel prices are forecast to increase as China is expected to reduce exports. This is a favorable factor for large steel companies such as Hoa Phat.

Dung Quat 2 project, with a total investment of up to 3 billion USD, has reached 45% progress. When completed, HPG's steel production capacity will reach more than 14 million tons of crude steel/year, putting Hoa Phat in the top 30 largest steel enterprises in the world from 2025.

This is considered a big boost for Hoa Phat Group. At the 2023 General Meeting of Shareholders, Mr. Tran Dinh Long said that by the end of this year, early 2025, when Dung Quat 2 factory is operational, Hoa Phat's revenue will increase by 80,000-100,000 billion VND.

Profits also increased sharply. At that time, Mr. Long's assets also accelerated, possibly approaching billionaire Pham Nhat Vuong, and even becoming the richest person in Vietnam.

The breakthrough in capital and asset scale of Hoa Phat, along with large private corporations such as Vingroup, Hoa Phat, Masan, Techcombank, FPT... in the new decade will produce more Vietnamese USD millionaires and billionaires.

In a report recently released by New World Wealth and investment consultancy Henley & Partners, the growth rate of accumulated assets of Vietnamese people will be the fastest in the world in the next 10 years, with a breakthrough of up to 125%.

According to New World Wealth, Vietnam currently has 19,000 USD millionaires and 58 people with assets over 100 million USD.

Source

Comment (0)